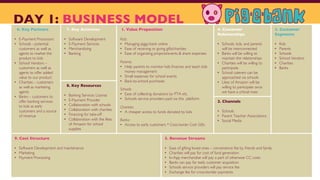

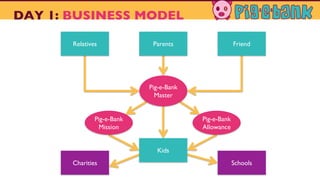

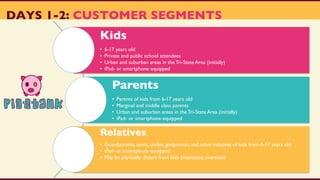

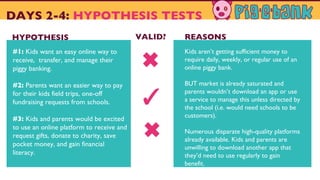

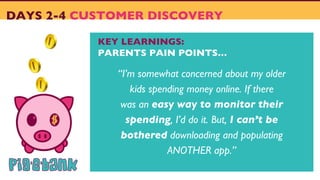

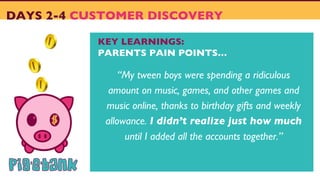

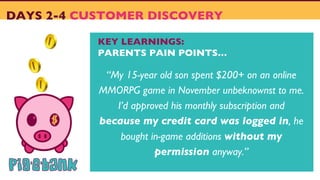

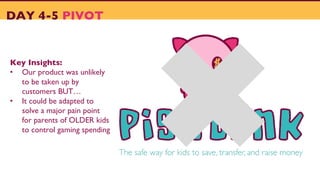

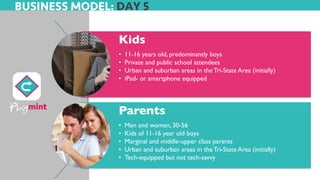

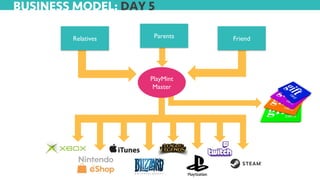

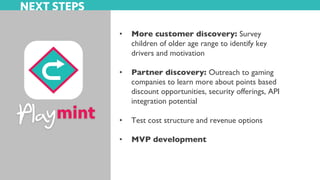

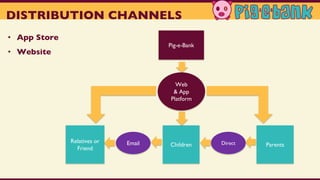

The document summarizes insights from a lean launchpad session focused on developing an online financial management platform for kids and their parents. Key findings include a desire for an easy way to manage piggy banks, concerns about children's online spending, and a need for schools to be involved to drive adoption. The document outlines potential customer segments, partnerships, and next steps for product development and customer discovery.