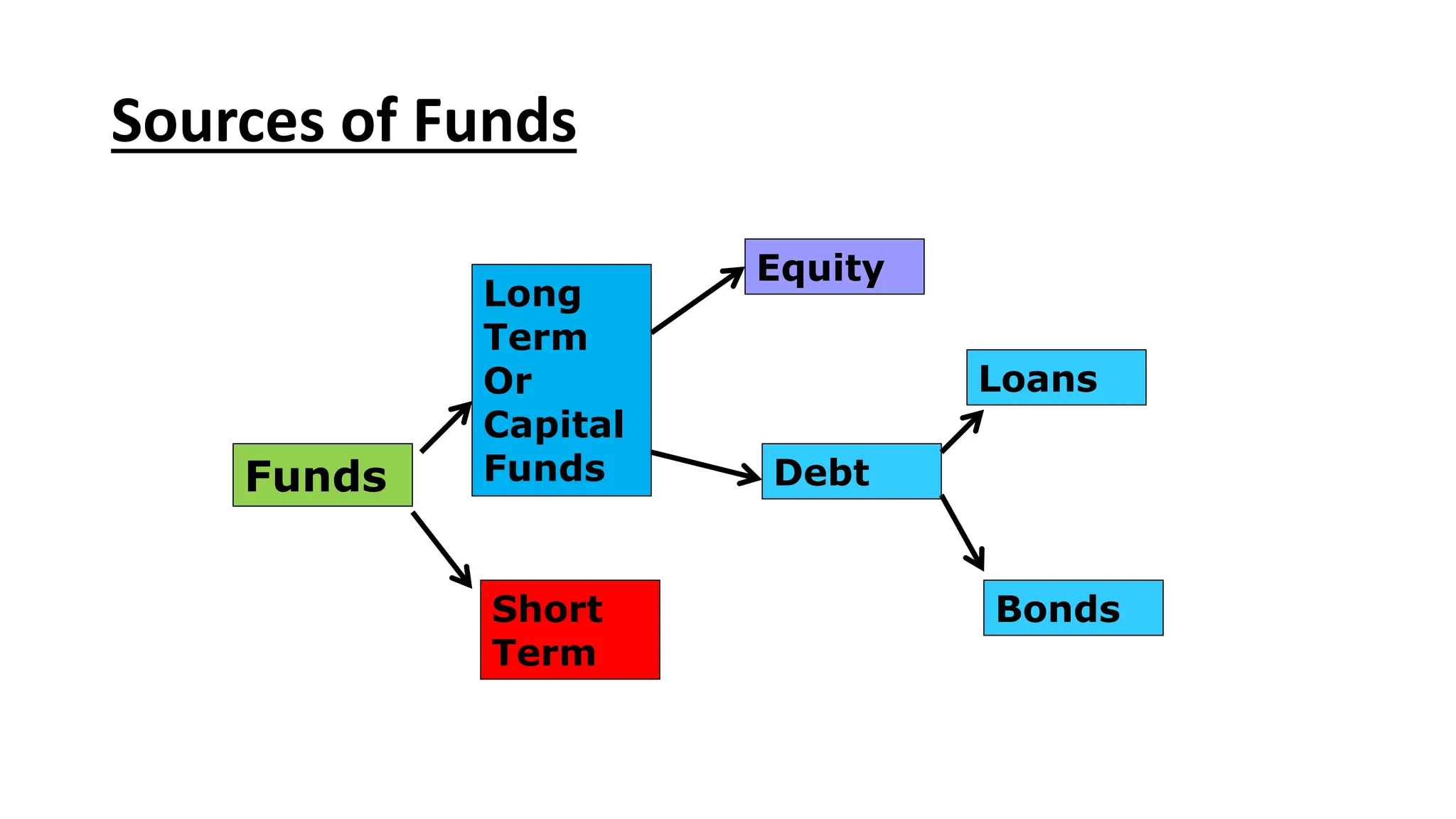

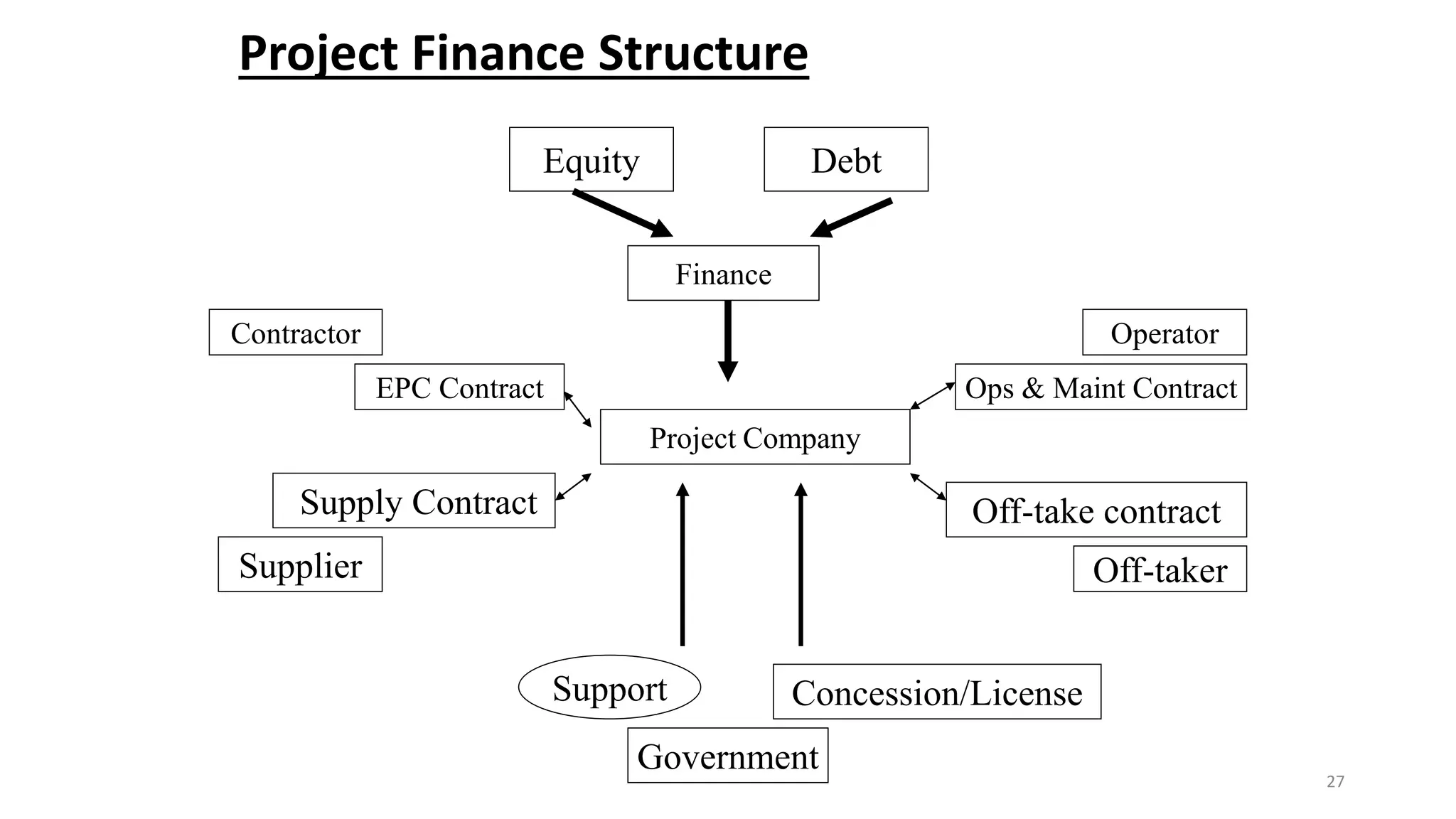

This document discusses financing large projects through project financing. It explains that project financing involves setting up a separate "ring-fenced" project company, with off-balance sheet or non-recourse financing and high leverage. The key is managing risks through contracts and structured financing to make projects bankable and attractive to equity sponsors and debt providers. Innovative instruments like stepped debt repayment, revenue claw-backs, and subordinated zero coupon bonds can increase comfort for lenders and returns for equity investors.