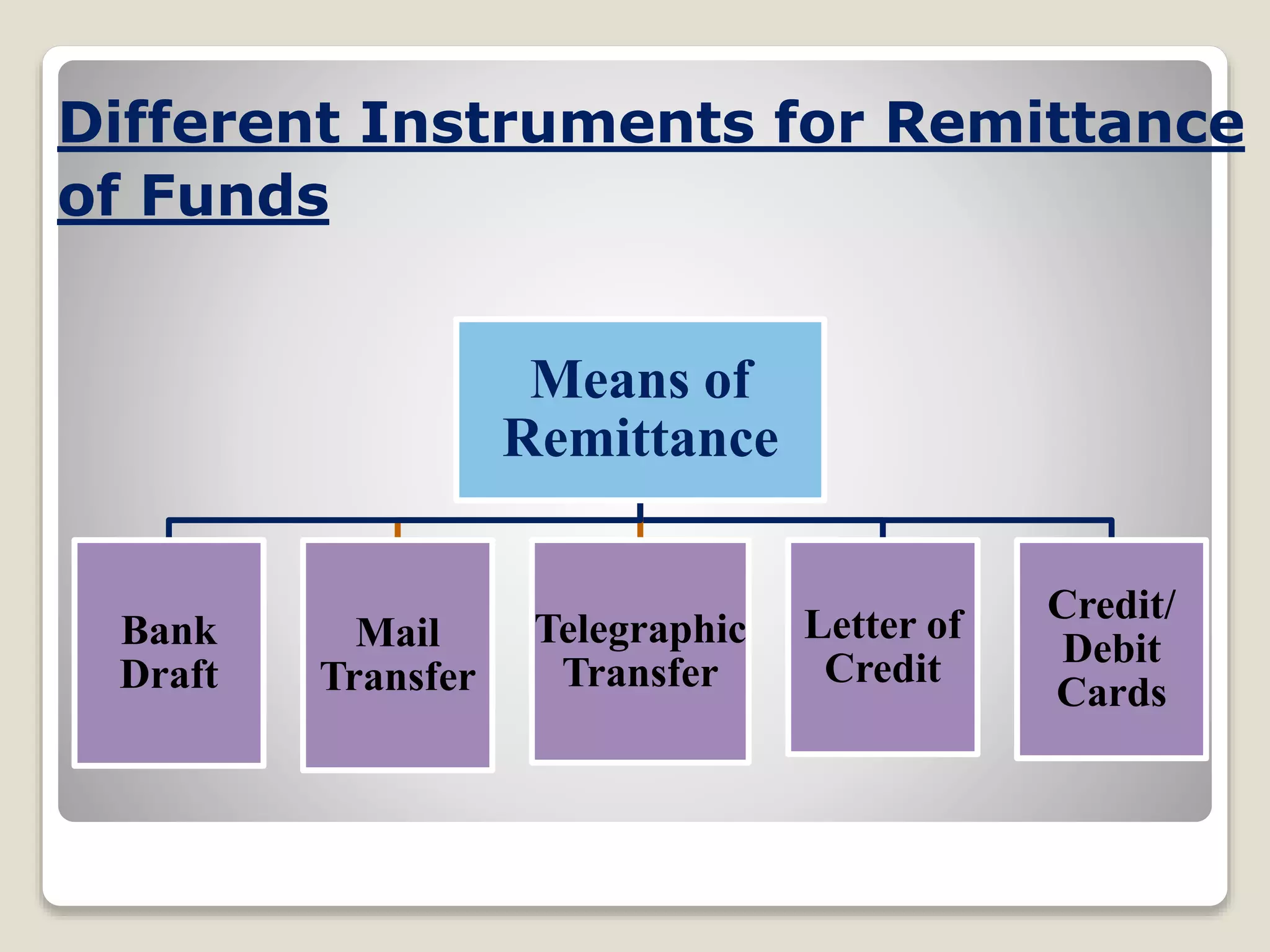

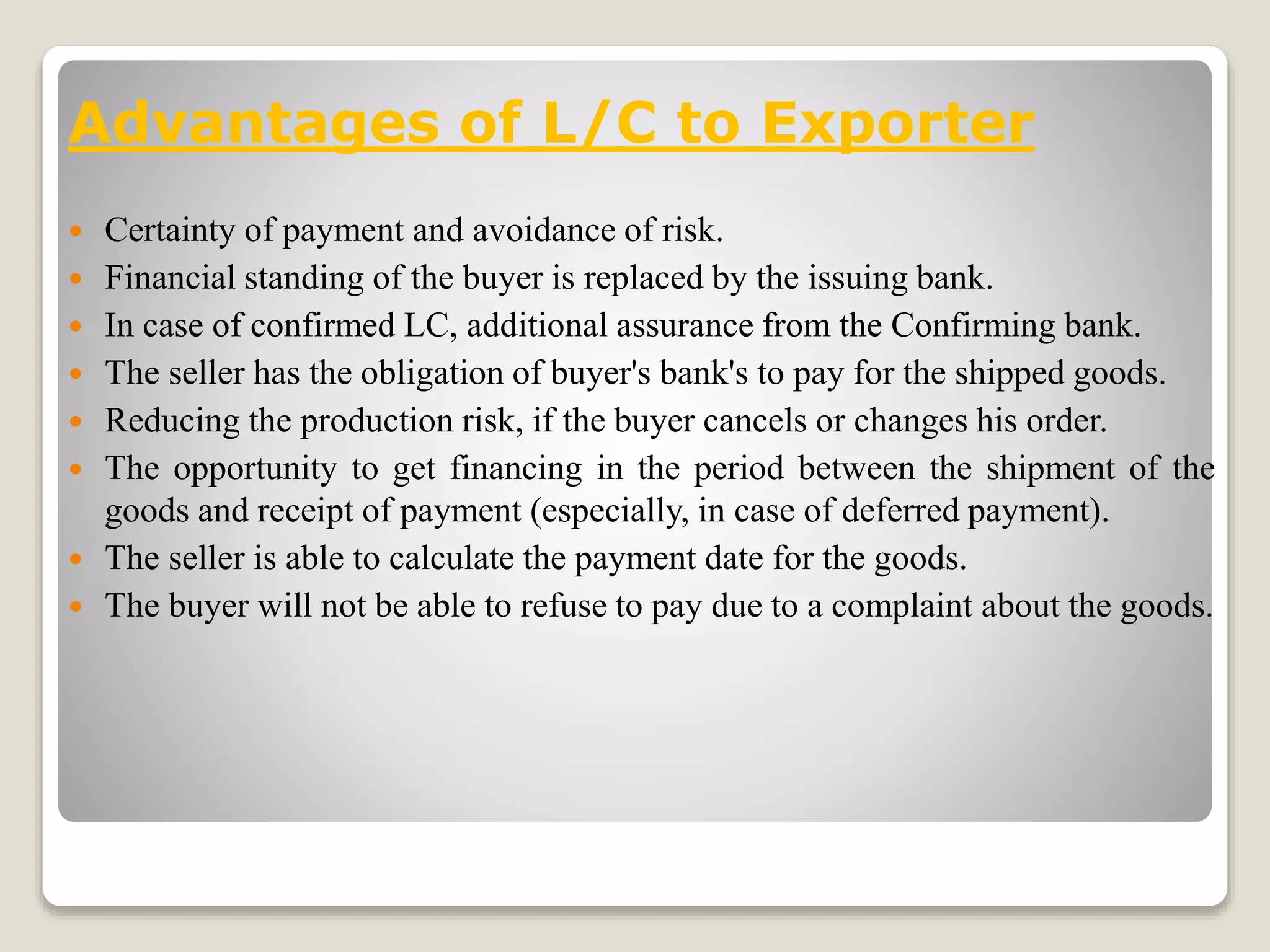

The document discusses different means of remittance, including internal and international transfers. It describes various instruments used for remitting funds such as demand drafts, mail transfers, traveler's cheques, and letters of credit. Letters of credit are defined as documents from a bank guaranteeing payment to a seller if delivery conditions are met. The key parties in a letter of credit are identified as the applicant, issuing bank, beneficiary, advising bank, confirming bank, negotiating bank, and reimbursing bank. Specific types of letters of credit are also outlined like travelers' letters of credit and letters of credit for commercial transactions.