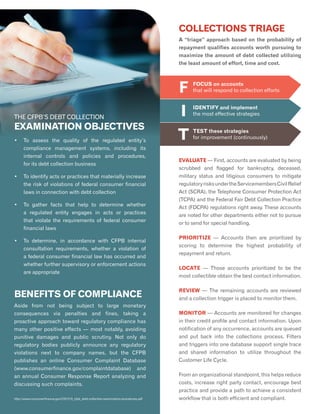

The document discusses the impact of the Dodd-Frank Act and the establishment of the Consumer Financial Protection Bureau (CFPB) on the financial landscape, specifically regarding debt collection practices and compliance regulations. It highlights the rise in complaints against debt collectors and the importance of accurate consumer data, emphasizing the scrutiny financial institutions face amid increasing regulatory demands. Additionally, it outlines the benefits of proactive compliance management systems to minimize risks and improve operational efficiency within the debt collection industry.