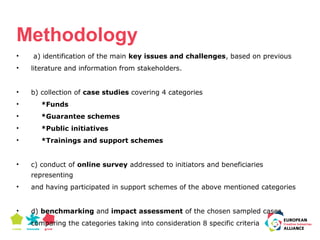

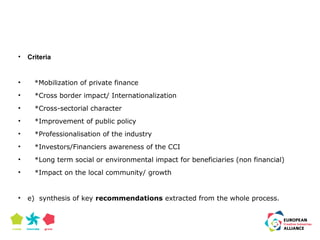

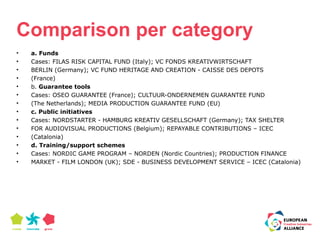

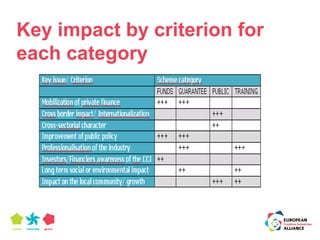

The document outlines a policy agenda aimed at enhancing access to finance for Europe’s creative industries, identifying current challenges, and proposing innovative funding solutions. It emphasizes the significant role of the cultural and creative sectors in economic recovery and stresses the need for improved investment readiness and measures to encourage private funding. The report includes specific recommendations for fostering cross-sectoral collaboration, better business support, and raising awareness of the creative industries' value.