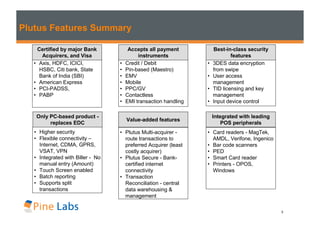

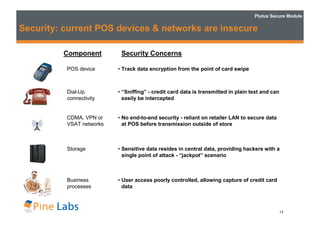

Plutus is a PC-based card processing solution that replaces traditional EDC terminals. It allows merchants to accept all major payment types through their existing PCs and offers several advantages over EDCs:

1) It eliminates telecommunication costs associated with EDCs by using existing internet connections instead of dial-up.

2) It streamlines operations at the point-of-sale by automating tasks, integrating with billing systems, and allowing faster transactions.

3) It allows merchants to centrally manage transaction routing rules to optimize costs, without relying on individual cashiers.

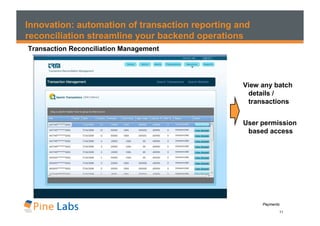

4) It facilitates transaction aggregation, settlement and reconciliation through centralized reporting and interfaces.