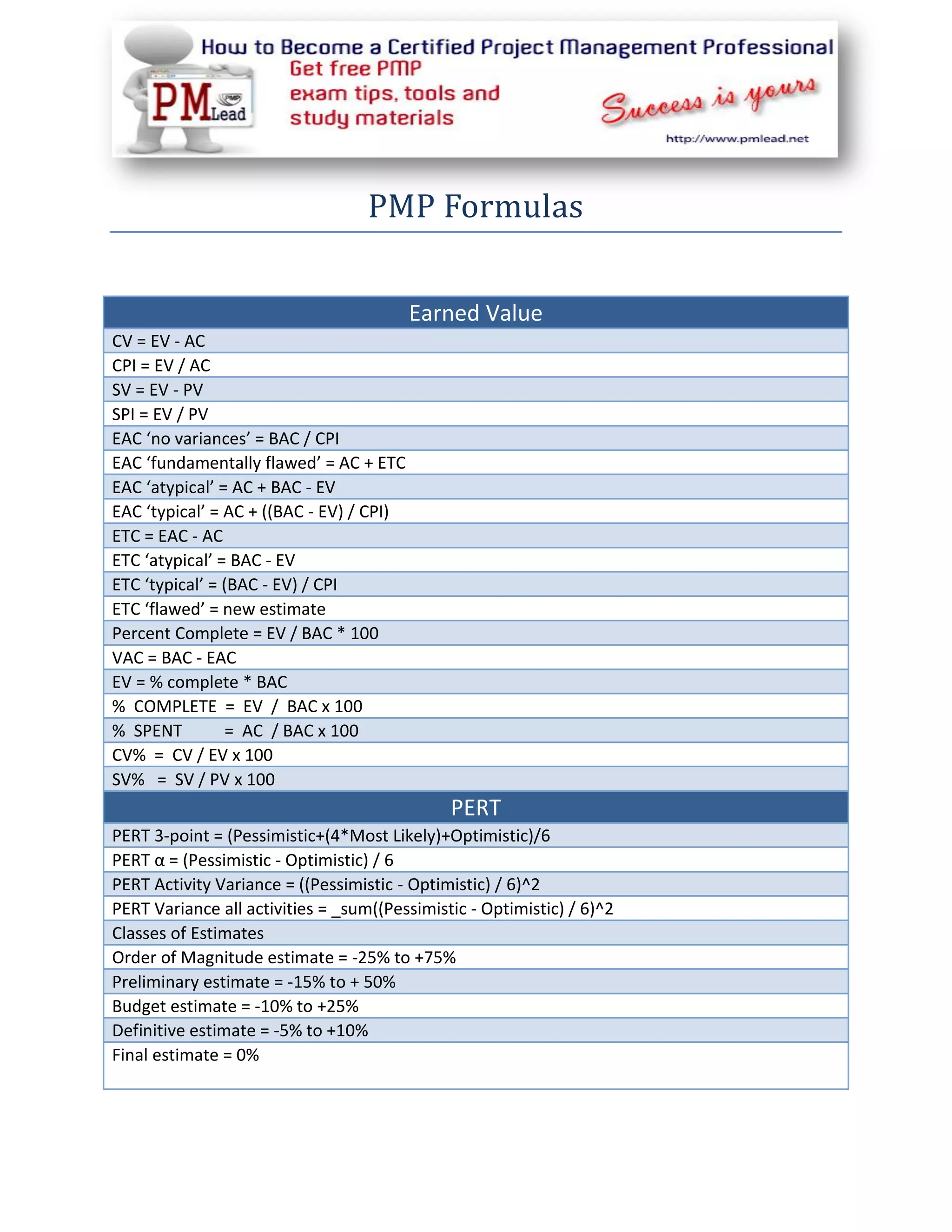

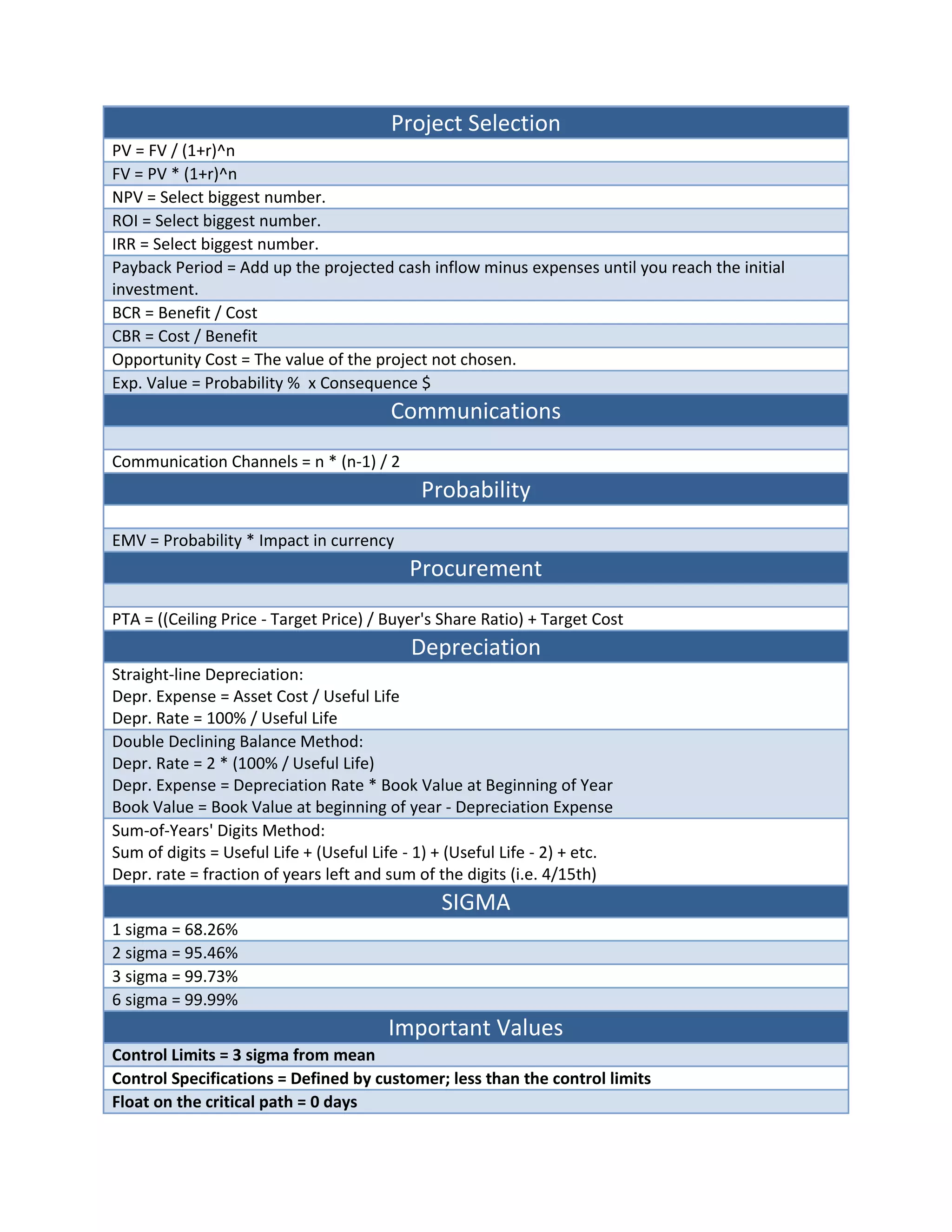

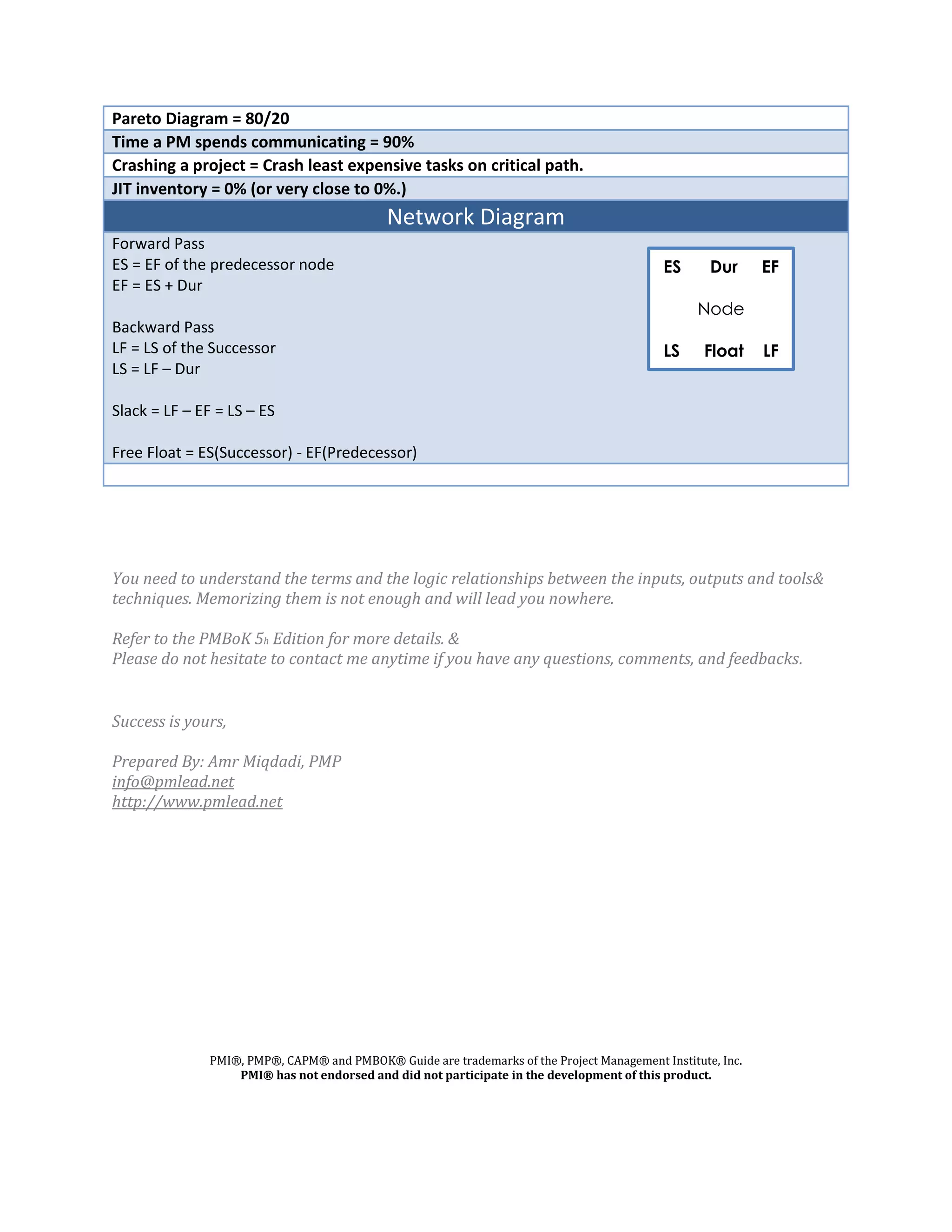

The document defines key project management formulas used to calculate earned value, estimate costs, analyze schedule performance, determine probability and risk, calculate depreciation, and perform network diagram calculations. It also defines common project management terms like sigma levels, Pareto analysis, communication channels, and float. The document emphasizes understanding the relationships between the inputs, outputs, and techniques rather than just memorizing the formulas.