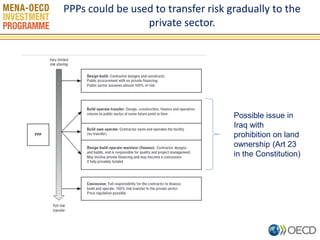

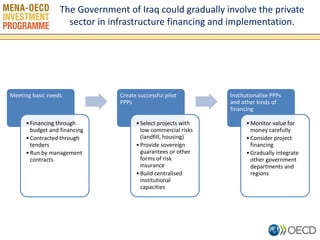

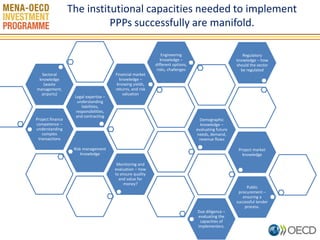

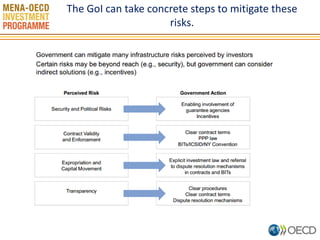

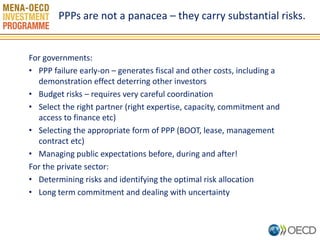

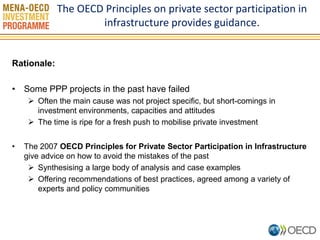

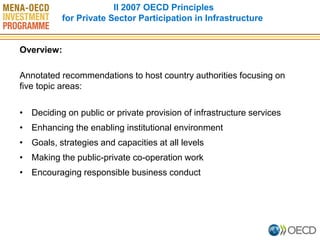

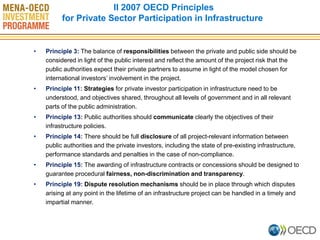

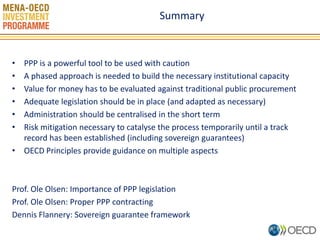

The document discusses infrastructure finance in Iraq and the potential role of public-private partnerships (PPPs). It recommends that Iraq take a gradual approach to involving the private sector by first meeting basic needs through traditional budget and contract approaches. Successful pilot PPP projects could then be established by selecting low-risk projects, providing guarantees to mitigate risks, and building centralized institutional capacity. Over time, the use of PPPs and private sector involvement could be further institutionalized by carefully monitoring value for money and developing additional legal and regulatory frameworks as outlined in the OECD Principles on private sector participation in infrastructure.