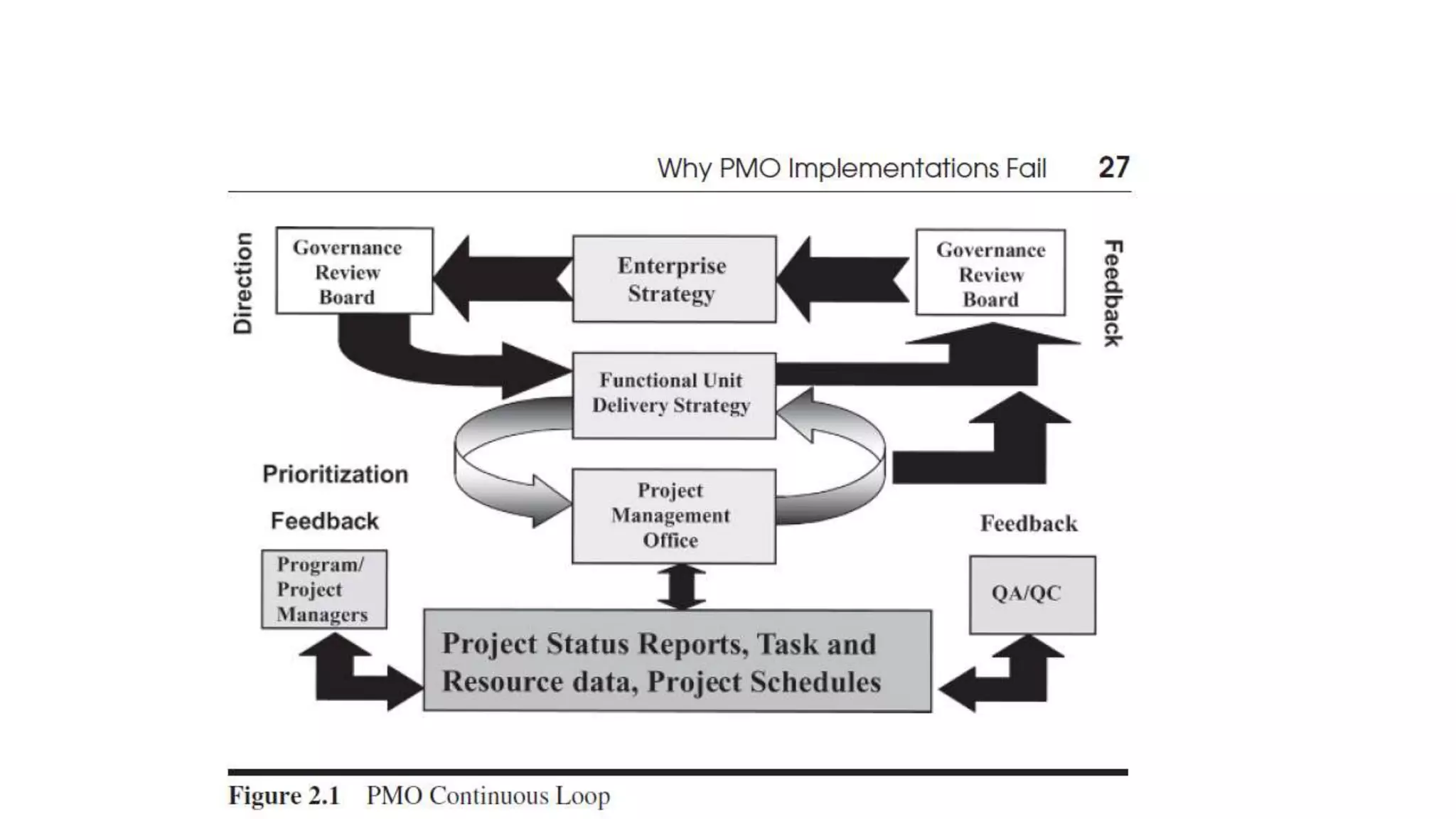

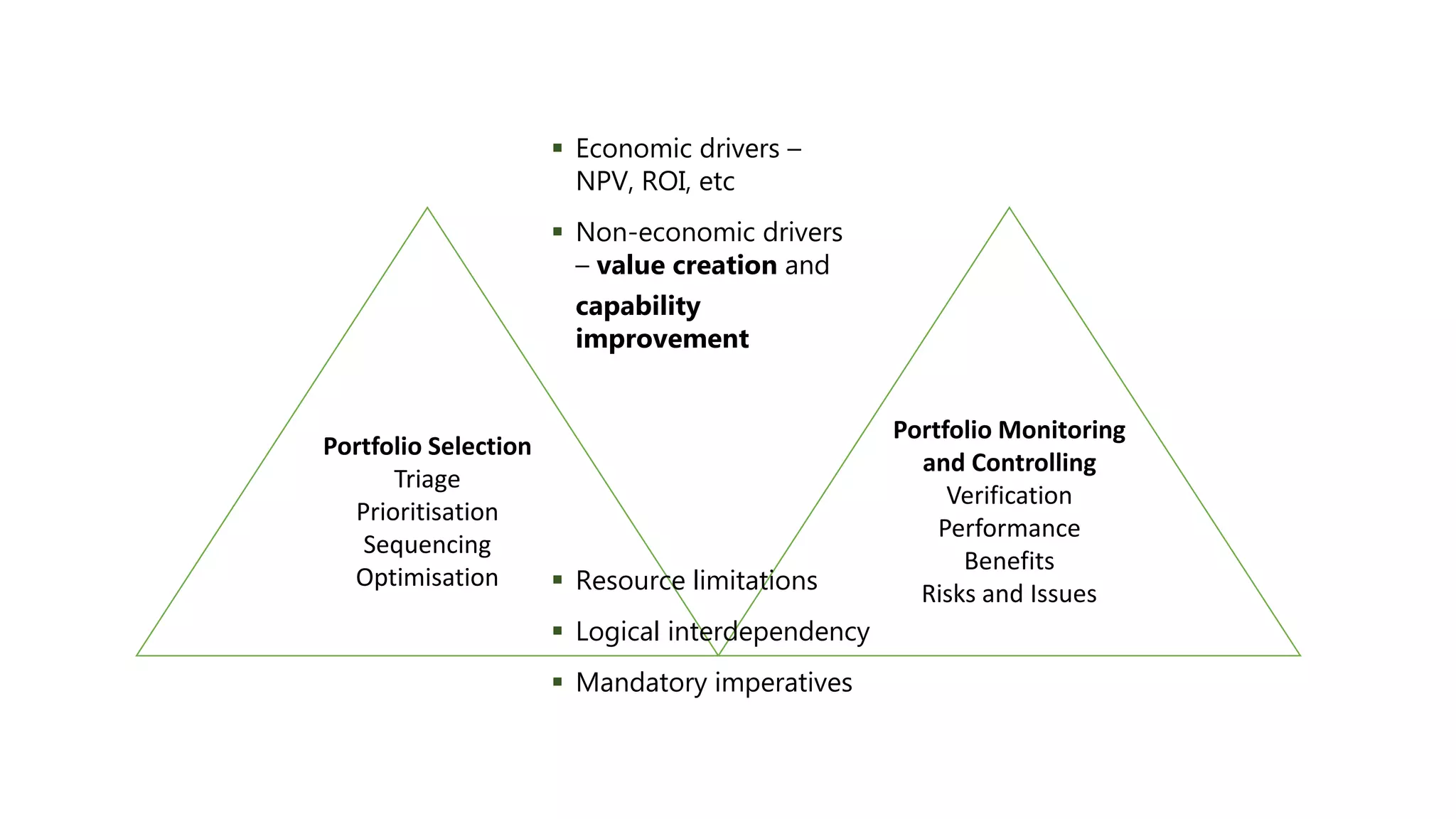

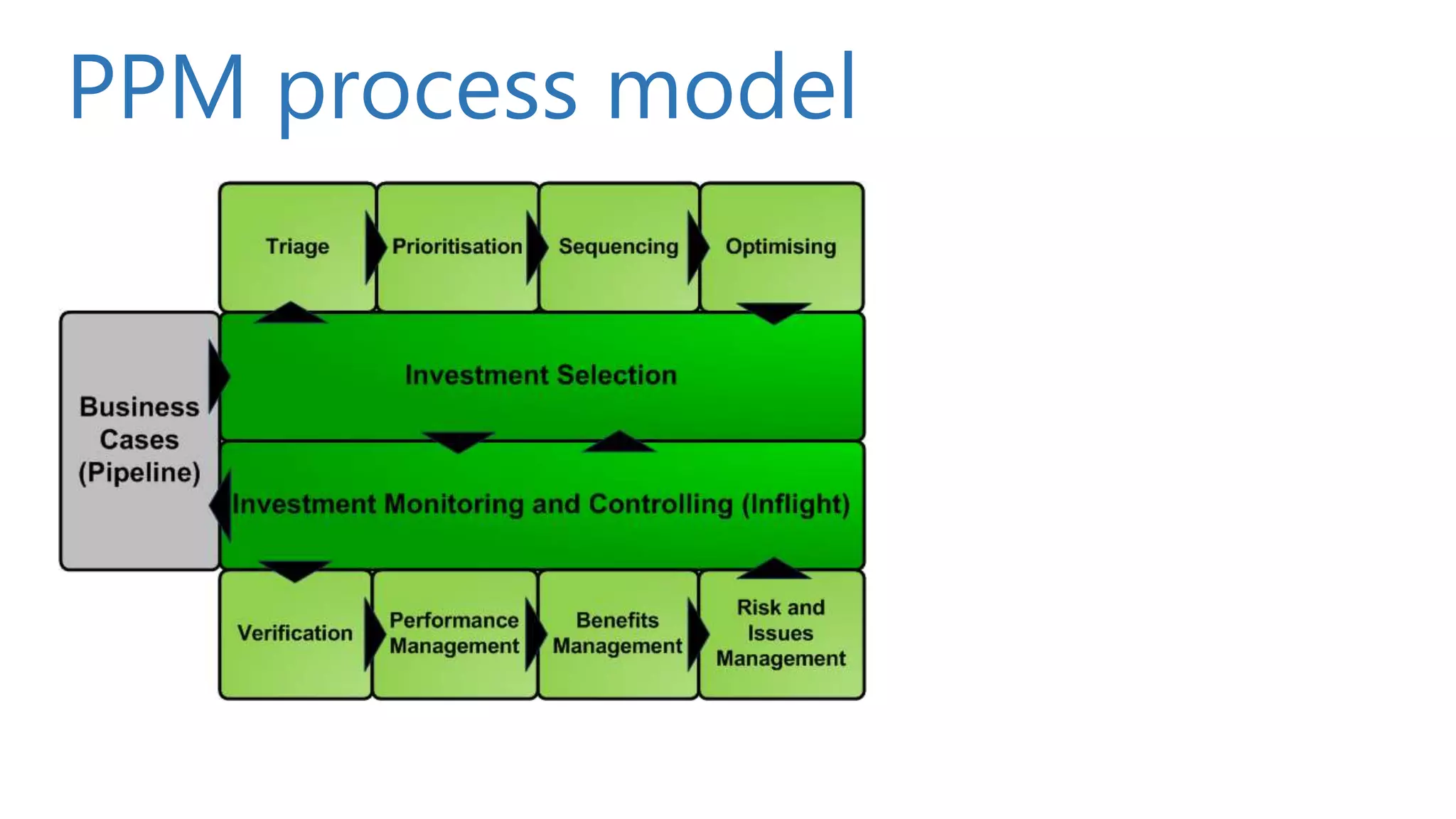

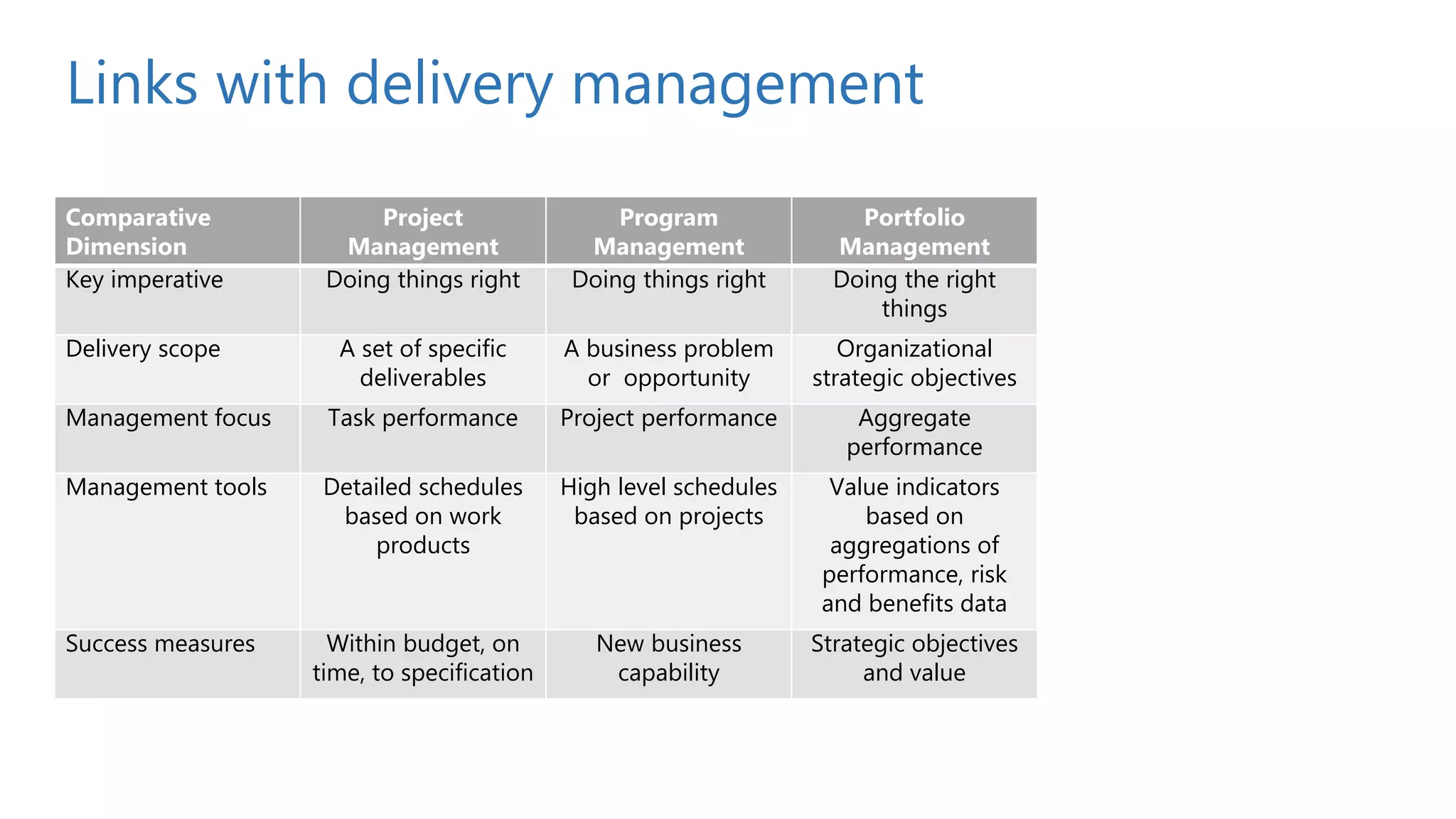

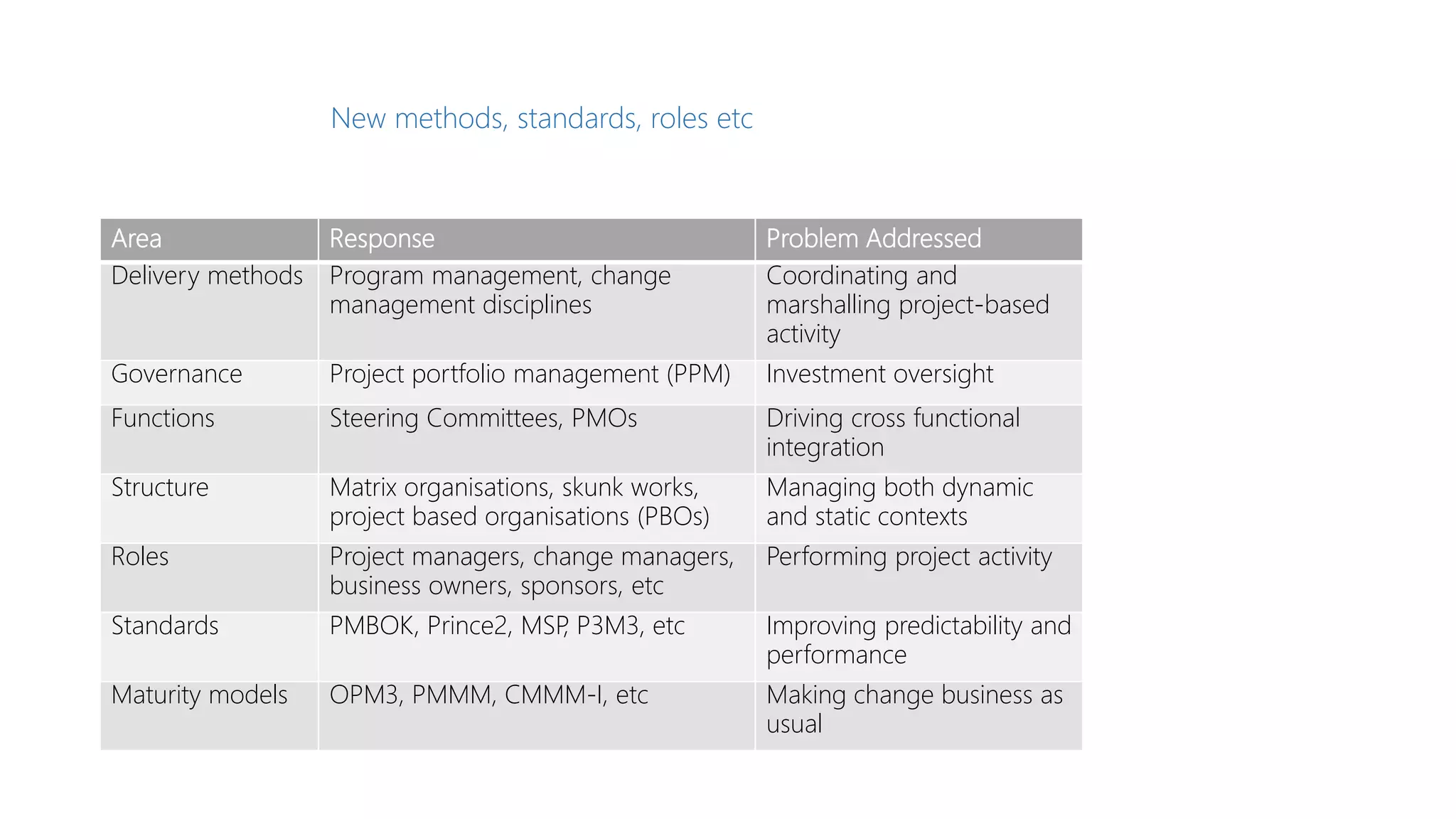

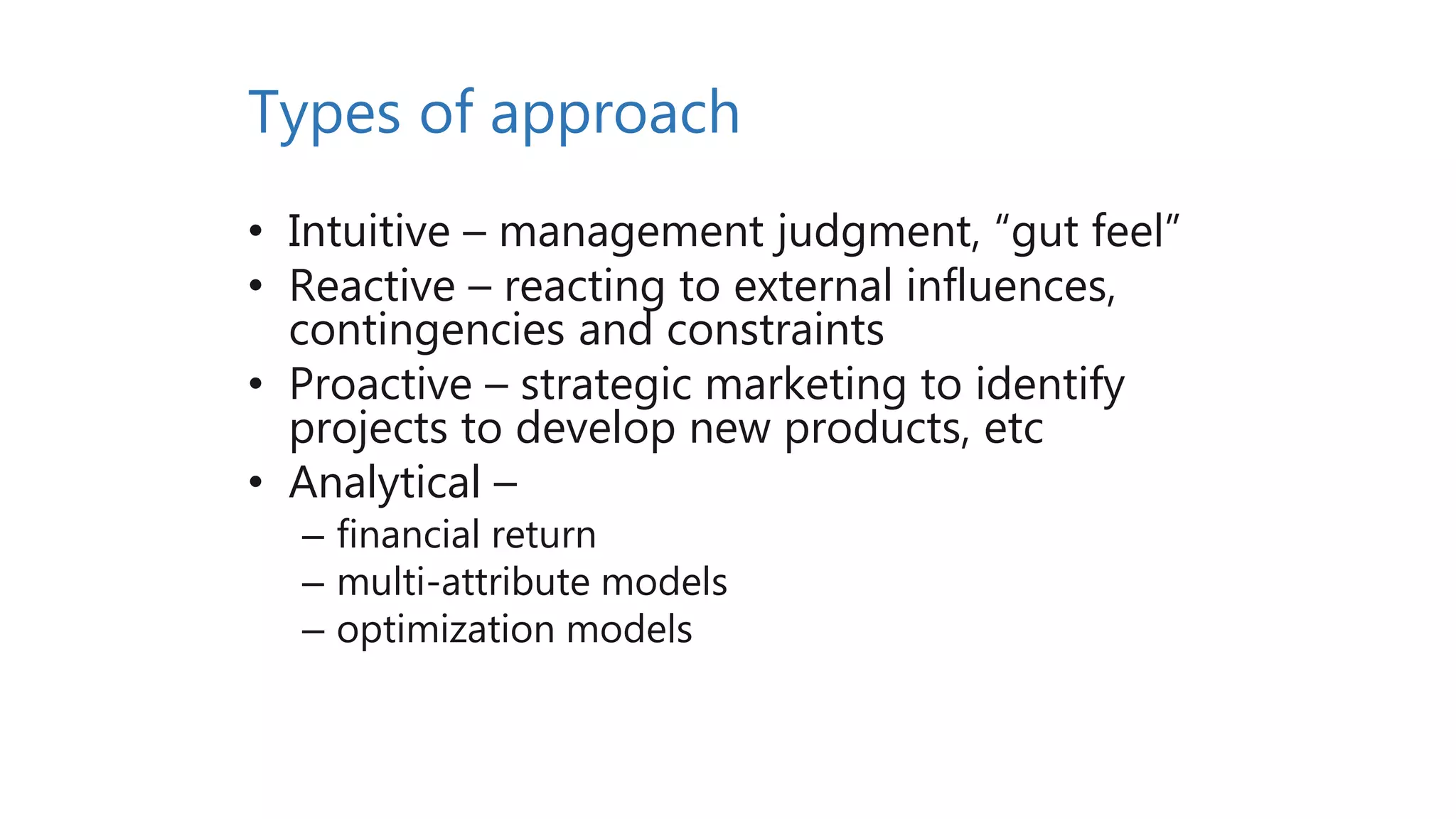

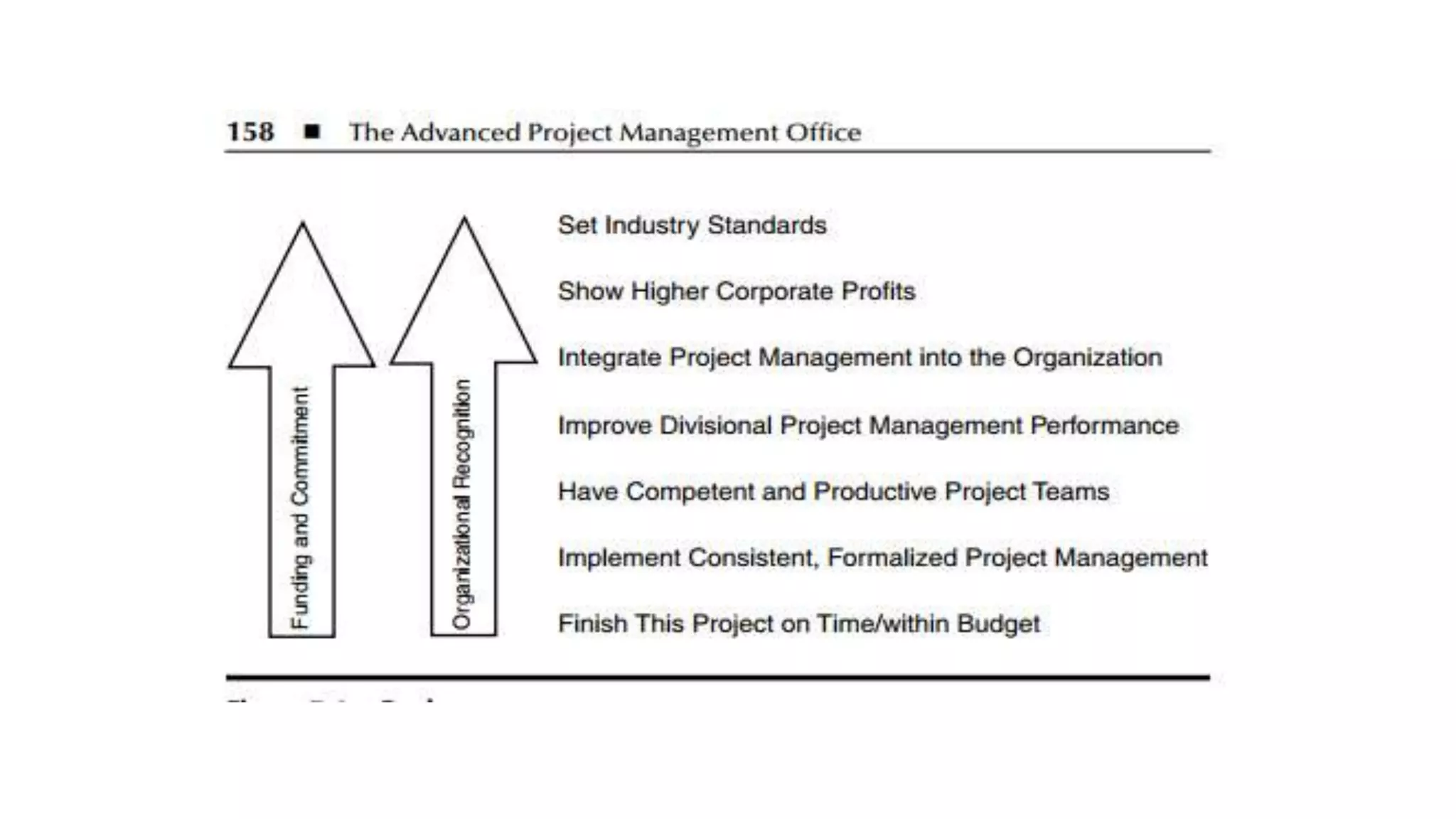

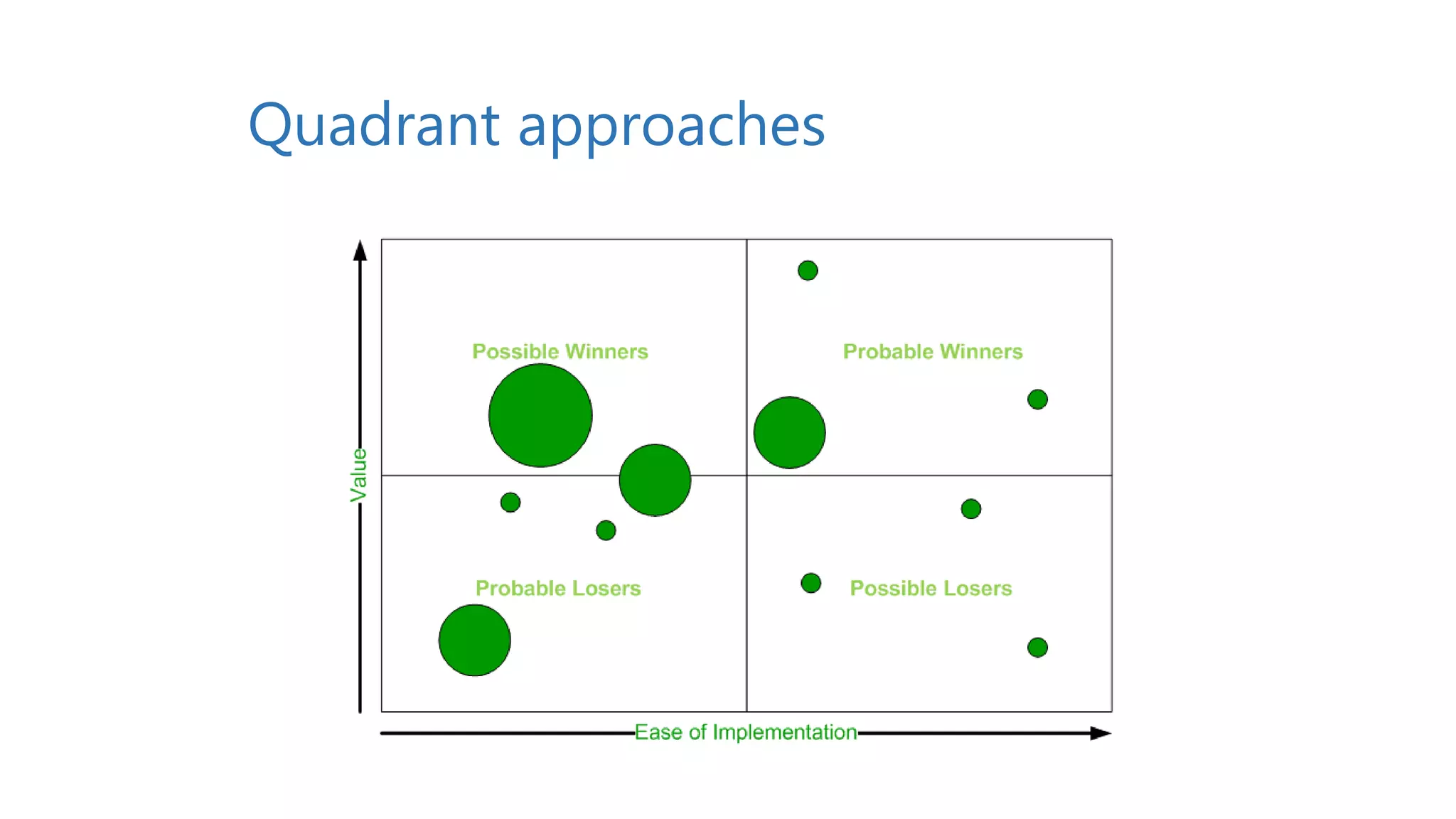

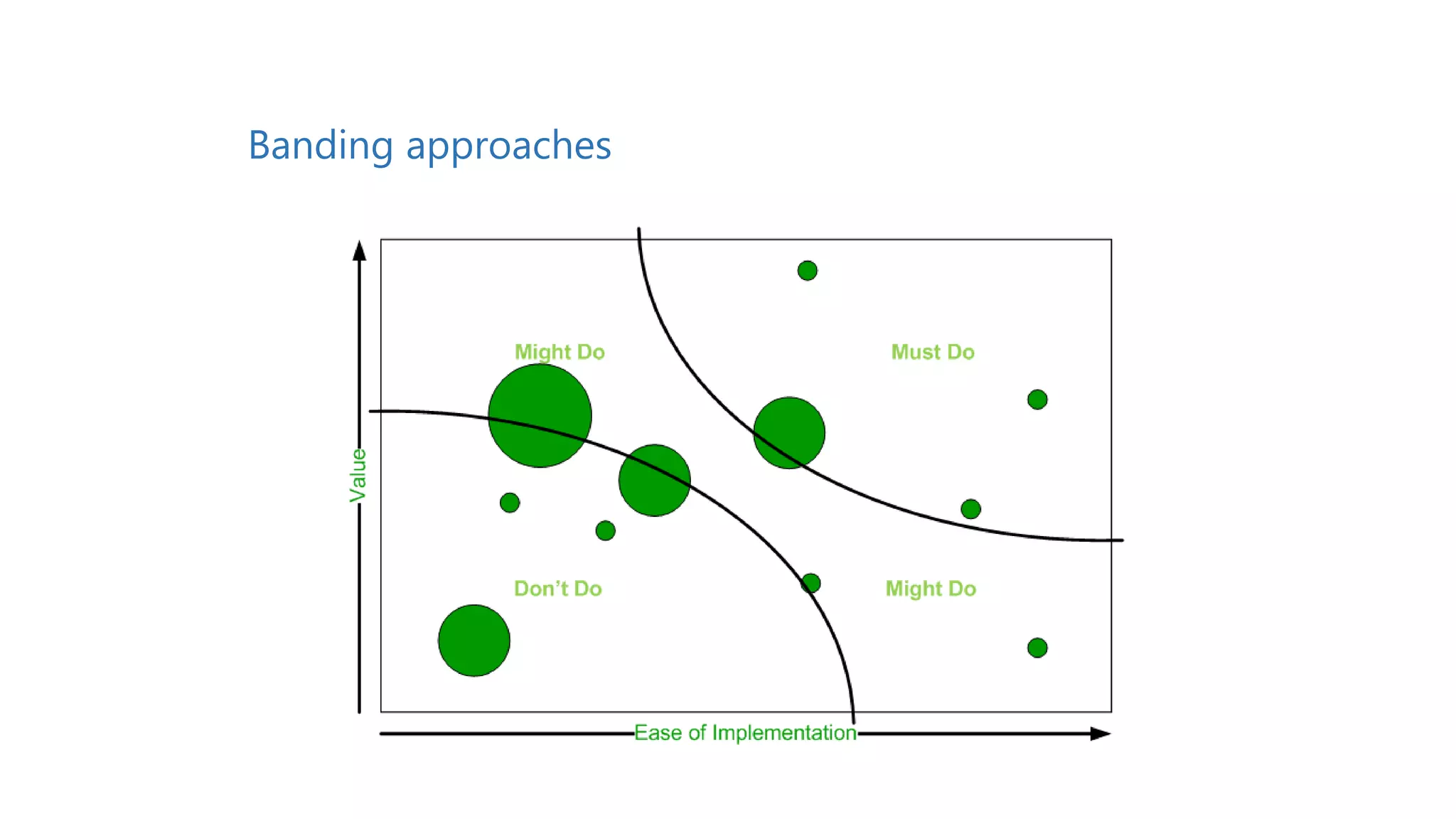

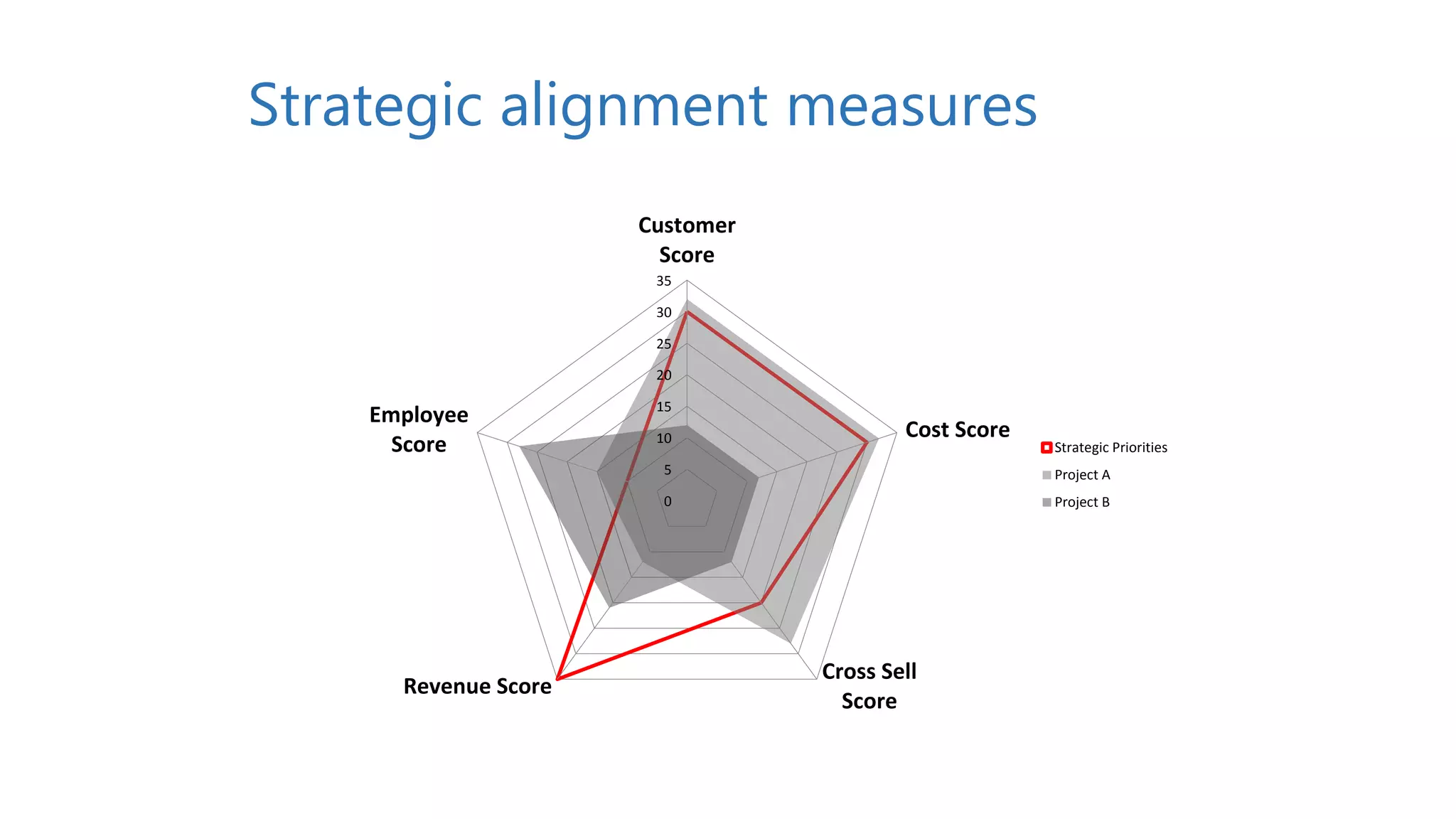

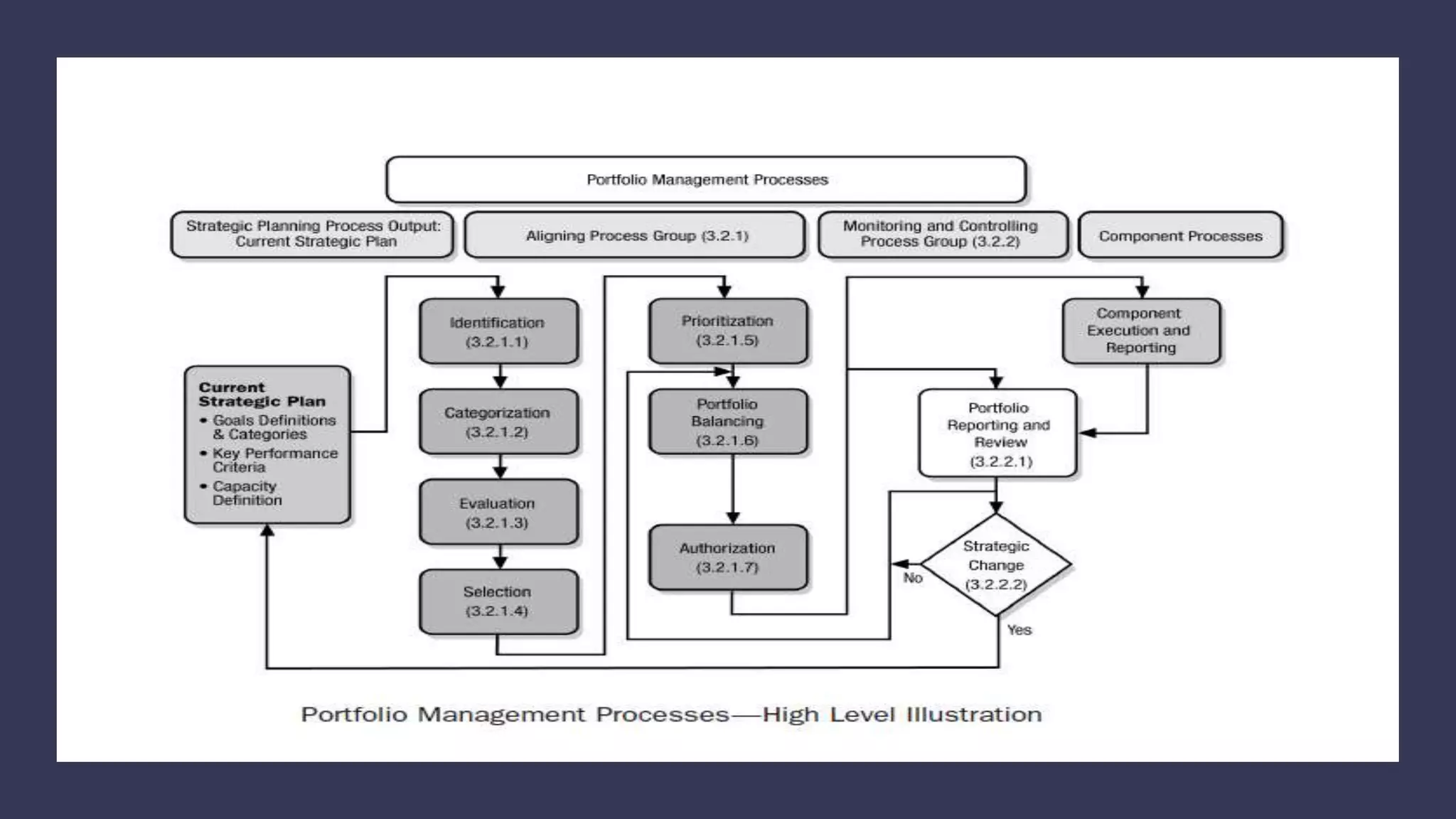

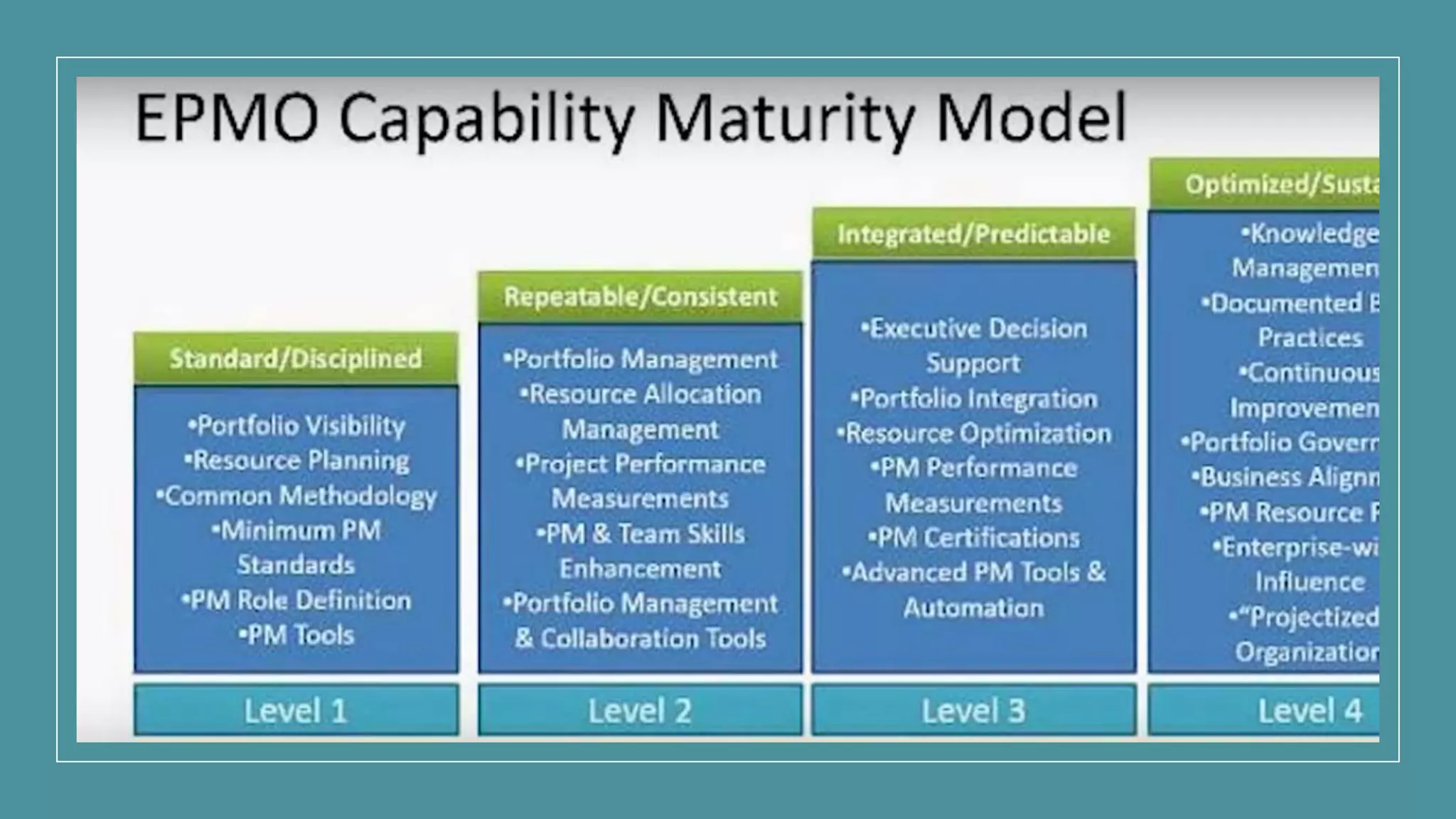

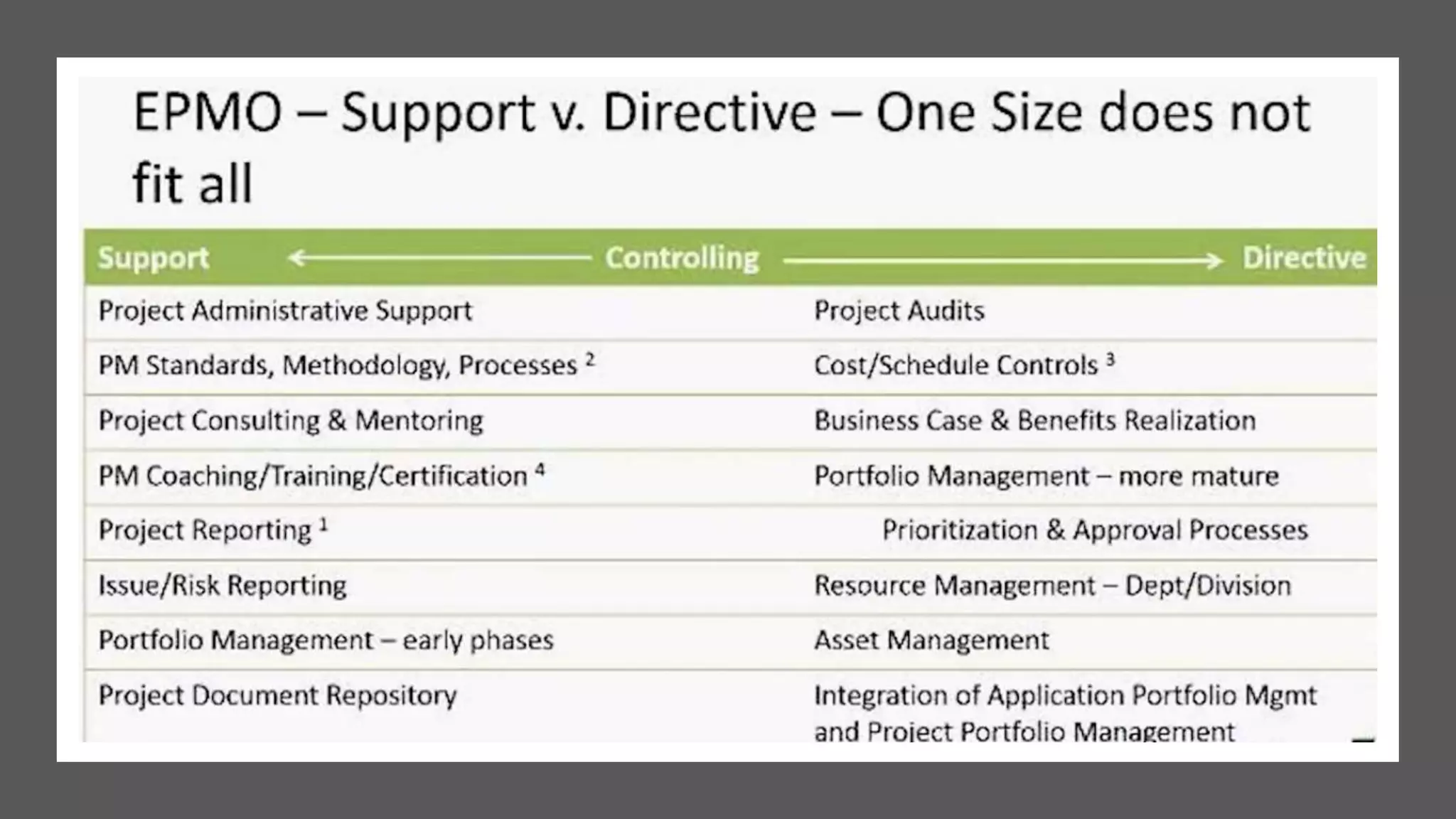

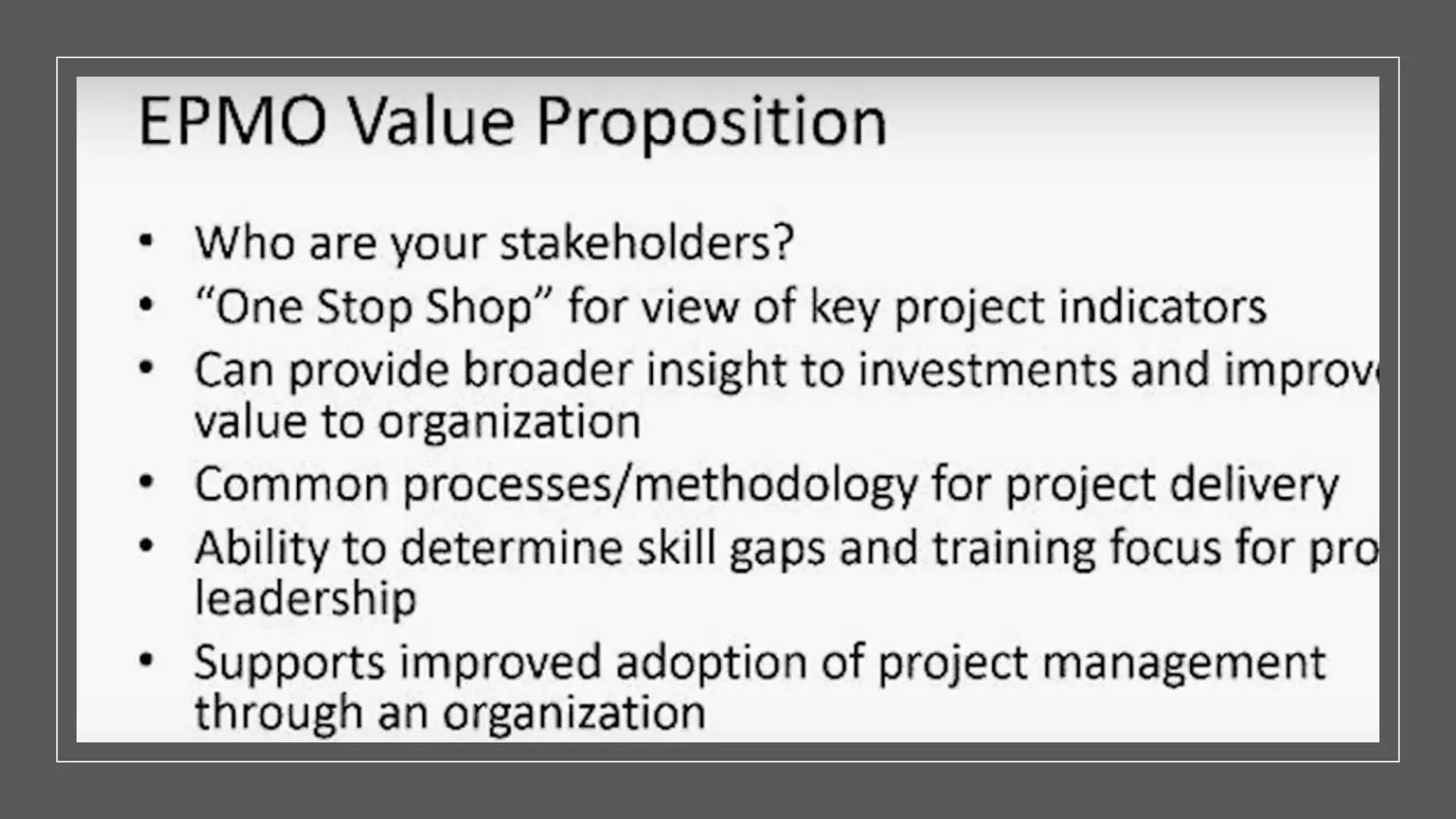

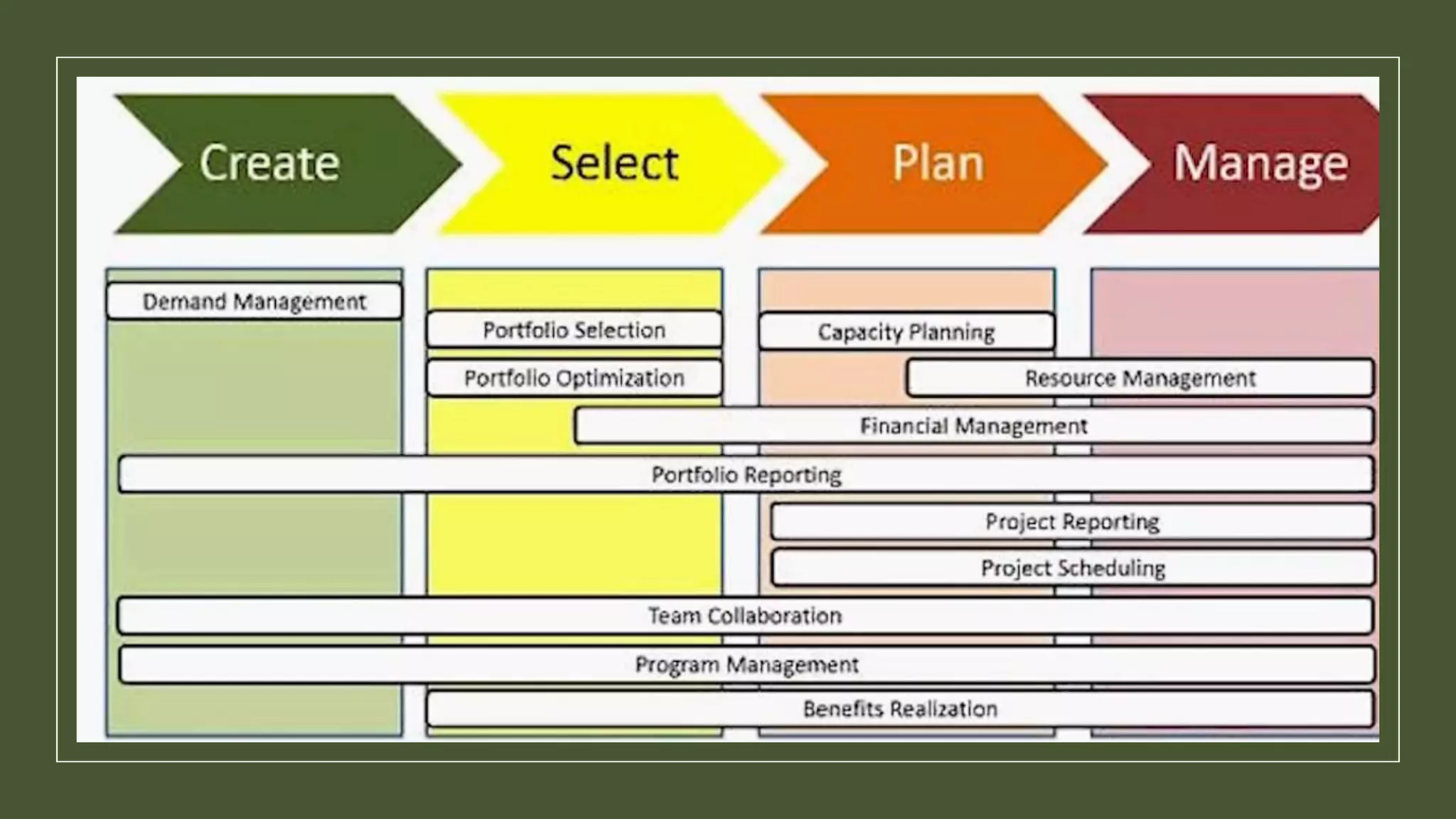

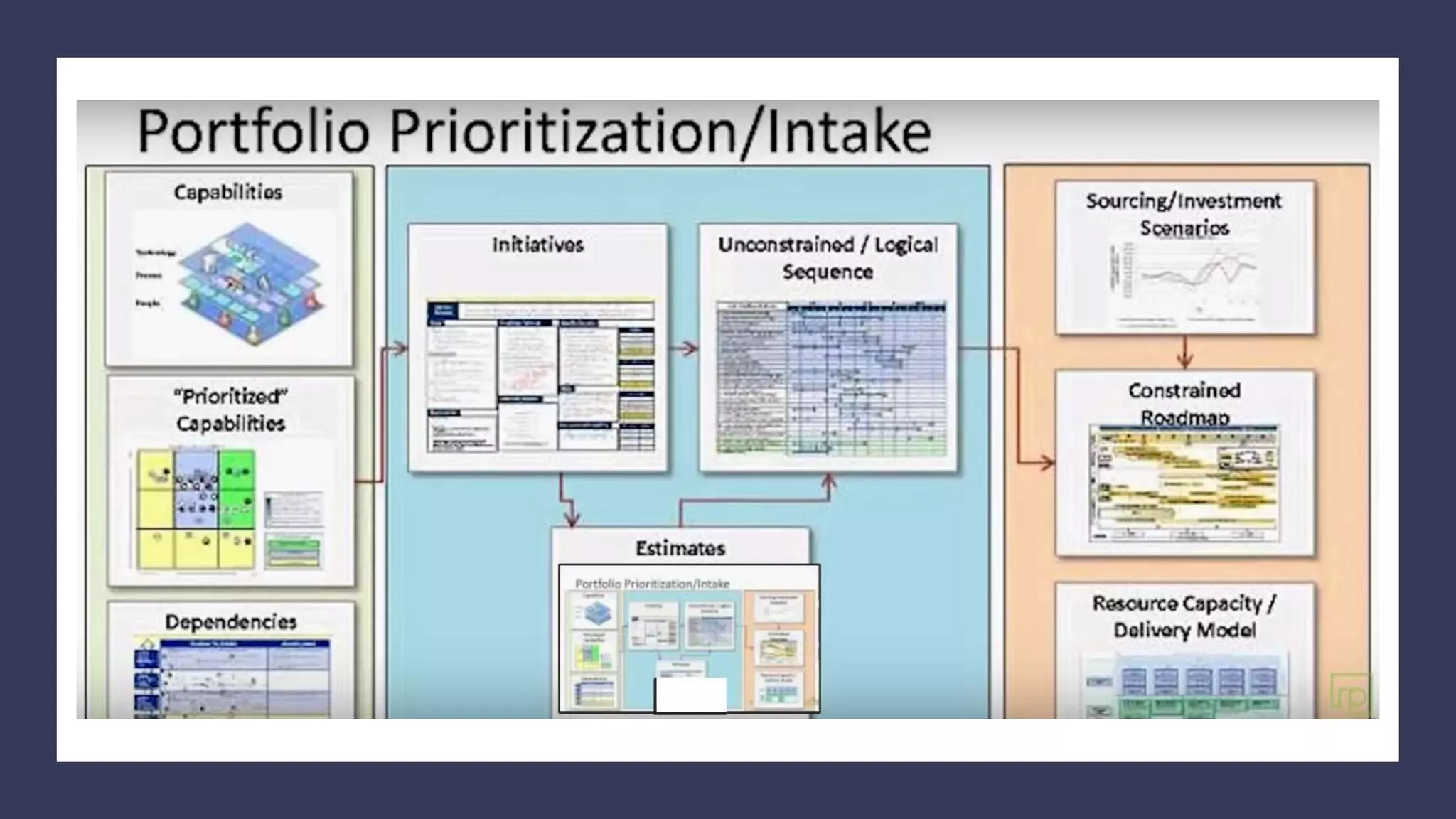

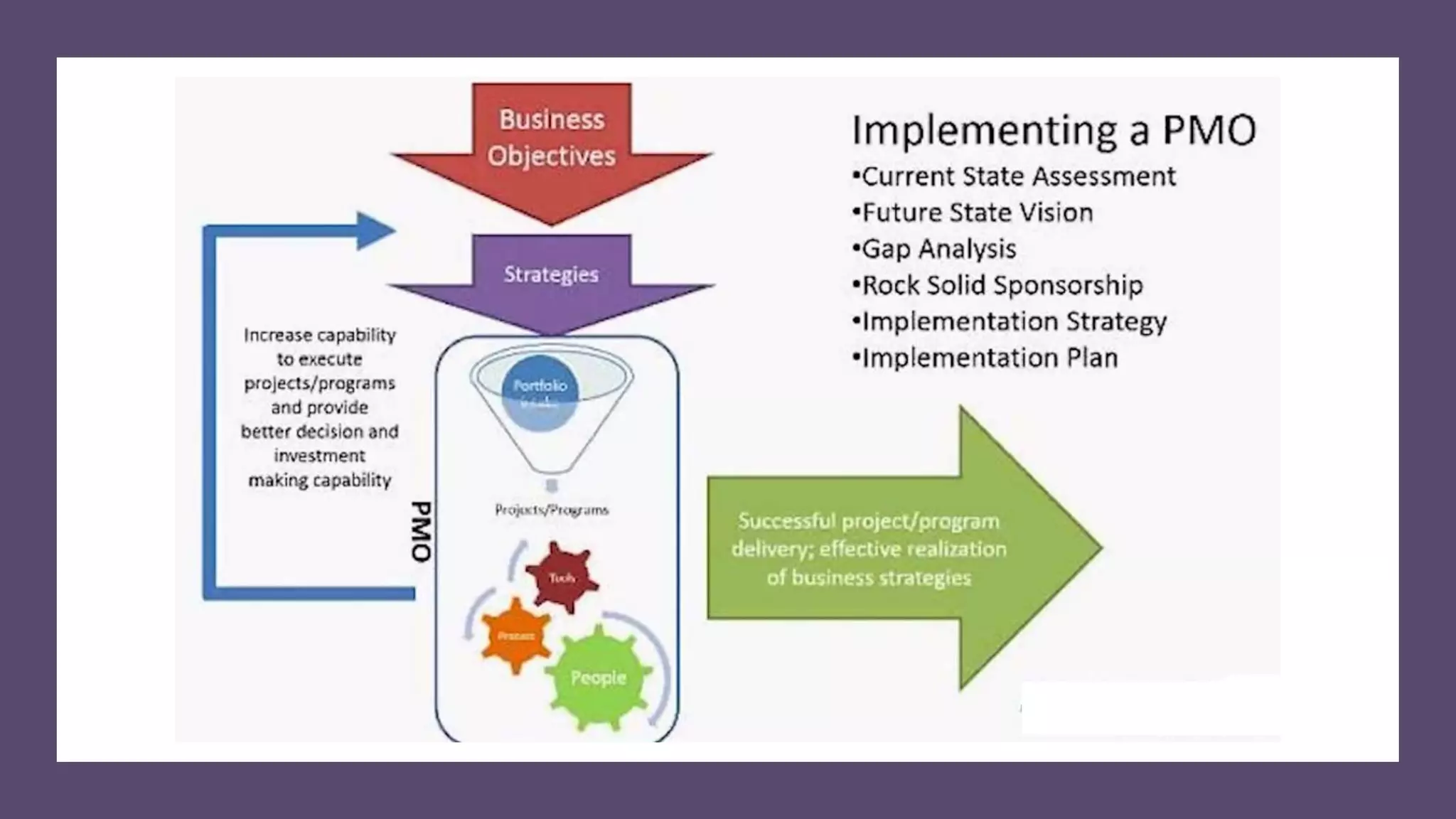

This document discusses portfolio management and the project management office (PMO) value model. It describes two models - the cost containment model which focuses on reducing costs, and the throughput model which aims to meet objectives by eliminating waste. The document also covers portfolio selection techniques like triage, prioritization, sequencing and optimization. It discusses the challenges of managing multiple related projects and how various approaches, standards, roles and maturity models help address these challenges.