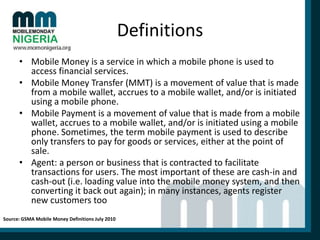

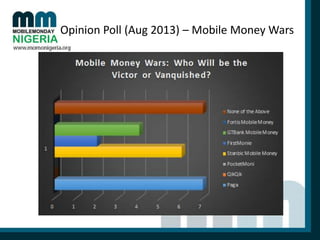

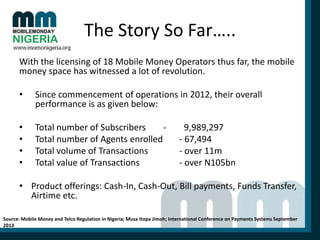

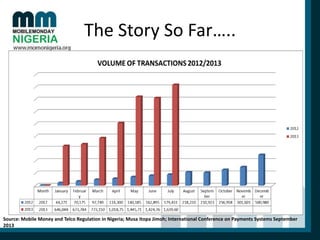

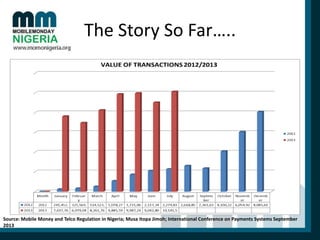

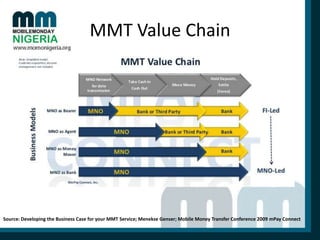

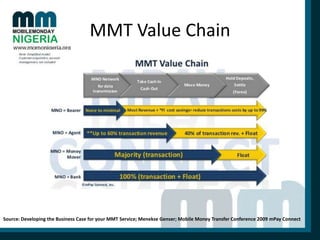

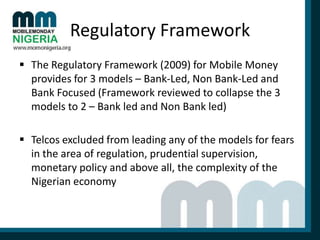

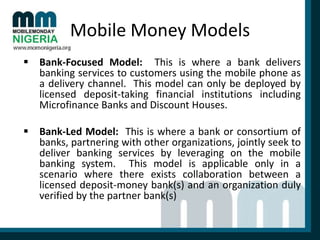

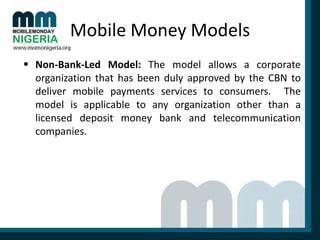

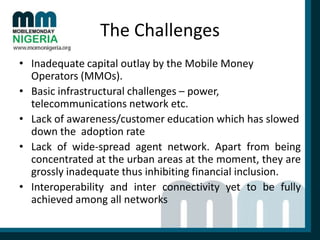

The document discusses mobile versus online payments in Nigeria, highlighting the definitions of mobile money, money transfer, and payment services. It covers the current mobile money landscape, regulatory frameworks, operational models, and challenges faced by mobile money operators. Additionally, it touches on online payment services, their operational mechanics, and the challenges within their infrastructure and user trust.