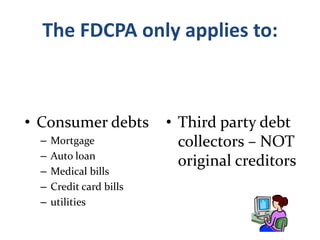

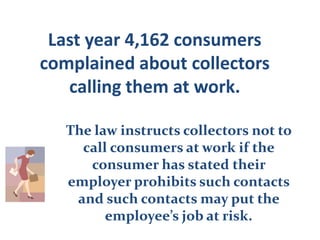

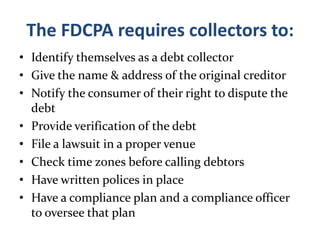

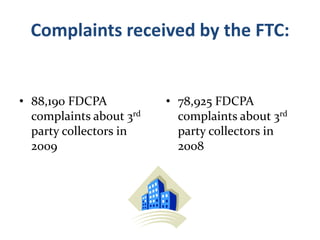

The Fair Debt Collection Practices Act (FDCPA) regulates how third party debt collectors contact consumers regarding debts. According to the FTC, complaints against in-house collectors increased from 26,652 in 2008 to 32,076 in 2009. The FDCPA only applies to consumer debts such as credit cards, medical bills, and mortgages collected by third parties, not original creditors. It requires collectors to identify themselves, provide debt validation, and limits contacting consumers at work or inappropriate times.