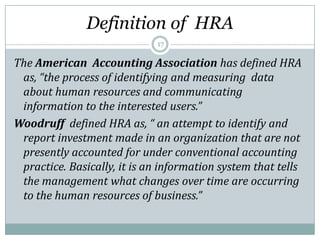

This document discusses various aspects of controlling and financial analysis. It defines controlling as evaluating performance and applying corrective measures if needed to ensure plans are followed. It outlines techniques like financial ratio analysis, return on investment, management audit, and social audit. It also discusses ratio analysis in depth, categorizing ratios into liquidity, activity, leverage, and profitability. Specific ratios under each category are defined such as current ratio, debt-equity ratio, and profit margin. Human resource accounting and management information systems are also summarized as important tools for controlling and analysis.