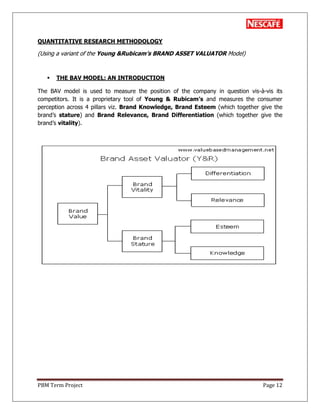

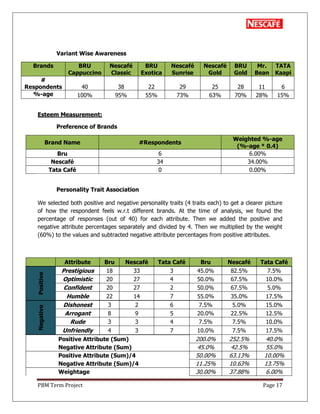

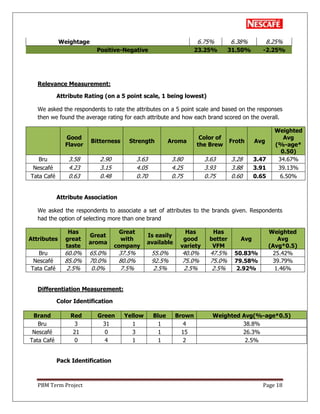

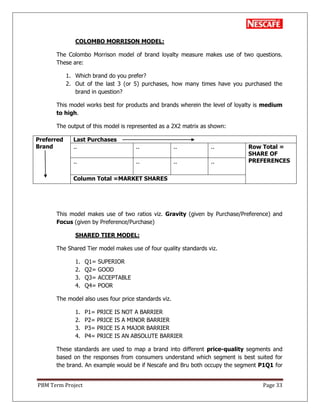

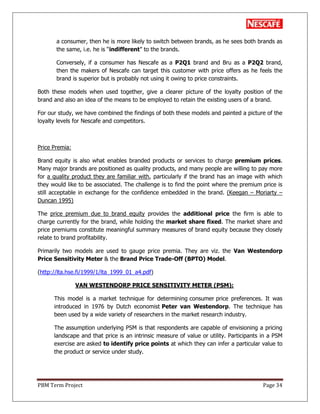

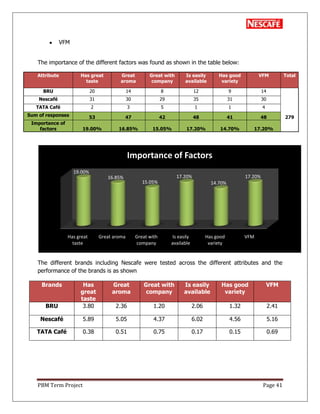

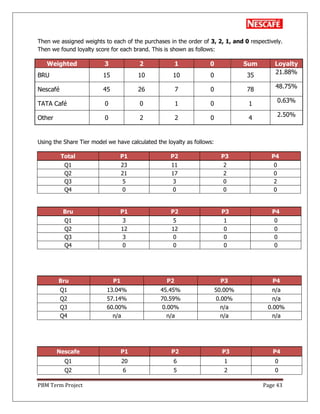

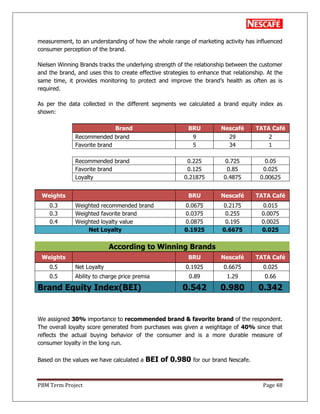

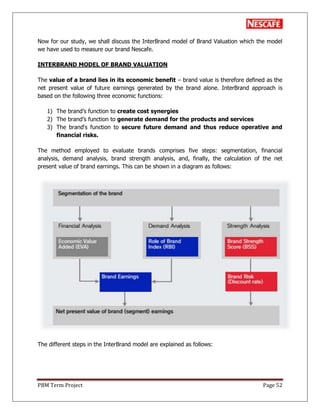

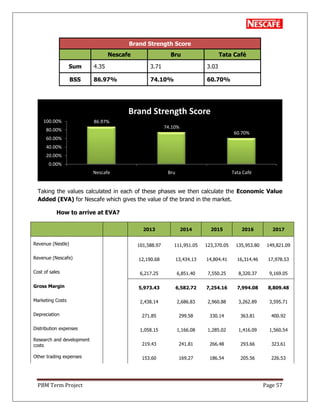

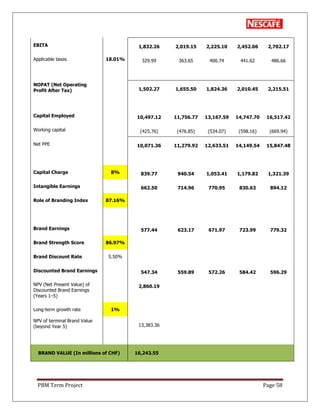

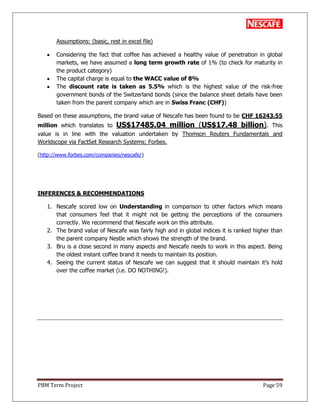

The document is a project report on Nescafé, detailing its brand history, market position, and research findings related to brand perception and equity. It utilizes quantitative and qualitative research methodologies to analyze Nescafé's performance against competitors, revealing that it maintains a strong market presence despite competition, particularly from Bru. Recommendations suggest that Nescafé should continue to understand consumer preferences to retain its market leadership.