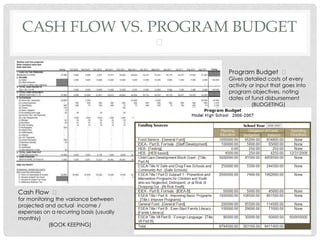

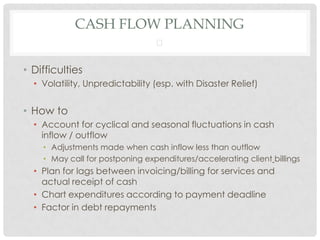

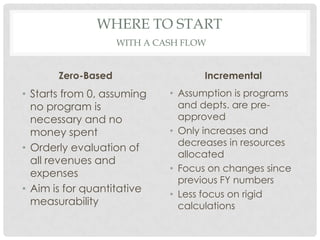

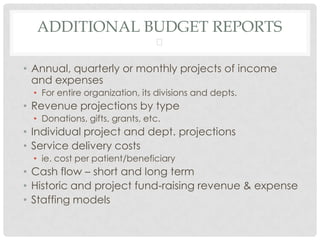

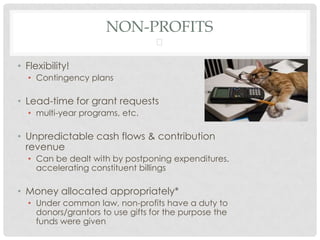

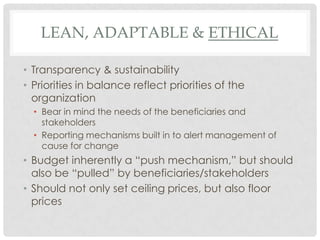

The document provides an overview of basic budgeting principles for non-profits, including how to prepare an effective budget that is realistic, consistent, flexible and measurable. It discusses the differences between program budgets and cash flow budgets, and offers tips for cash flow planning such as accounting for seasonal fluctuations and timing expenditures according to payment deadlines. Effective budgeting for non-profits requires flexibility, transparency, and ensuring funds are used appropriately to balance organizational priorities with beneficiary needs.

![OTHER CONSIDERATIONS

• As much money as possible in federally insured,

interest bearing accounts

• Once cash reserves exceed operating costs,

consider longer-term investments

• Staff increases, technological investments

• Budget spreadsheets often, requested by third-

party stakeholders / [potential] donors

• Tracking of expenditures enhances ability to report

accomplishments](https://image.slidesharecdn.com/budgetingpresentationedit-111106122953-phpapp01/85/PDPM-Budgeting-Presentation-11-320.jpg)