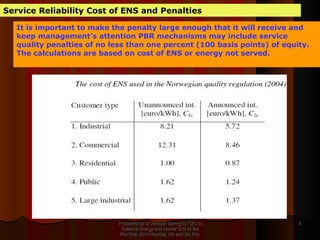

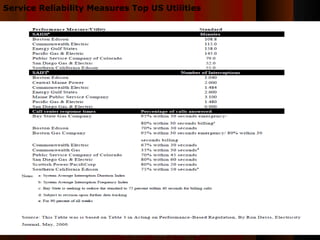

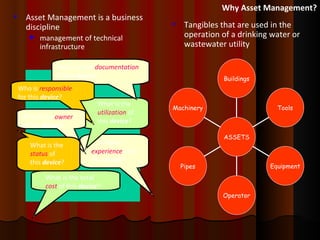

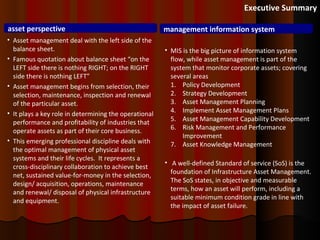

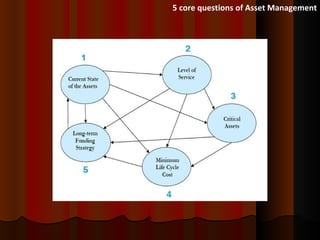

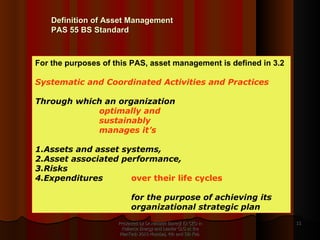

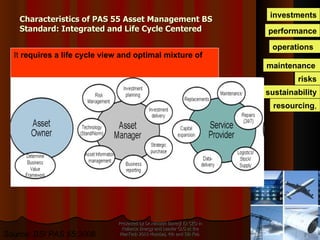

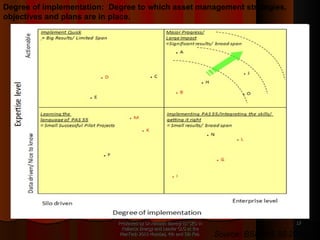

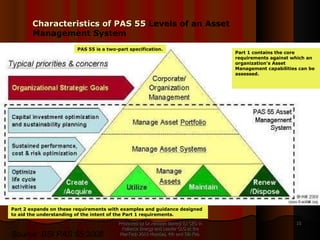

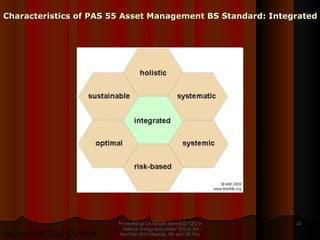

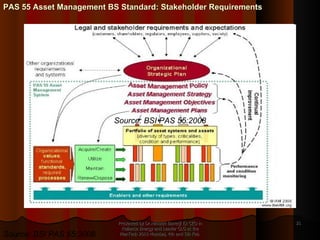

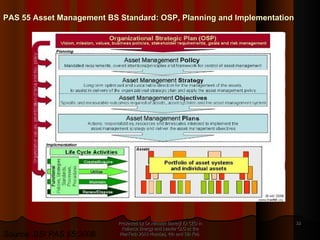

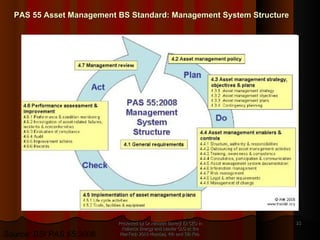

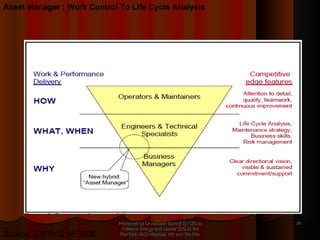

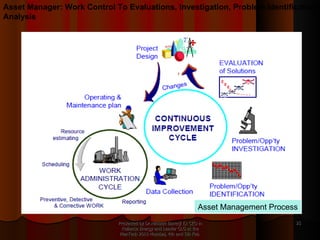

Dr. Himadri Banerji gave a presentation on asset management and performance-based regulation in electric utilities. He discussed the definition and goals of asset management, including optimizing asset performance and life cycle costs. He also covered the PAS 55 standard for asset management, which takes a holistic life cycle approach. Finally, he explained how performance-based regulation can be used to incentivize utilities to improve reliability through mechanisms like service standard targets and penalties.