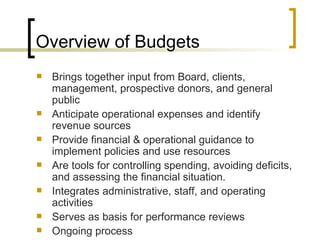

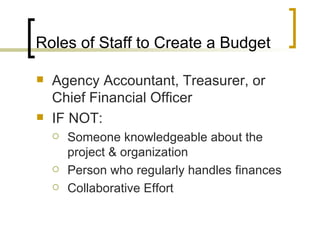

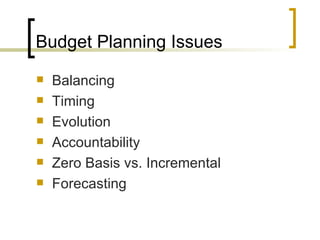

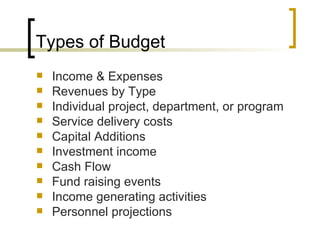

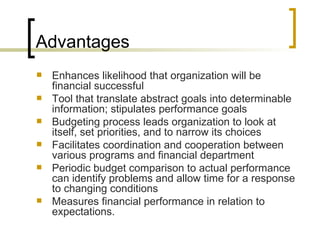

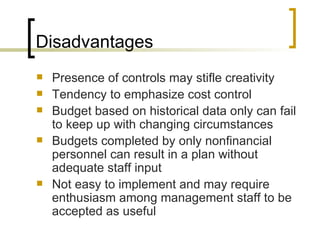

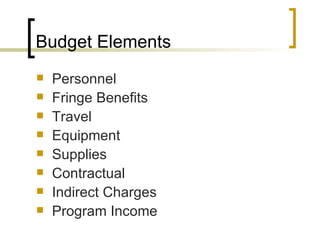

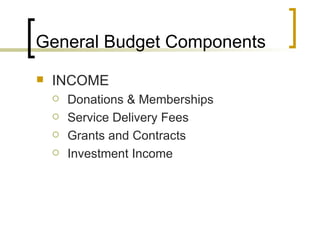

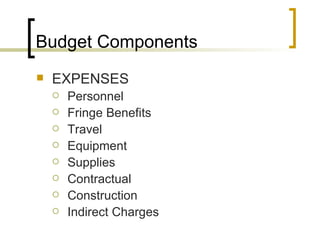

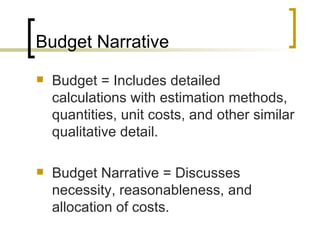

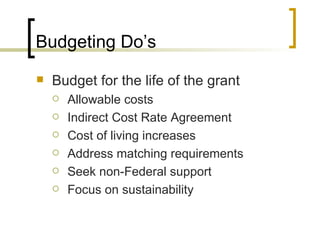

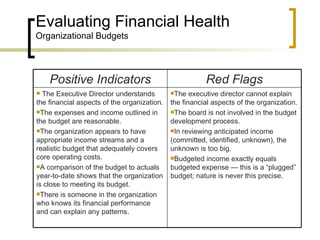

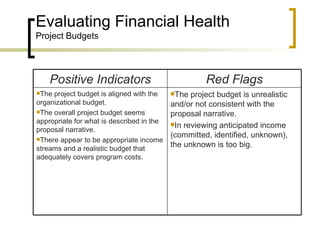

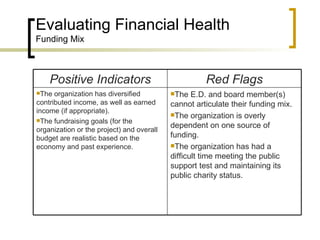

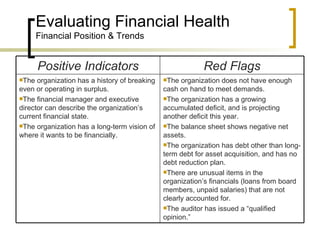

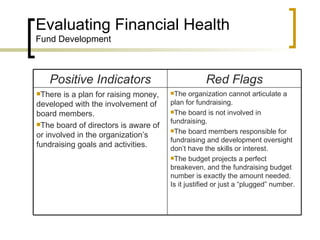

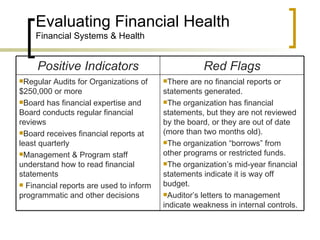

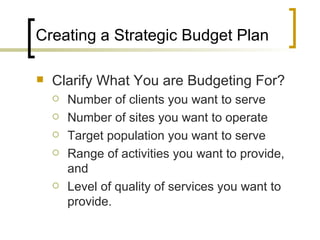

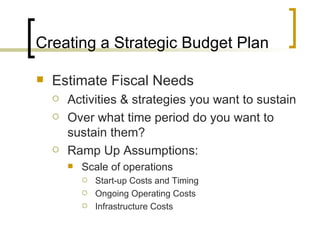

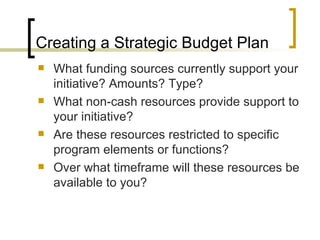

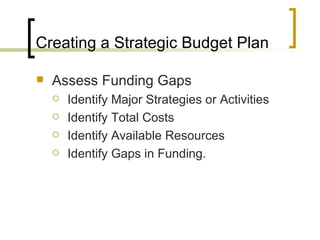

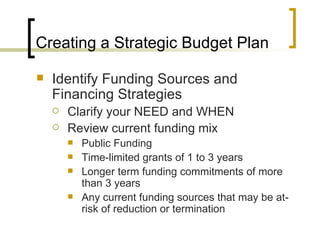

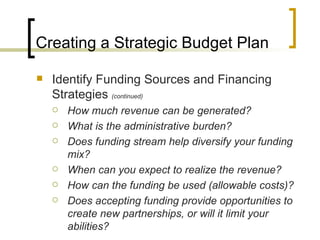

The document discusses how to create budgets for grant writing, including defining a budget, the benefits of budgets, budget planning issues, types of budgets, budget elements, general budget components, evaluating financial health, and creating a strategic budget plan to identify funding gaps and sources. It provides guidance on the key components to include in an organizational or project budget.