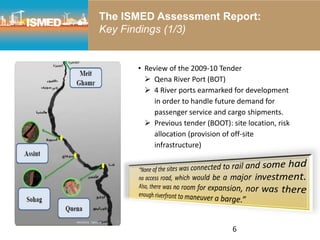

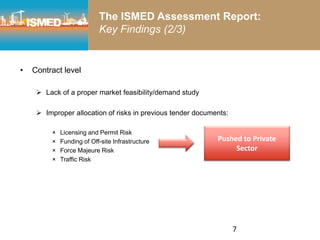

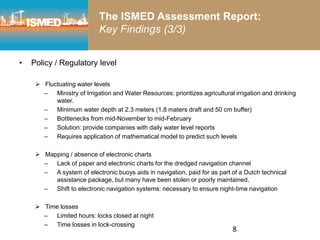

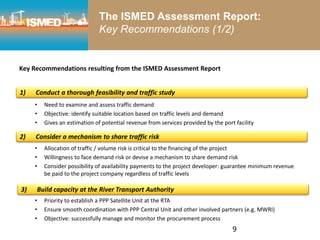

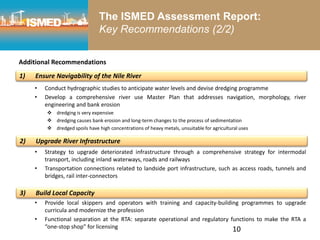

The assessment report on the Nile River ports project aims to promote river transport in Egypt by addressing previous public-private partnership failures and proposing improvements for four targeted river ports. The report highlights the under-utilization of river transport despite its cultural significance and presents key findings and recommendations for enhancing infrastructure, operational efficiency, and capacity building within the River Transport Authority. The plan includes a comprehensive feasibility study, risk-sharing mechanisms, and collaboration with stakeholders to improve the investment climate and operational structure for the river transport sector.