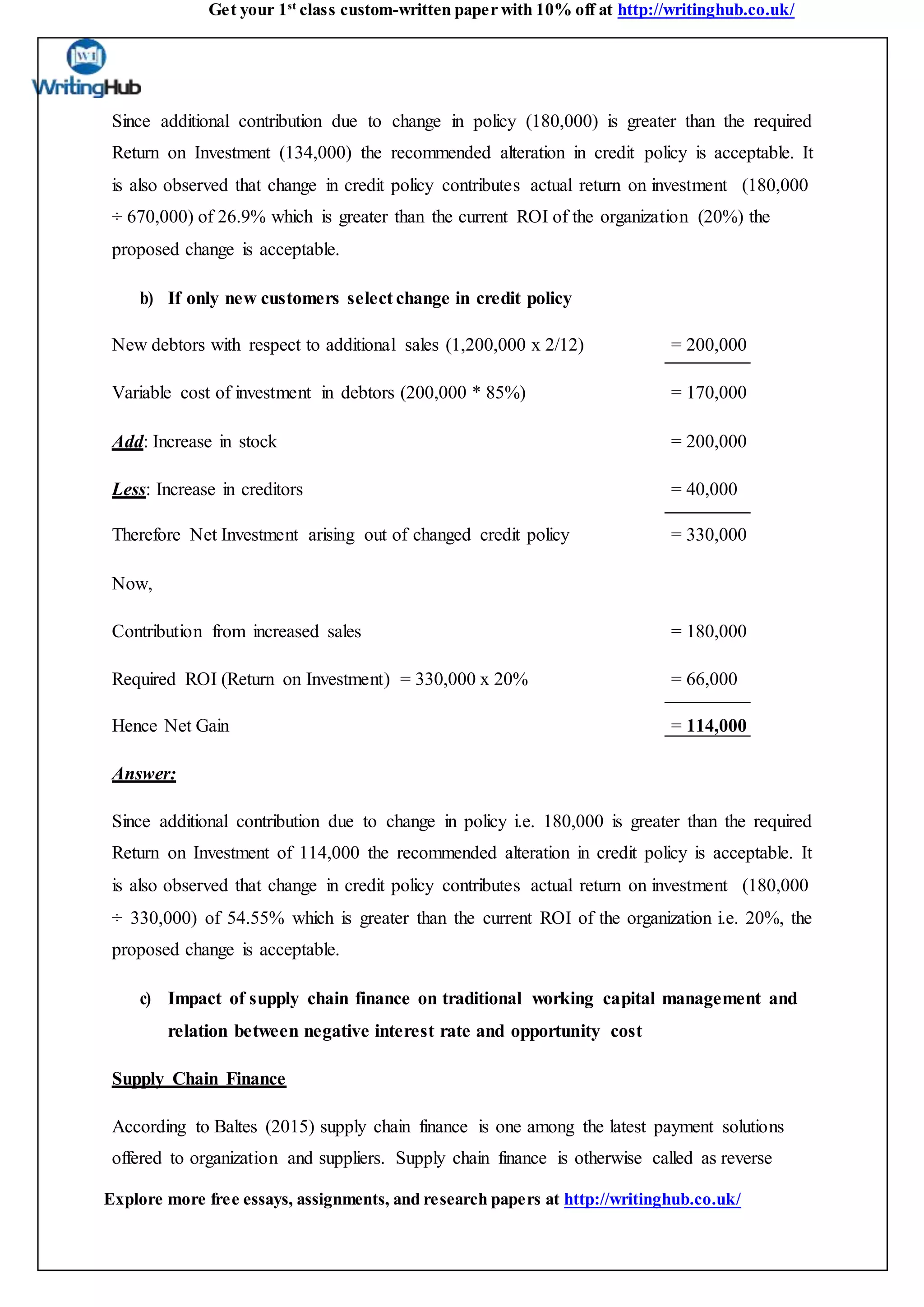

The document discusses credit policies and working capital management. It analyzes how changing credit policies at a company called Borboleta could impact profitability. The analysis finds that the proposed changes would increase contribution and return on investment. The document also compares supply chain finance to traditional working capital management, finding supply chain finance improves operational efficiency but may involve higher financial risks. Finally, it states that negative interest rates could adversely impact opportunity cost by diminishing business growth and cash flows.