The document outlines the fundamentals of budget writing, emphasizing its objectives, processes, techniques, and best practices. It highlights key concepts such as income, expenditure, capital budgeting, and different budget types, including zero-based and activity-based budgeting. The conclusion stresses the importance of involving stakeholders in the budget creation process to ensure accuracy and effectiveness.

![Worksheet contd.

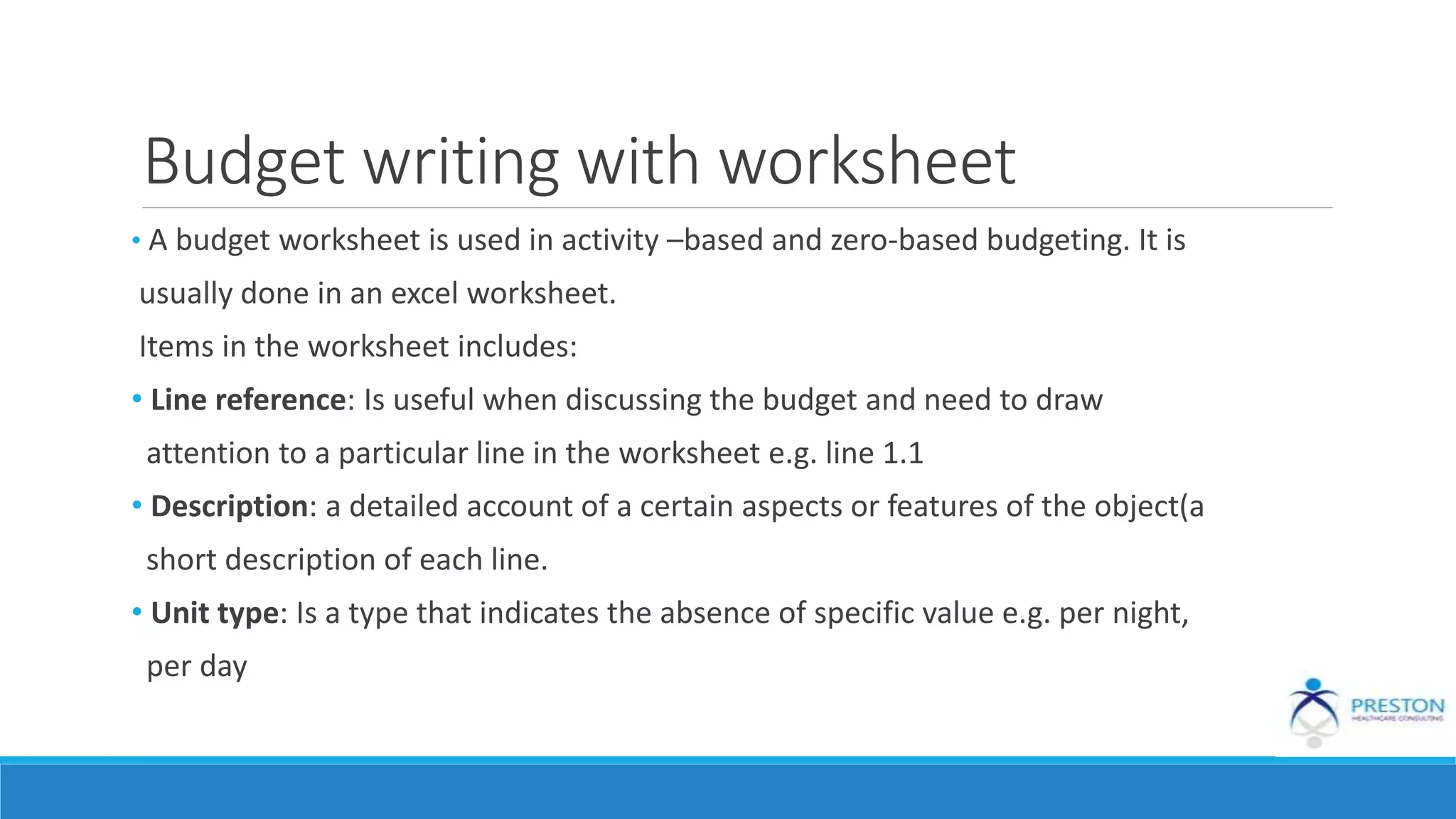

• No. Unit: Specifies the number of units required in the project e.g. 22

fieldworkers

• No. Times or Frequency: the number of time a value occurs, and it is useful where

items are described more than once.

• Unit Cost: This describes what each unit cost as defined in the budget. E.g the

cost of lunch for 22 fieldworkers on each day for 4 days at 50k per person

[22*4*50] N4400.

•Note: Comments column is to clarify what item is for and how quantities have

been arrived at.](https://image.slidesharecdn.com/budgetwriting-170504153938/75/Budget-writing-17-2048.jpg)