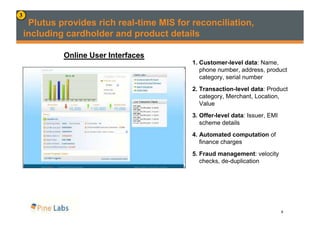

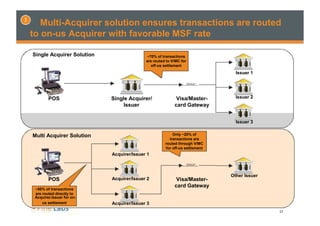

The document summarizes an instant EMI solution that allows manufacturers to offer 0% financing offers at point of sale to drive incremental sales. It works by integrating with a merchant's POS to authorize EMI transactions in real-time based on rules set by the manufacturer, such as by product, store, or transaction value. The transactions are settled directly between the credit card issuer and manufacturer. The solution provides control, reach, and reporting benefits for manufacturers while enhancing the customer experience.