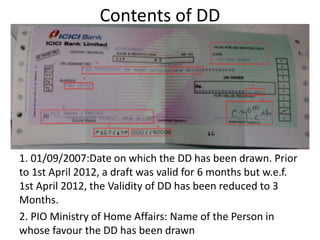

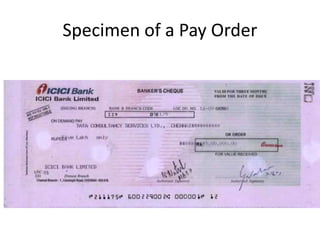

A demand draft (DD) is a pre-paid negotiable instrument issued by a bank directing another bank to pay a specified sum to a payee. When issuing a DD, the bank deducts the amount from the requester's account. DDs can be made out in cash under Rs. 50,000 or by cheque for higher amounts. DDs must quote a PAN for amounts over Rs. 50,000. Banks charge variable fees of Rs. 1.5 to Rs. 4 per thousand for DDs. DDs are valid for 3 months and if crossed as "account payee" can only be deposited, not cashed. A pay order is similar to a DD but is "not negotiable" and