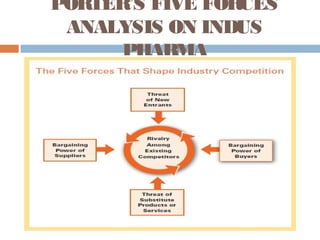

Indus Pharma was founded in 1969 by Saeed Ismail with a vision of providing quality medicines at affordable prices. Porter's five forces analysis shows that rivalry among existing competitors in the Pakistani pharmaceutical industry is high due to companies creating substitutes for new drugs. While threats of entry by new competitors is medium due to high research and development costs and regulatory hurdles, bargaining power of buyers like hospitals is also medium as they can pressure companies on pricing. Bargaining power of suppliers is low as materials and equipment have multiple sources. Availability of substitutes like herbal products is high. In conclusion, Porter's model shows low to medium competitive forces in the industry.