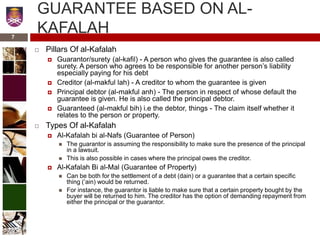

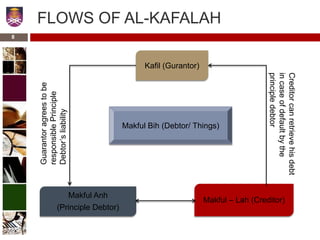

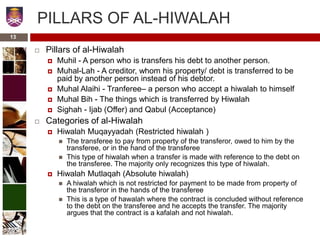

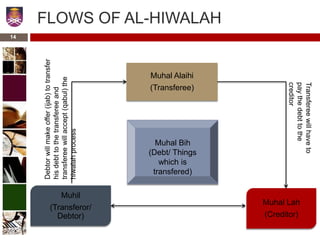

This document provides an overview of various Islamic banking concepts including agency (al-wakalah), guarantee (al-kafalah), commission (ju'alah), fee (al-ujar), and remittance (al-hiwala). It defines each concept and outlines their key pillars and principles in 1-2 paragraphs. Agency involves appointing an agent to act on one's behalf. Guarantee involves a guarantor ensuring a debtor meets their obligations. Commission pays a fee for completed work. Fee pays for services rendered. Remittance transfers a debt from one party to another.