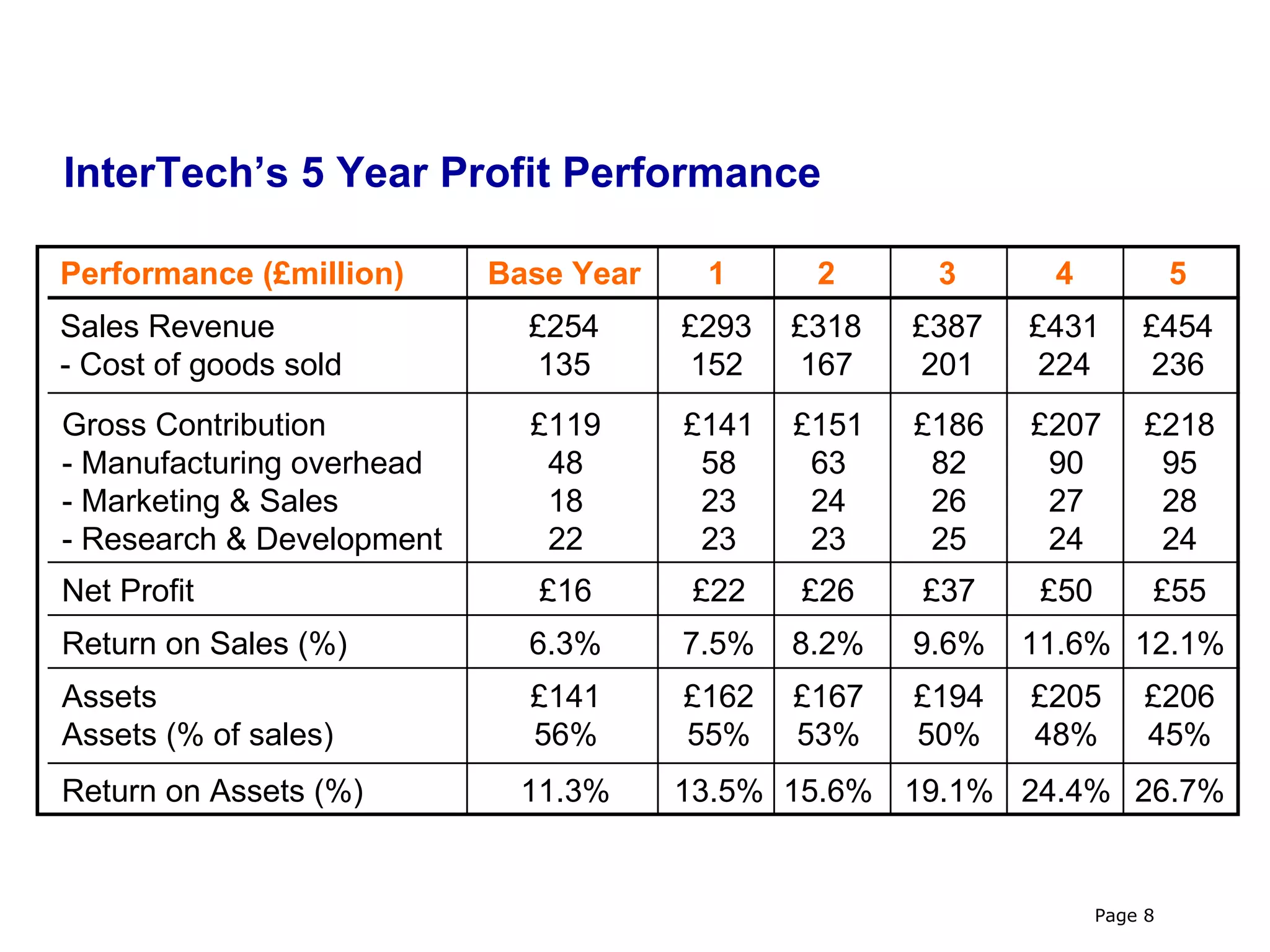

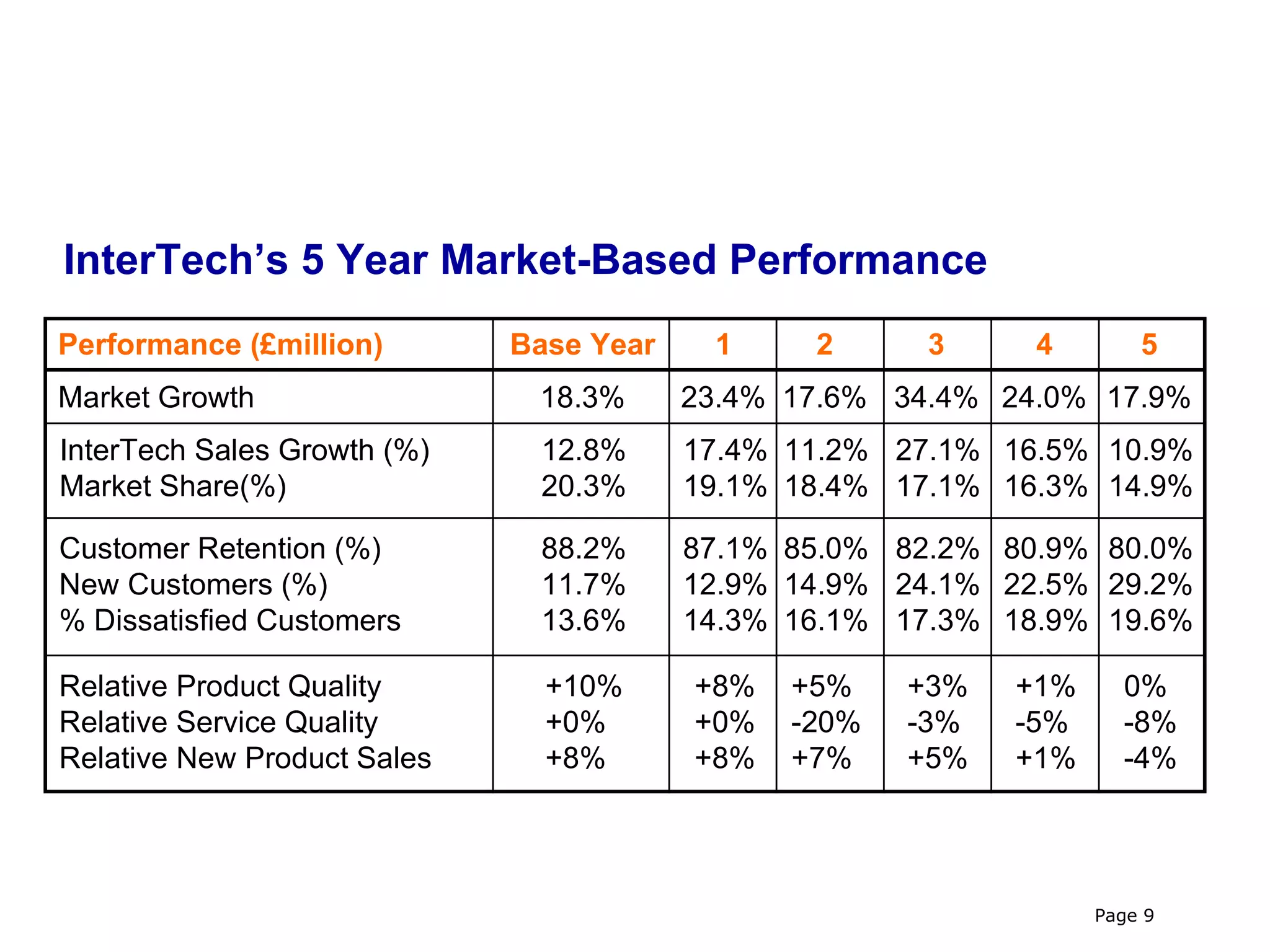

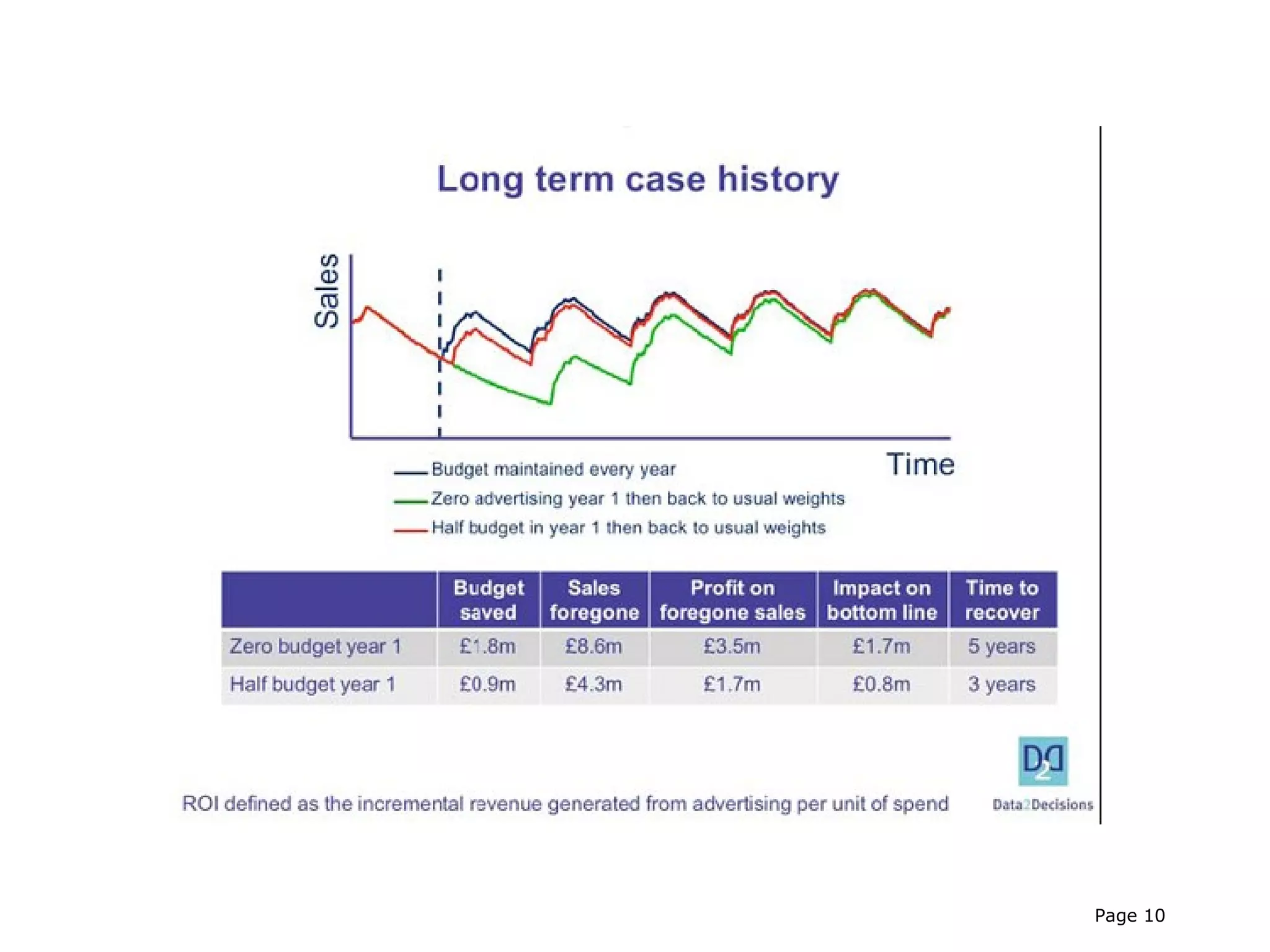

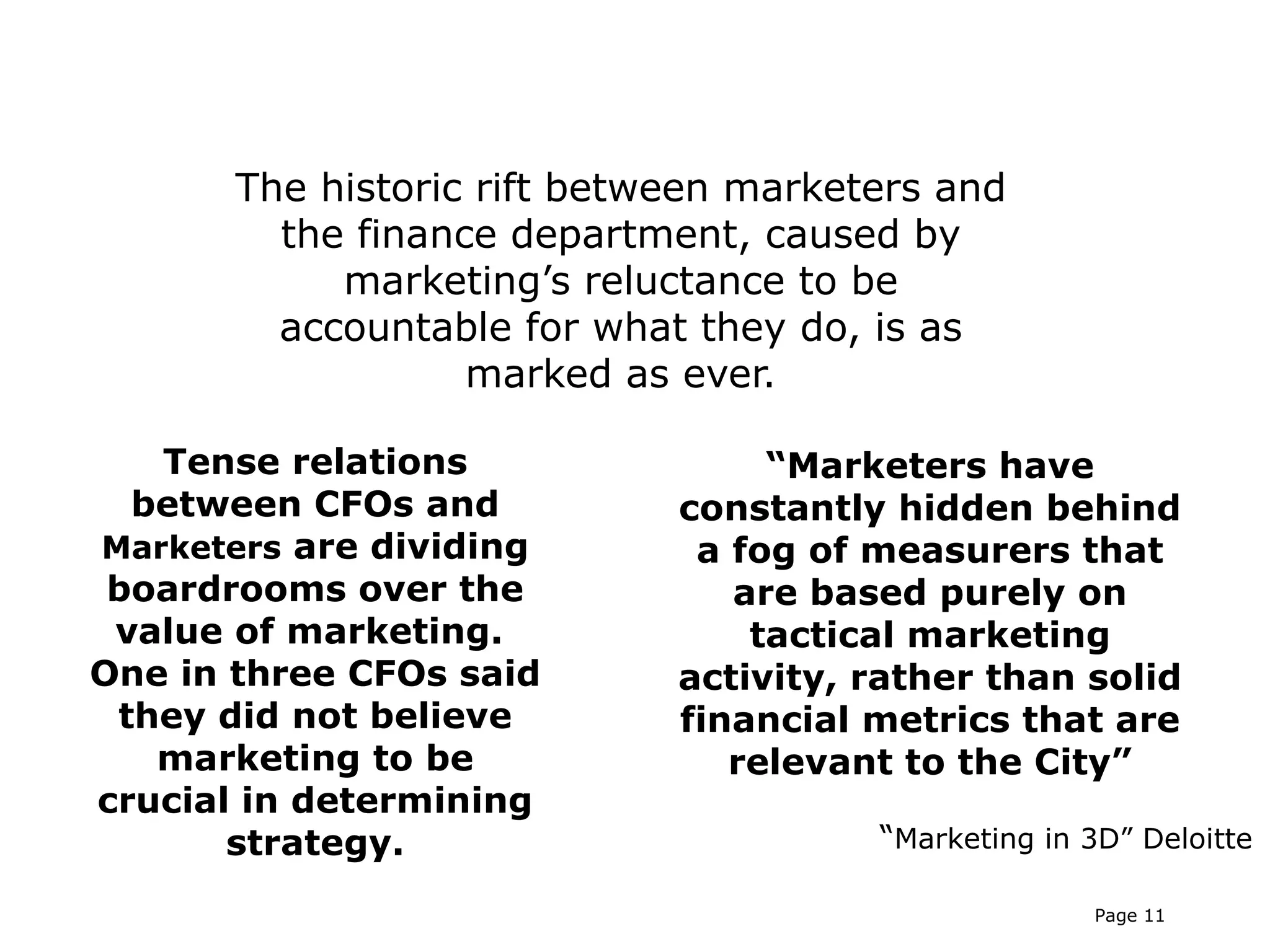

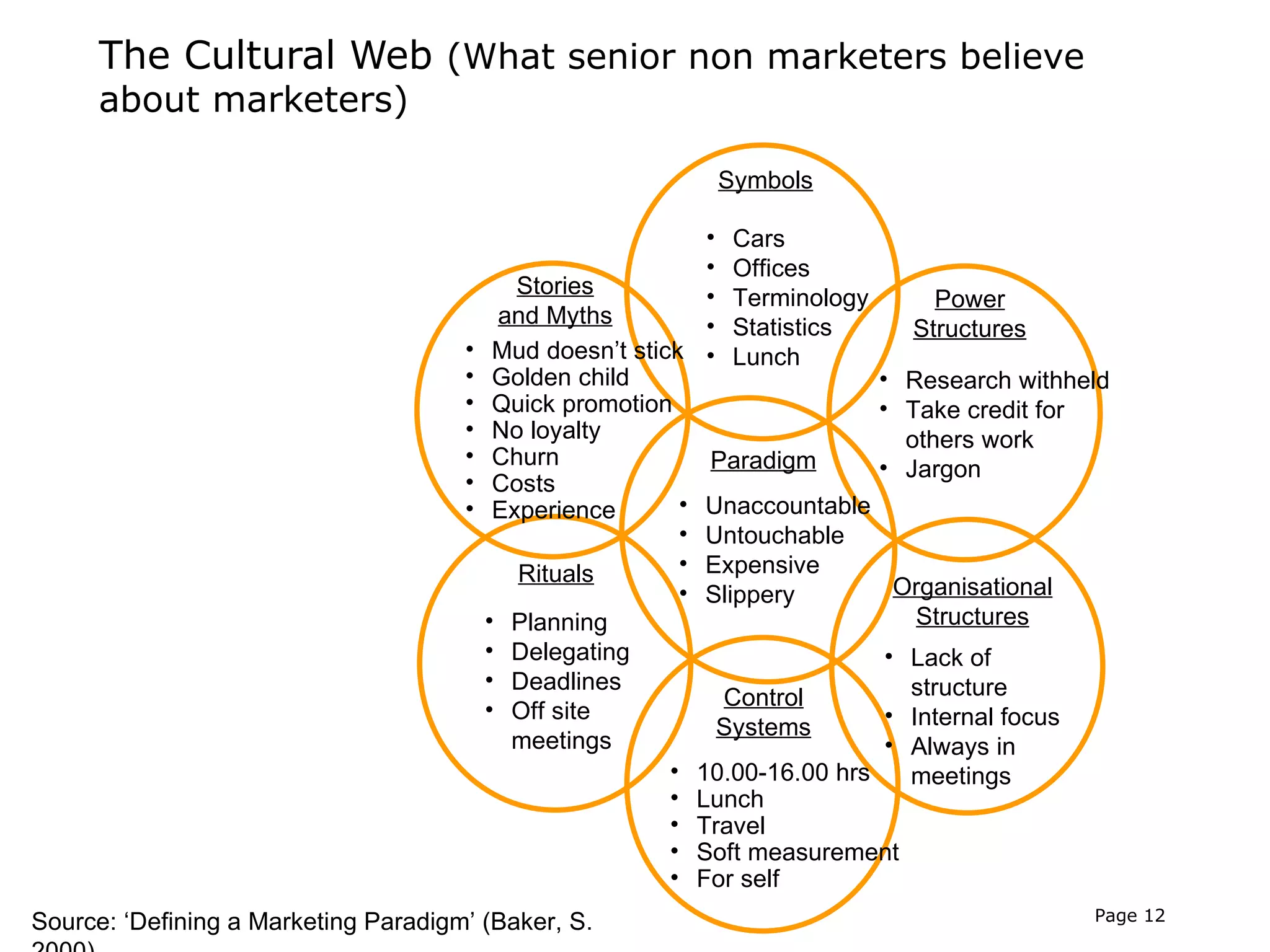

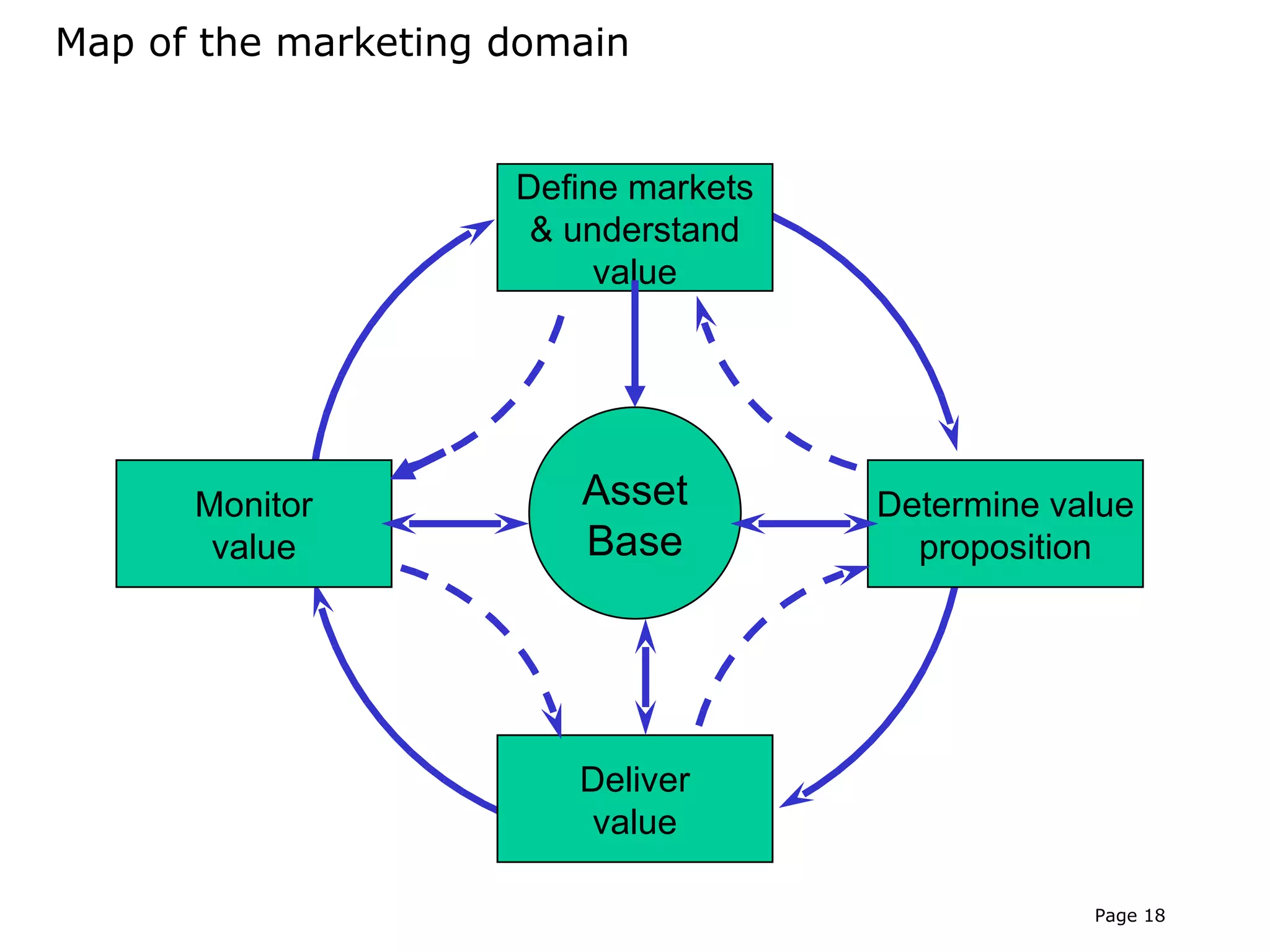

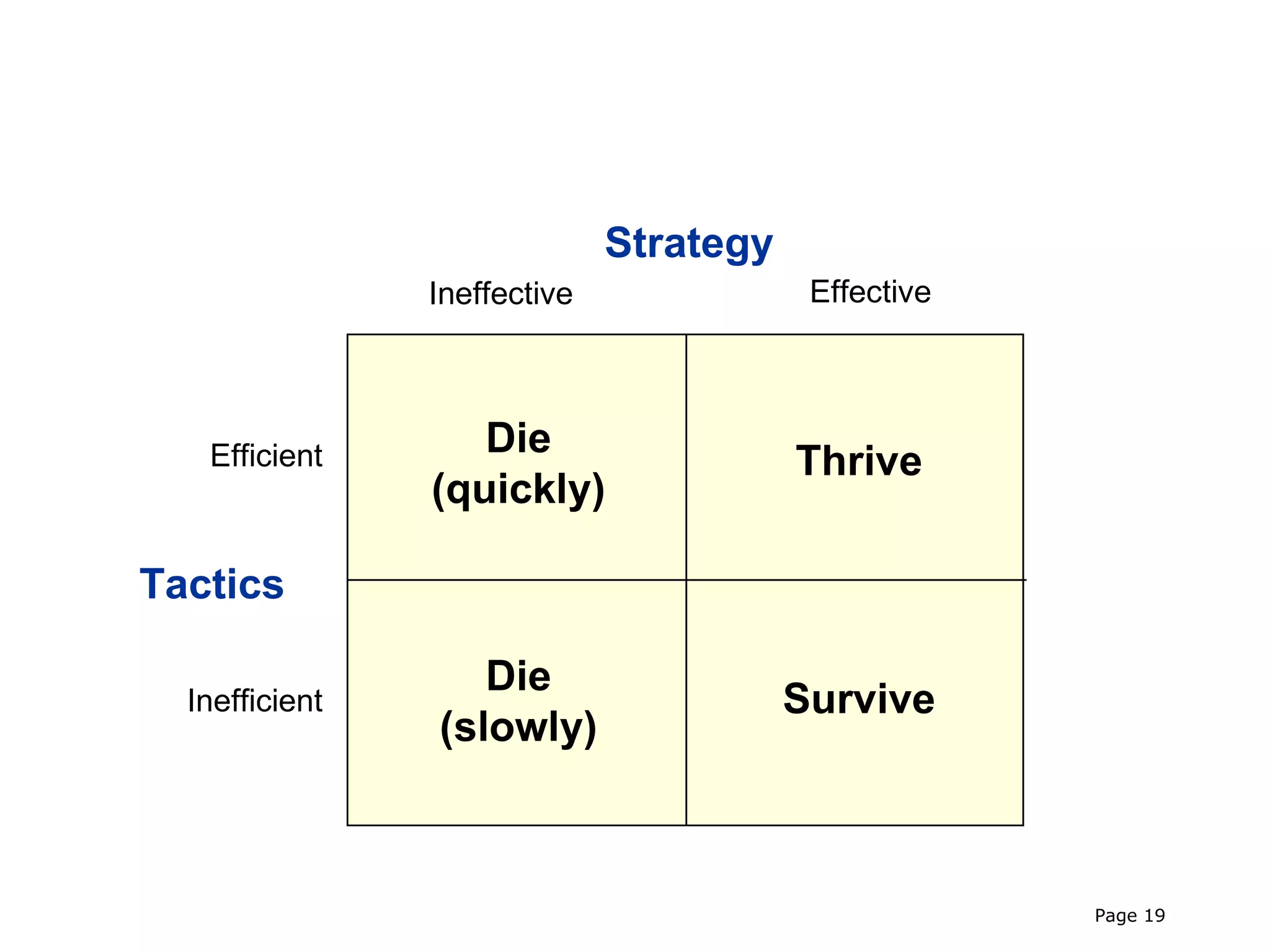

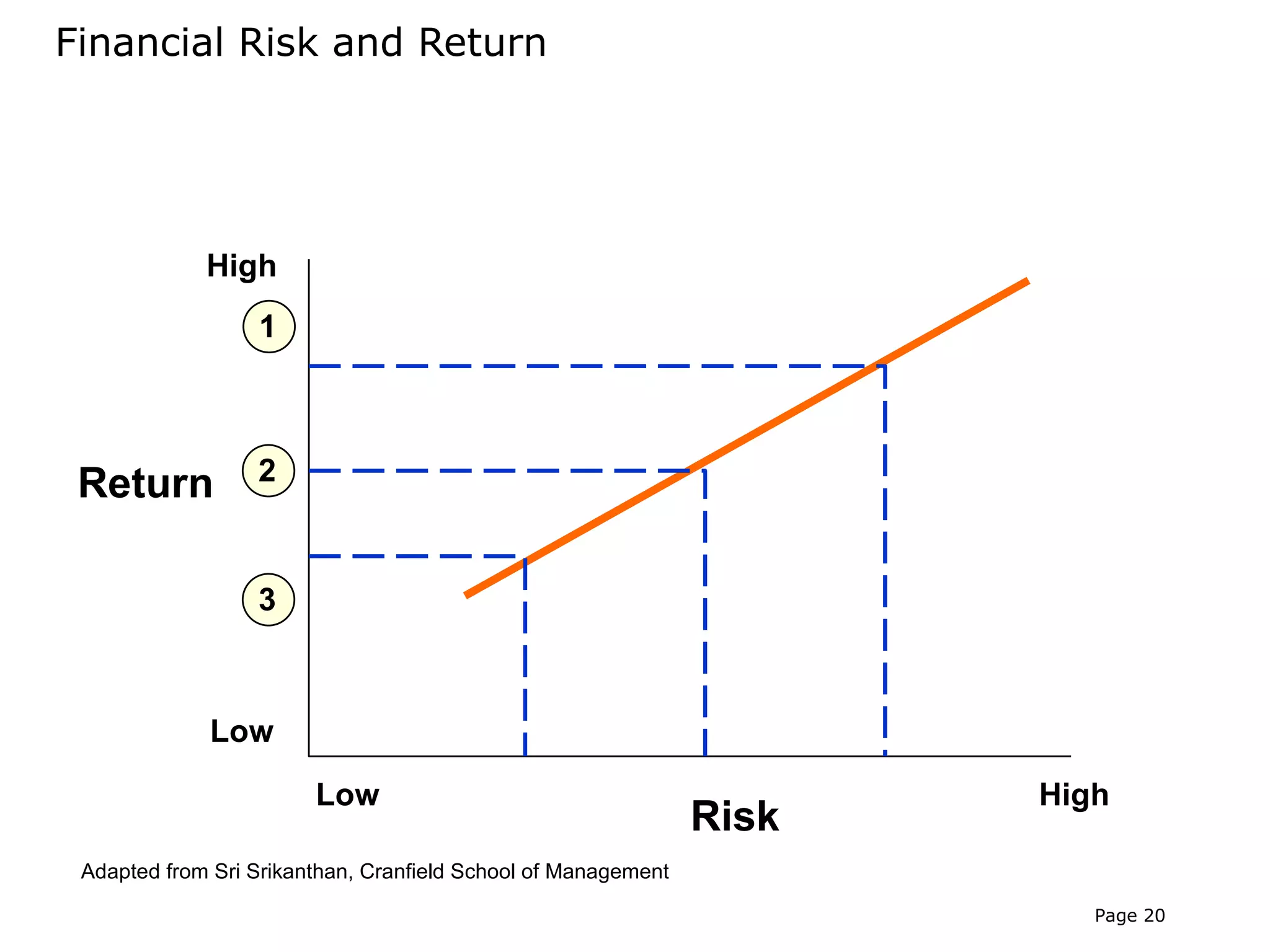

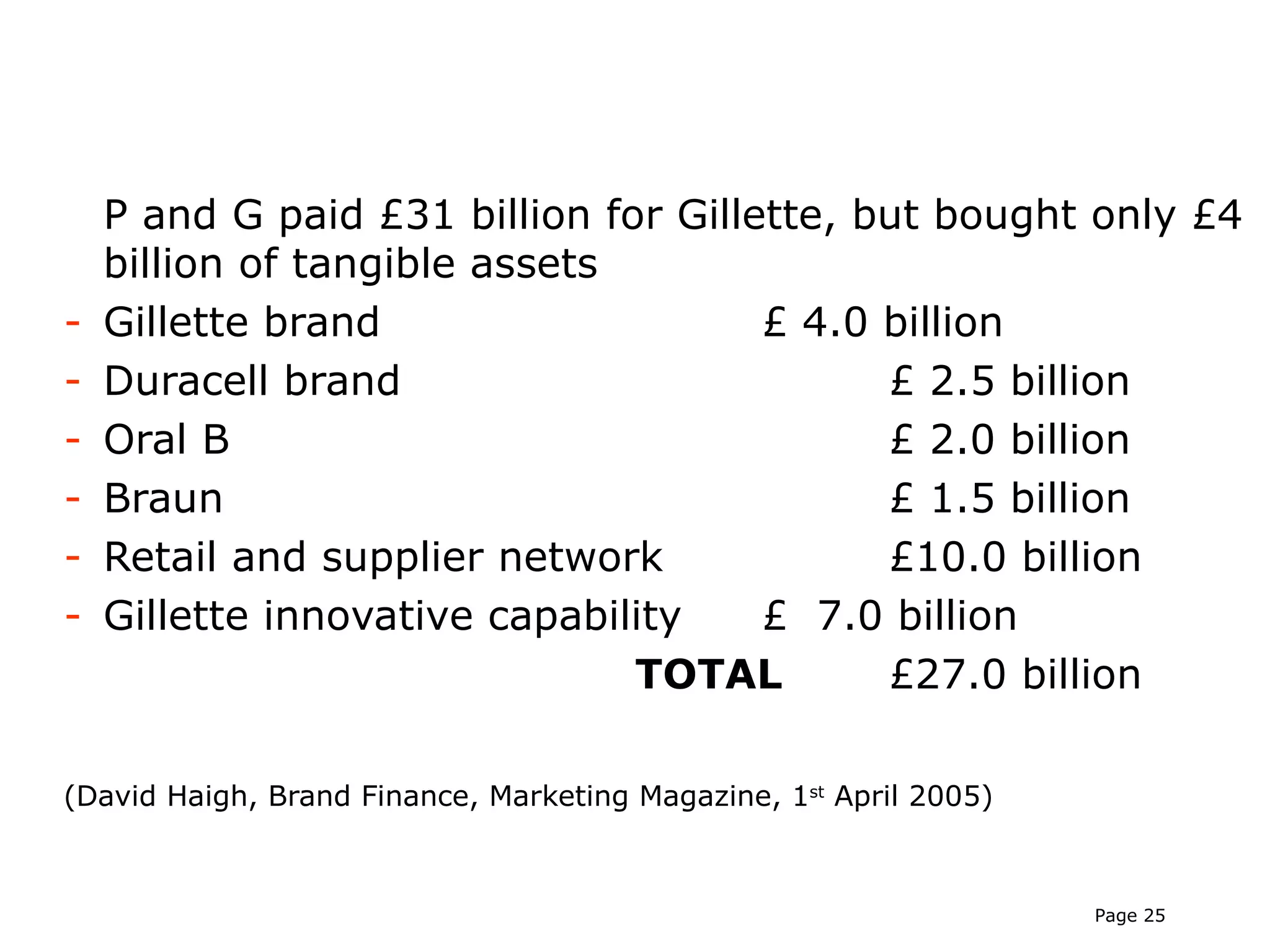

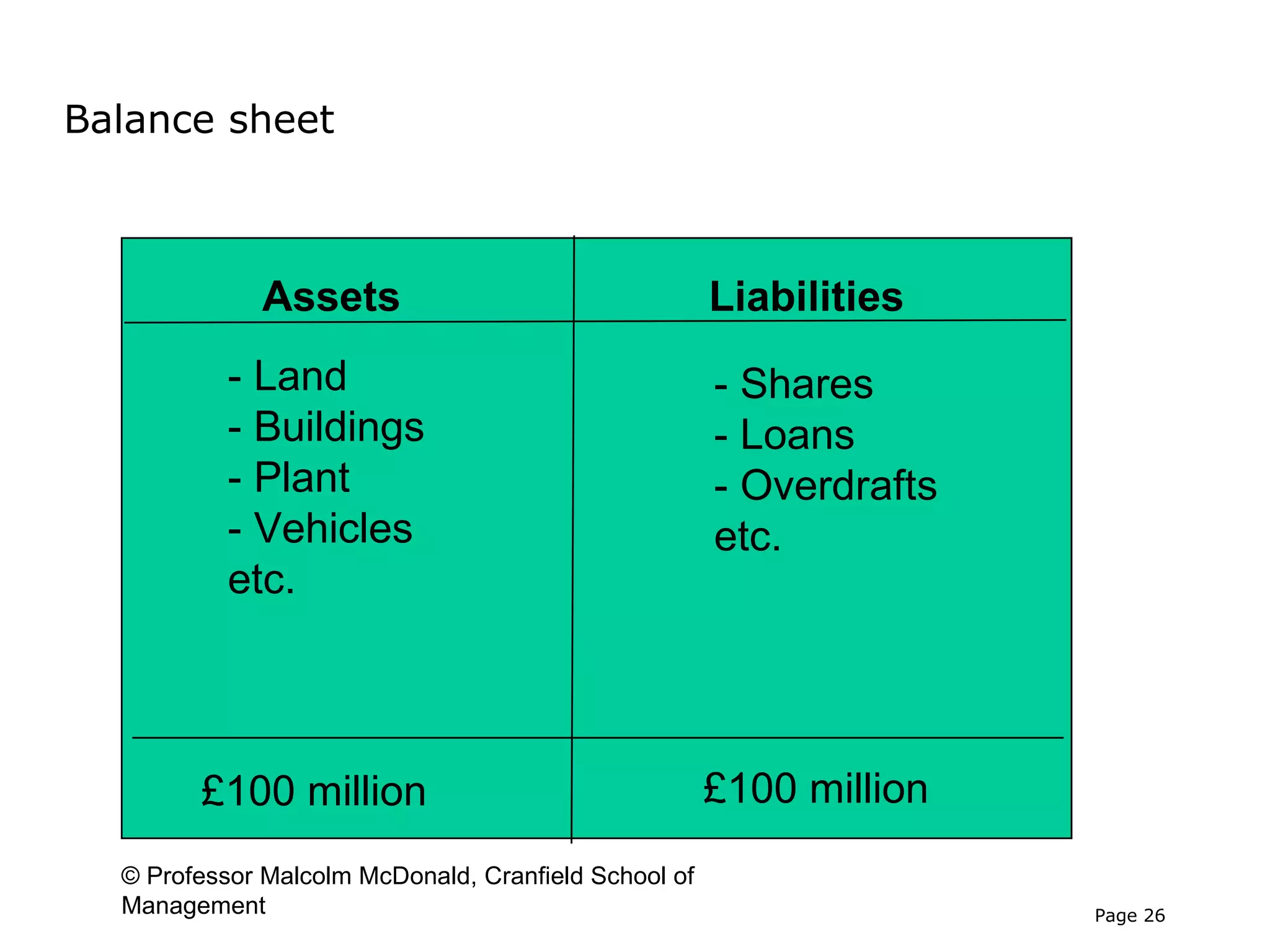

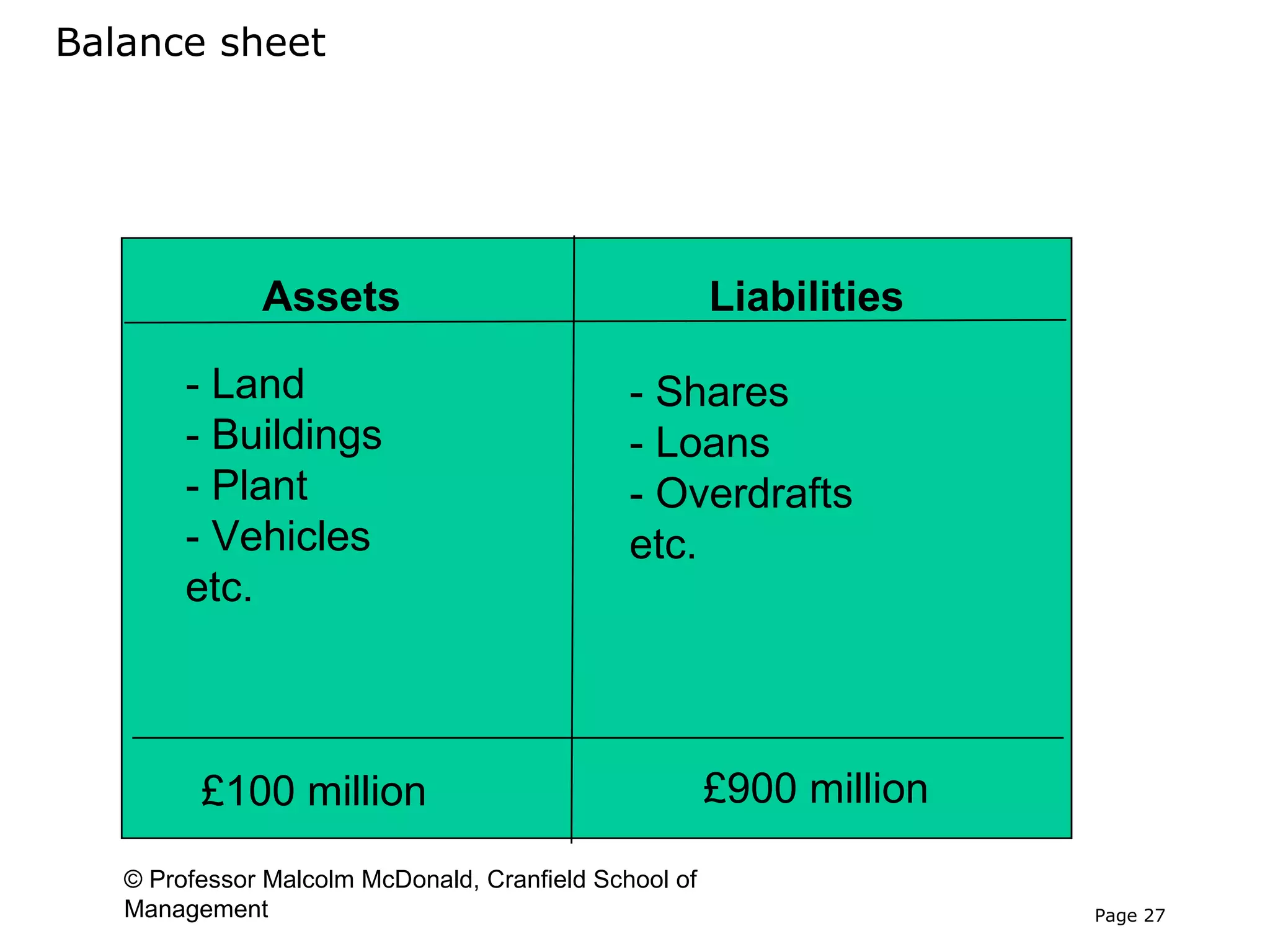

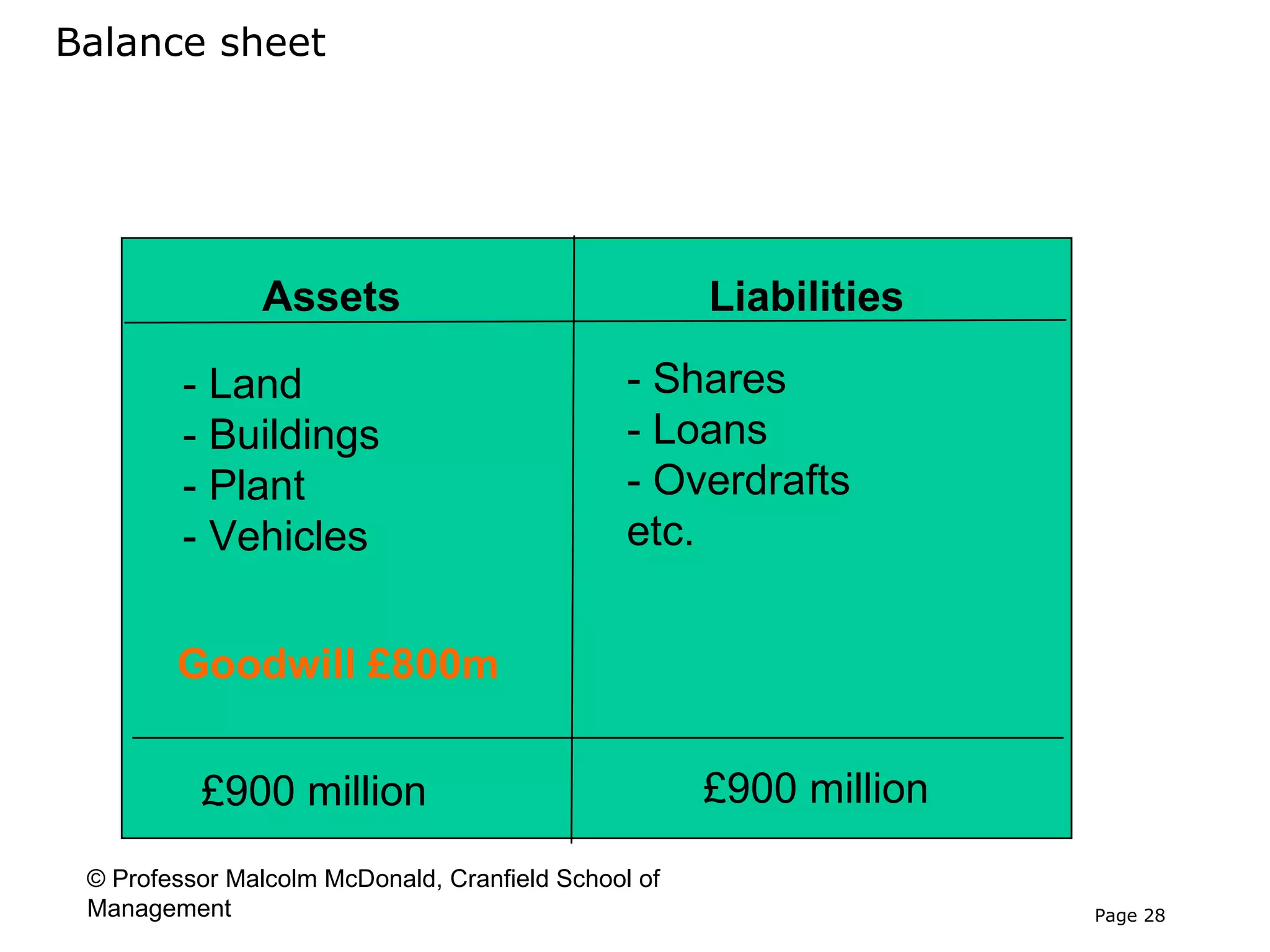

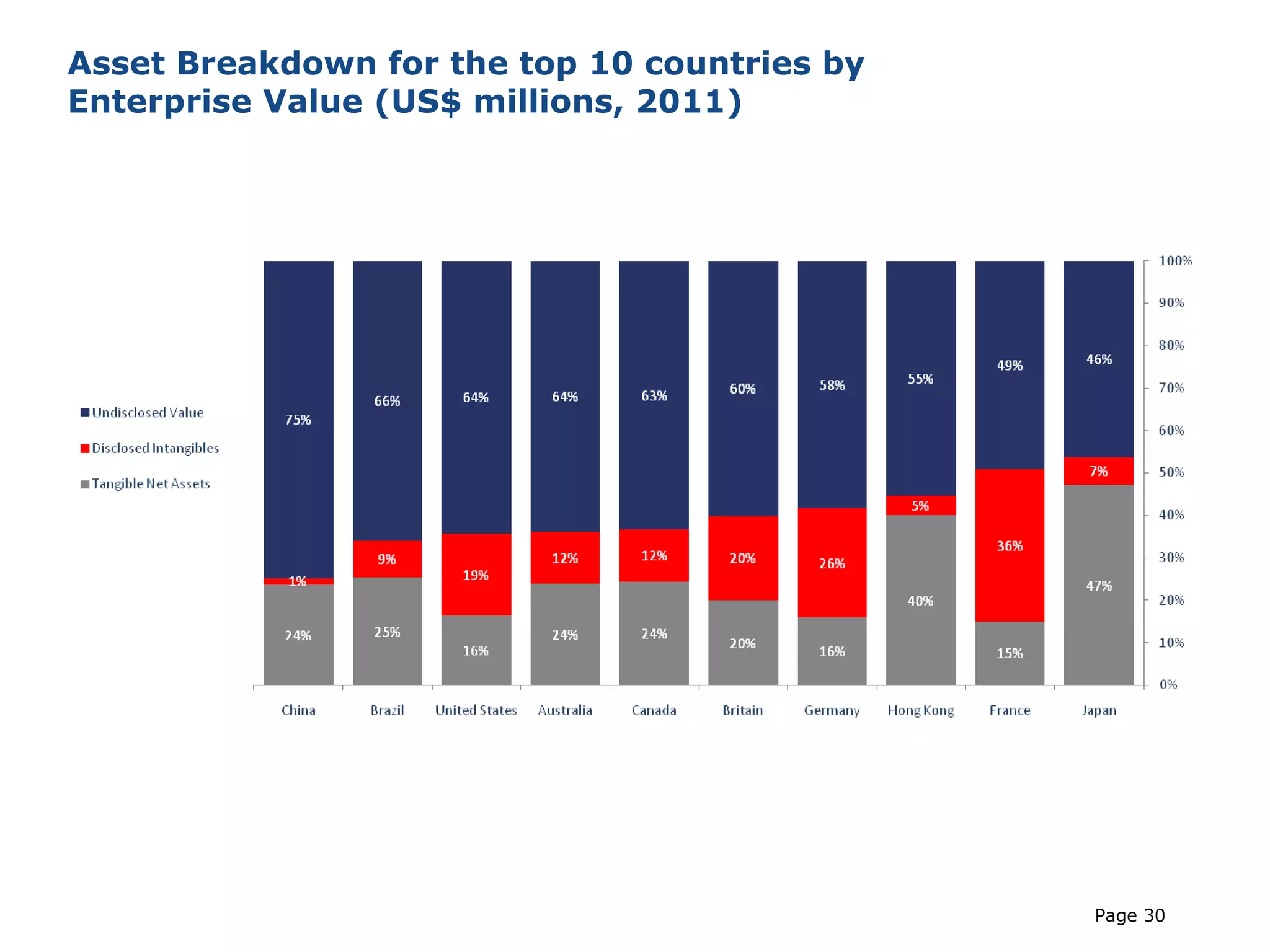

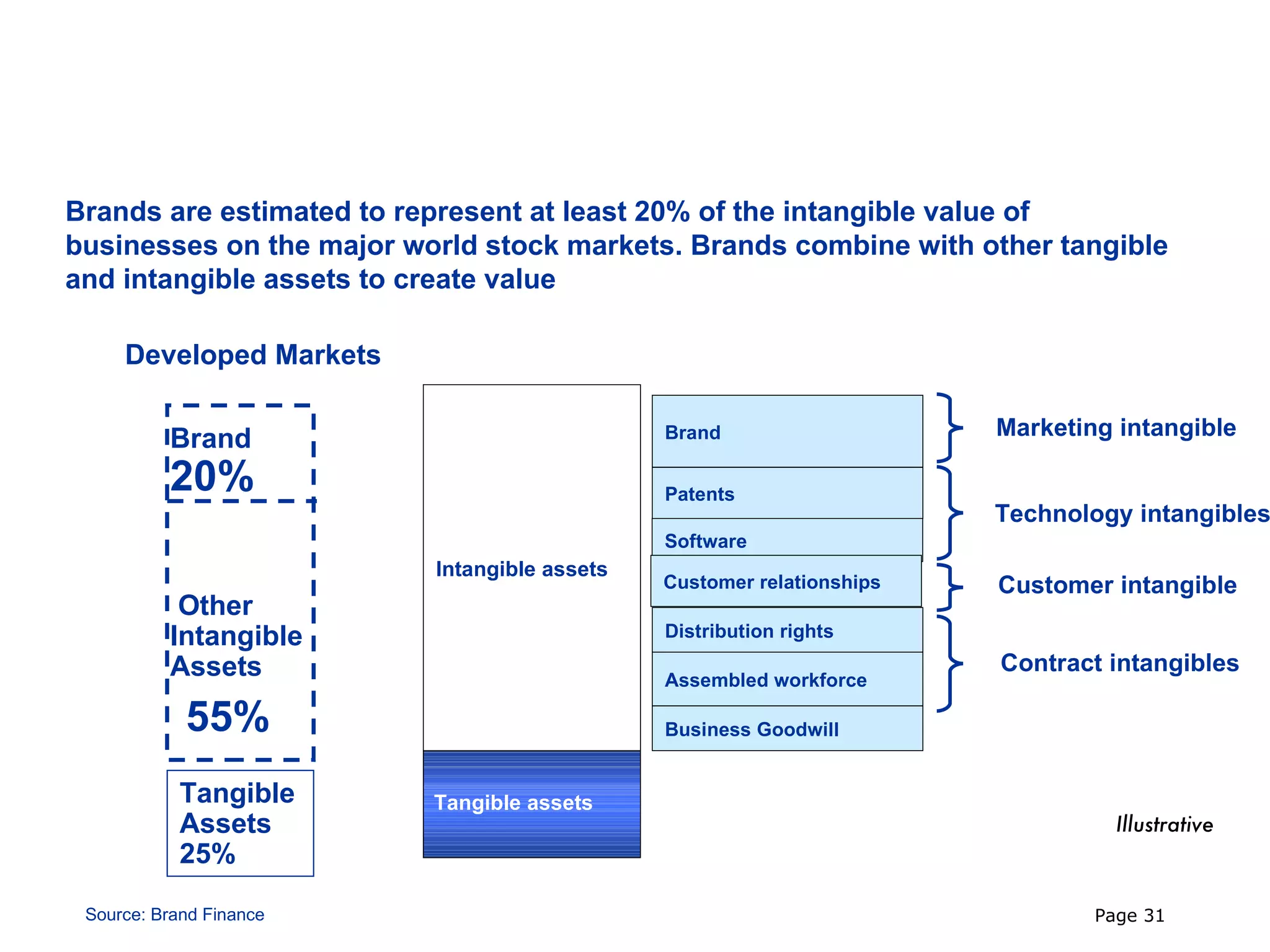

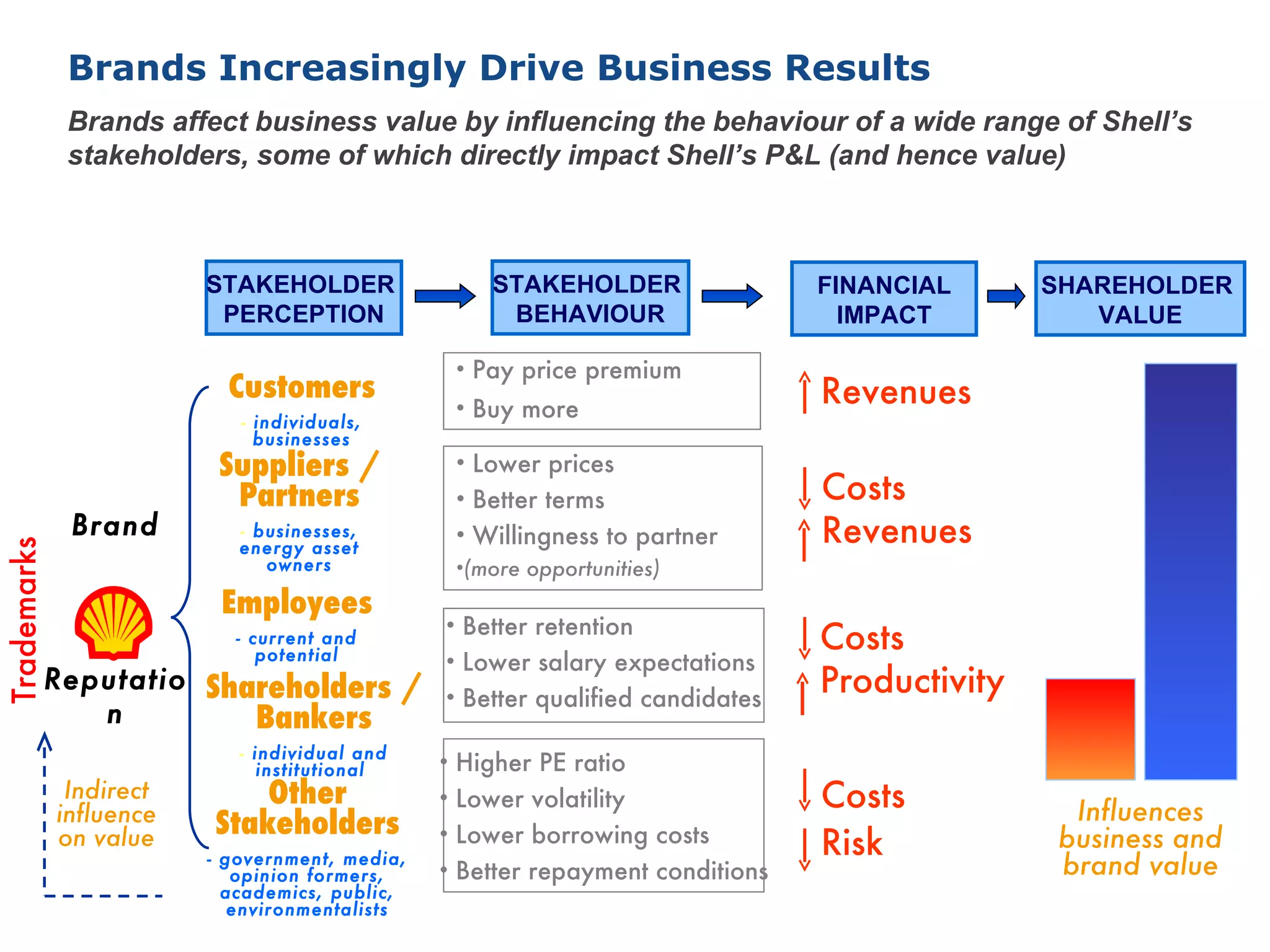

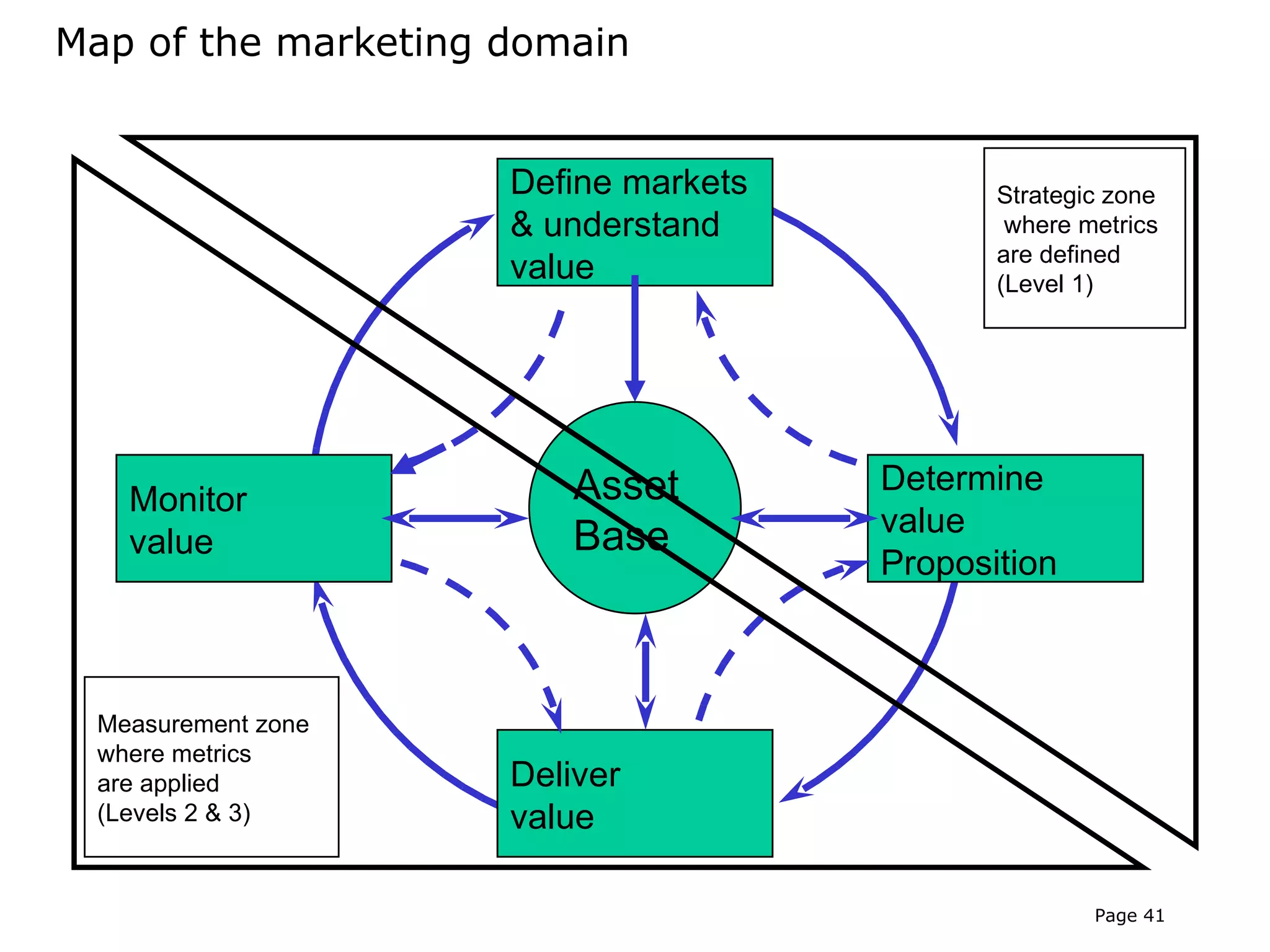

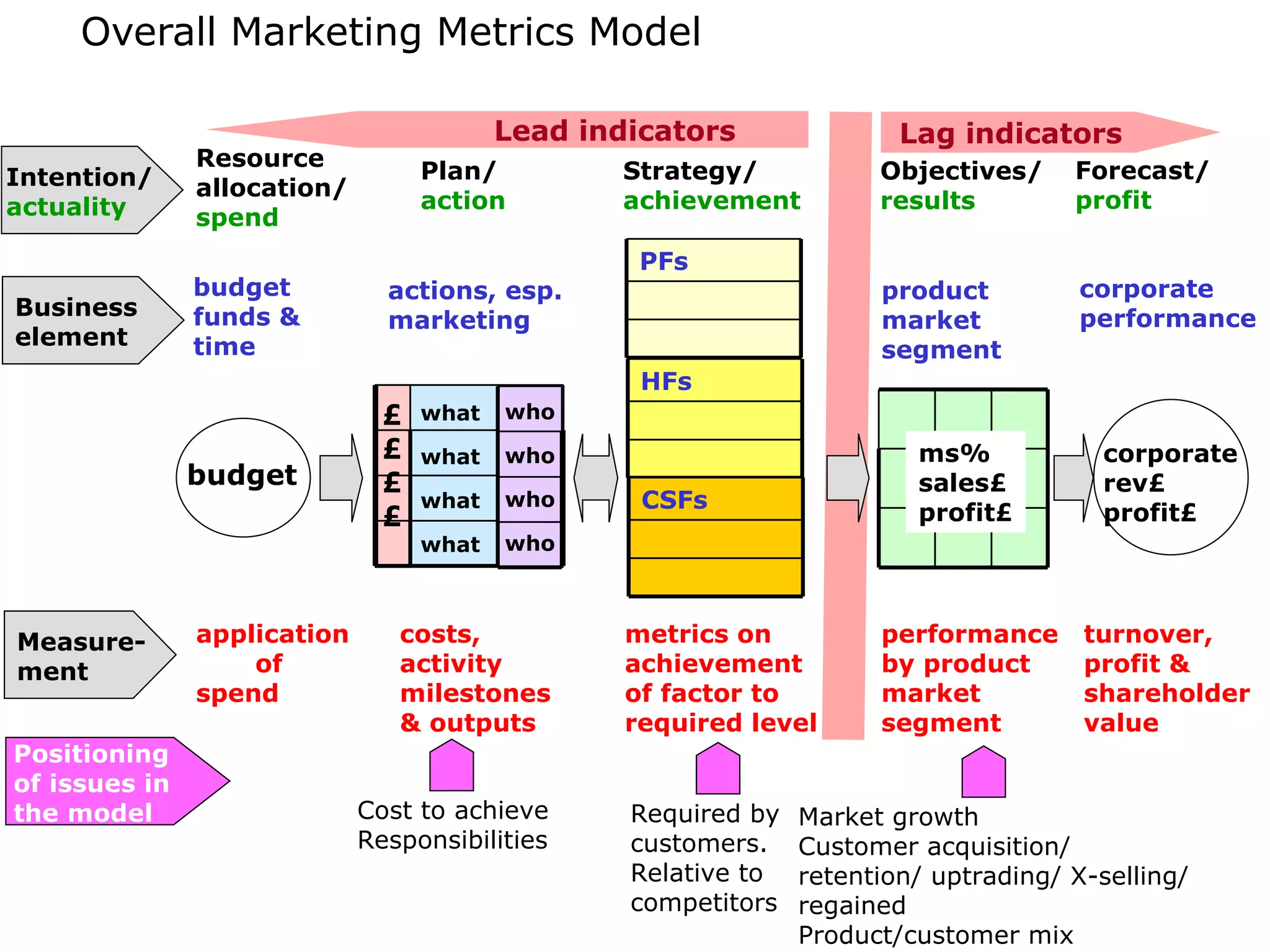

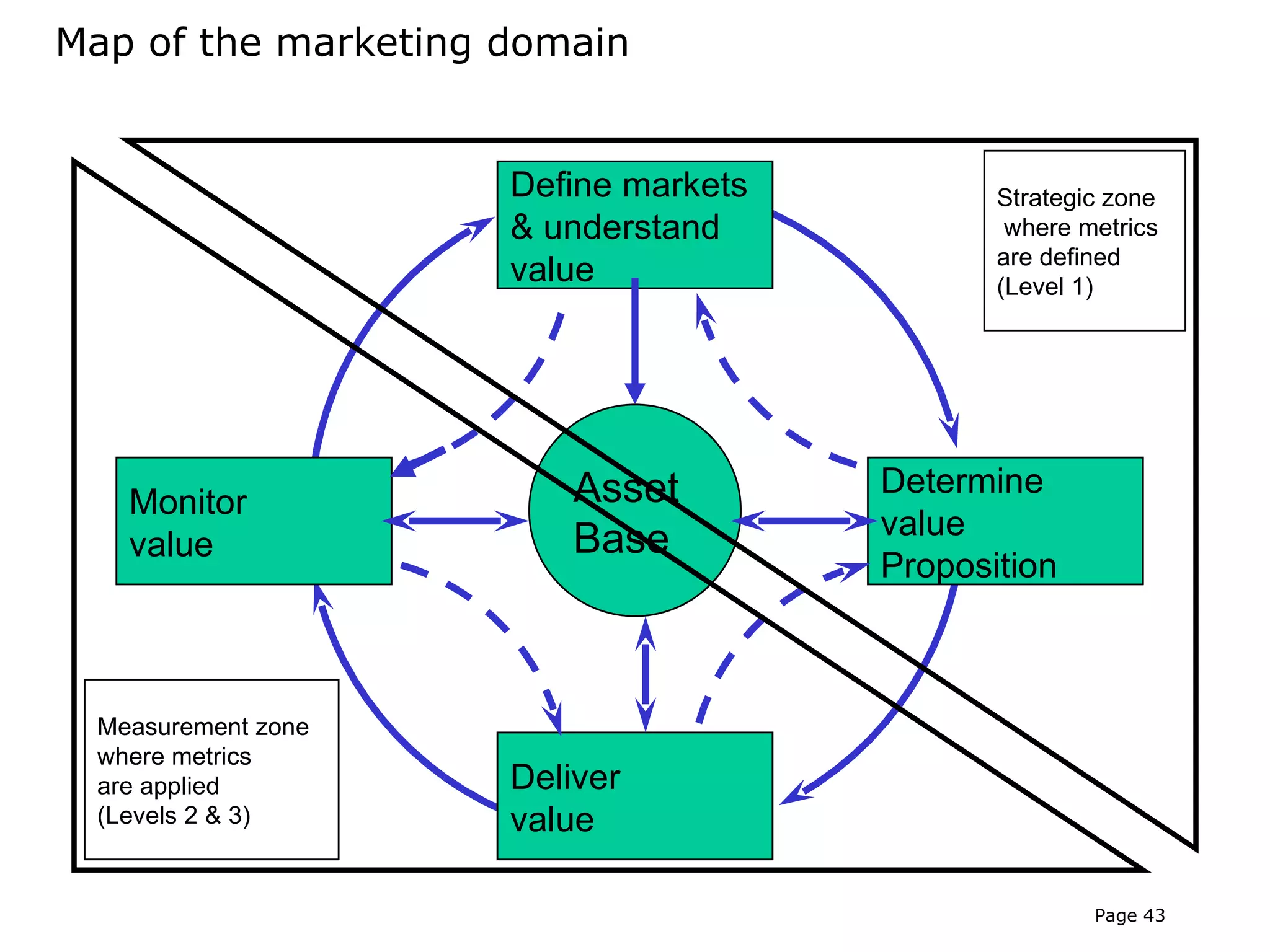

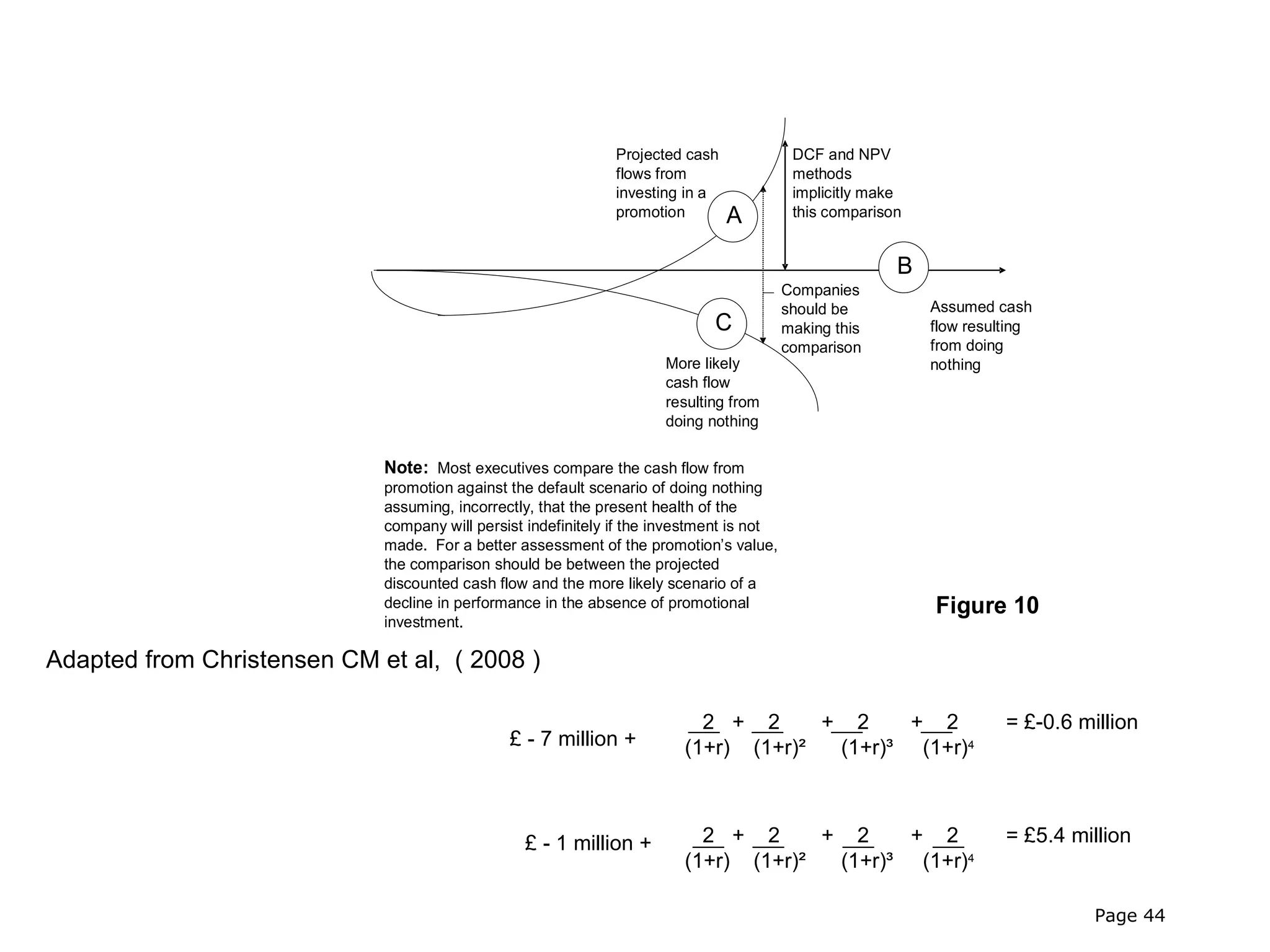

The document discusses the future of marketing. It covers a brief history of marketing including how it has evolved from a focus on practitioners, consultants, and academics. It also discusses how marketers must demonstrate their value to boards by being accountable and using solid financial metrics rather than just tactical measures. Finally, it emphasizes that the overall purpose of strategic marketing is to create sustainable competitive advantage by understanding customer value and developing effective long-term strategies based on market insights.