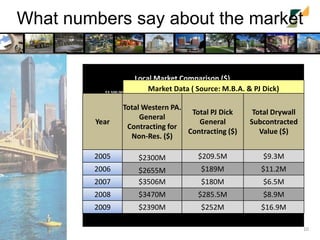

PJ Dick is a general contractor and construction manager specializing in commercial and institutional projects, with a growing presence in various states. The document evaluates the potential for PJ Dick to self-perform drywall activities, analyzing financial scenarios, market conditions, and risks associated with different entry strategies such as acquisitions or joint ventures. Experts anticipate an industry recovery, presenting a prime opportunity for PJ Dick to enter the drywall market as current financial conditions suggest favorable outcomes.