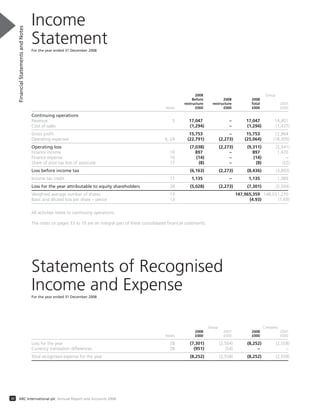

ARC International provides multimedia solutions and intellectual property to consumer electronics companies globally to improve the audio and video experience on electronic devices. In 2008, ARC grew revenues driven by higher royalty payments from new customers, but remained cautious due to economic uncertainty. ARC strengthened its portfolio through acquisitions, broadened its target markets, and restructured operations to lower costs and accelerate transition to profitability.