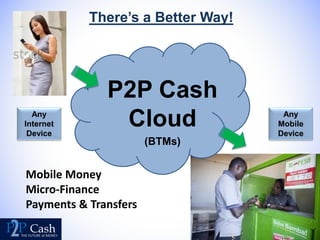

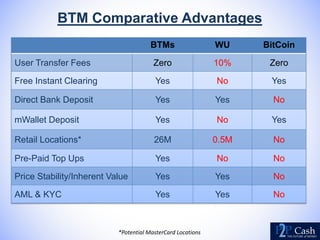

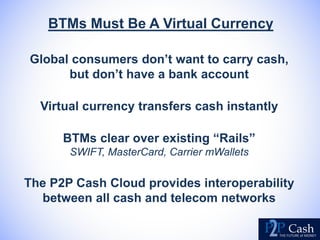

P2P Cash presents a mobile payment platform called BTMs that allows users to transfer money and purchase prepaid minutes using their mobile phones. BTMs connect to existing payment rails like SWIFT, MasterCard, and mobile money platforms to enable instant, low-cost transfers without fees compared to services like Western Union. The platform aims to bank the unbanked global population of over 1 billion people who have mobile phones but no bank accounts. BTMs would partner with retailers to provide financial services and transactions to consumers, driving new customers and revenue for banks and retailers. P2P Cash is led by an experienced management team with backgrounds in finance, technology, and mobile payments.