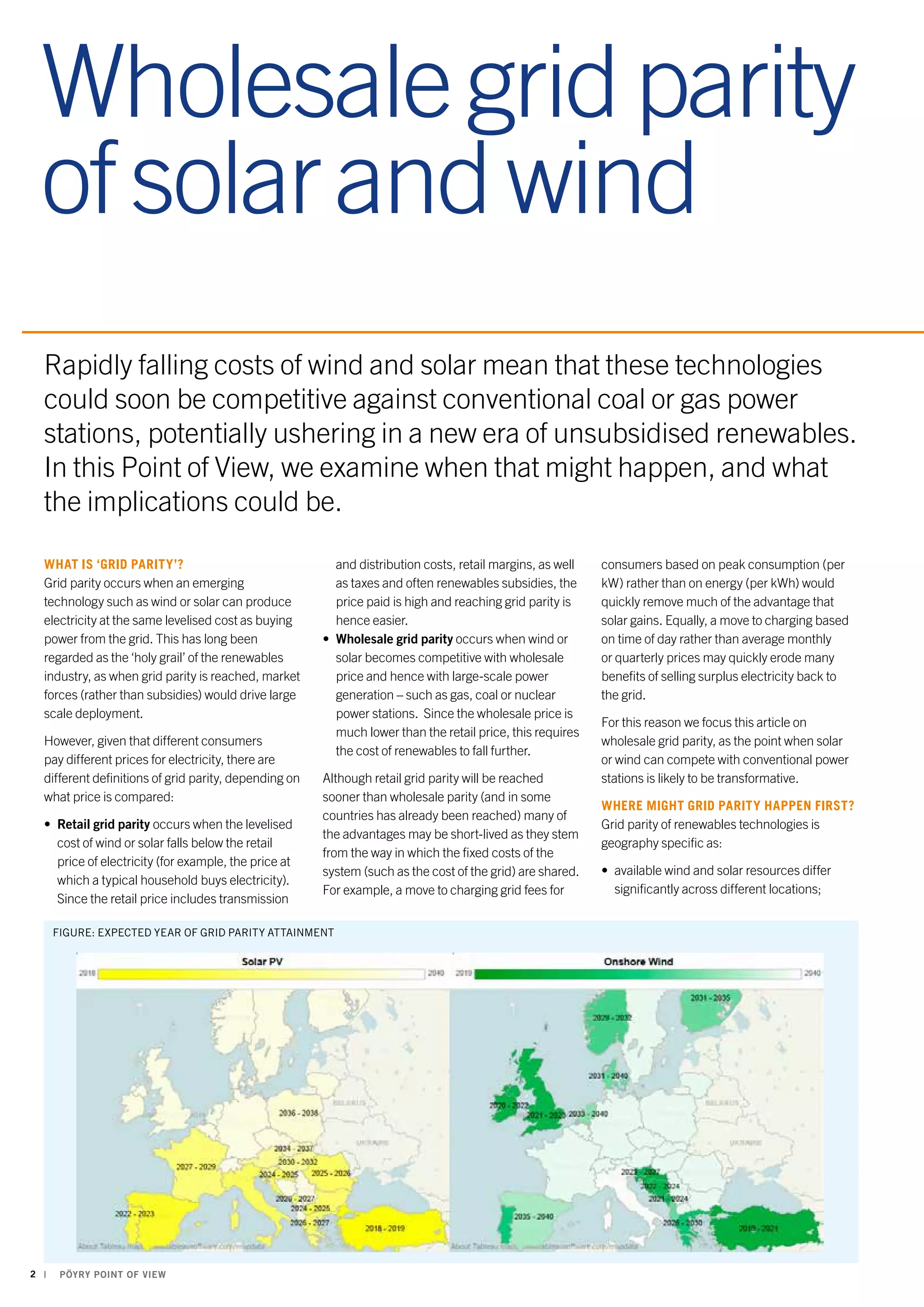

The document discusses the potential for renewable energy sources, particularly solar and wind, to achieve wholesale grid parity, meaning they can compete with conventional power sources without subsidies. It details the geographical and economic factors influencing when and where grid parity might be reached in Europe, forecasting that regions with high electricity costs and good renewable resources will likely lead the way. Key findings suggest significant grid parity achievements for solar PV in southern Europe and for onshore wind in certain northern countries by 2021-2032, although various challenges could hinder higher levels of renewable deployment.