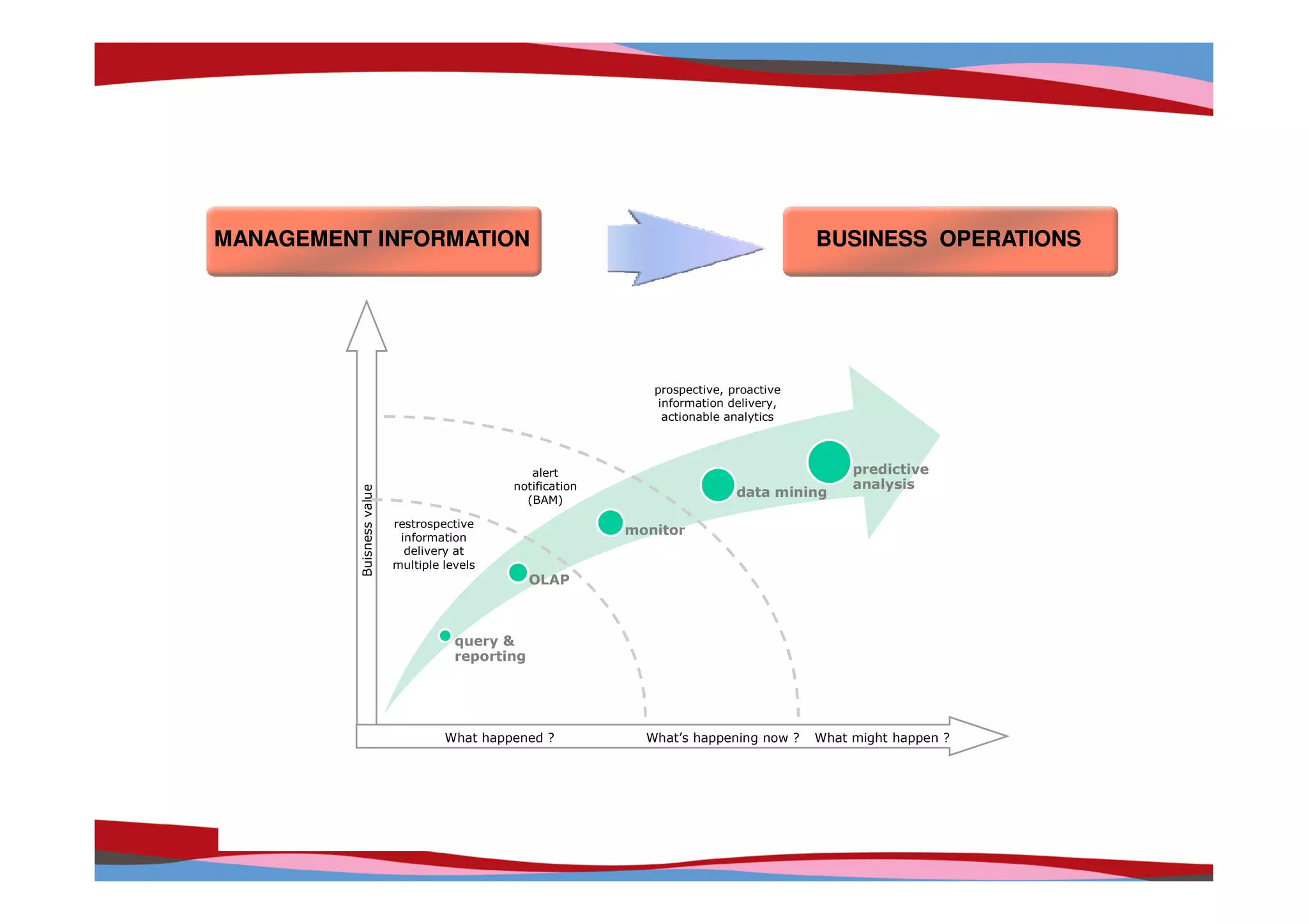

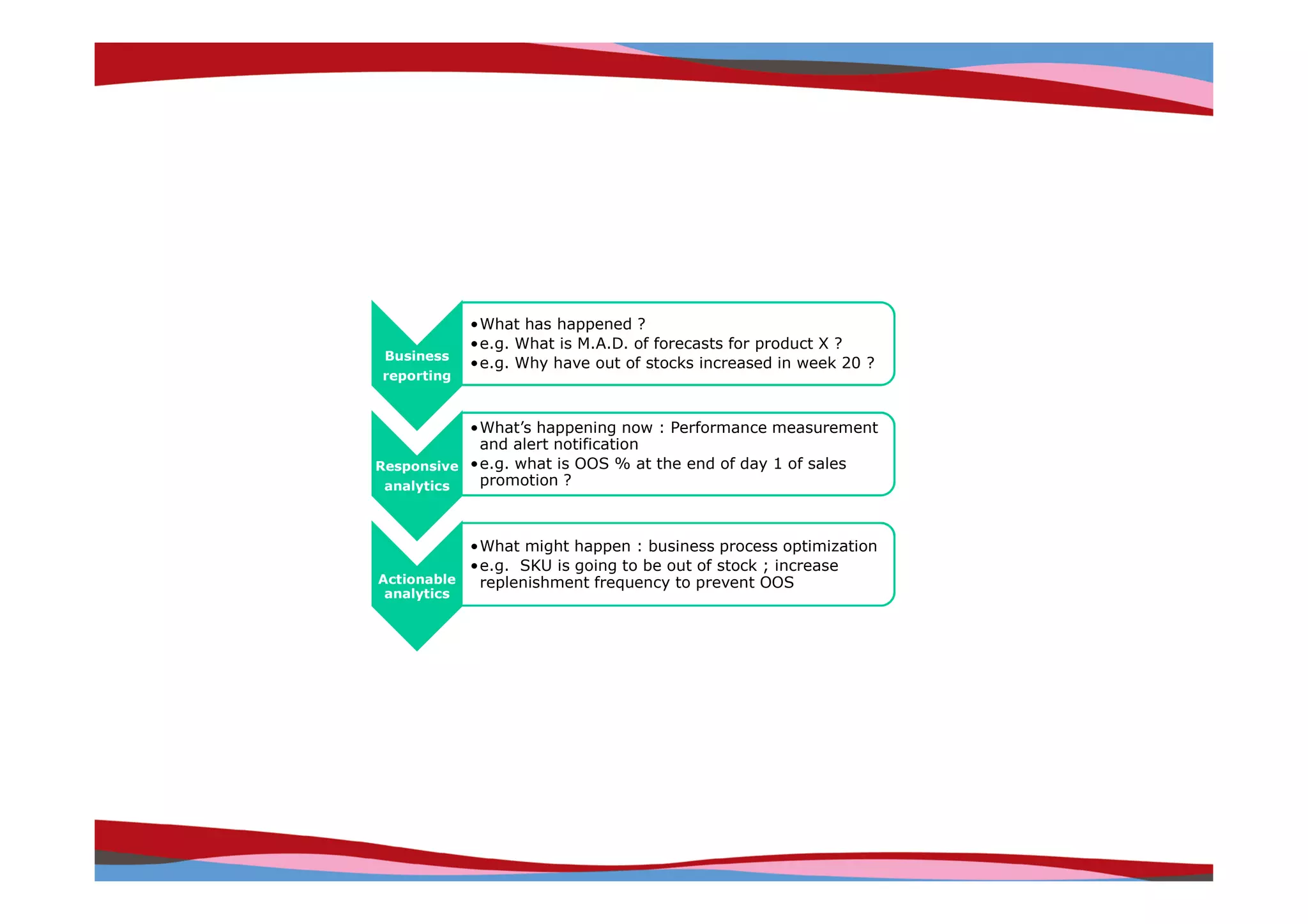

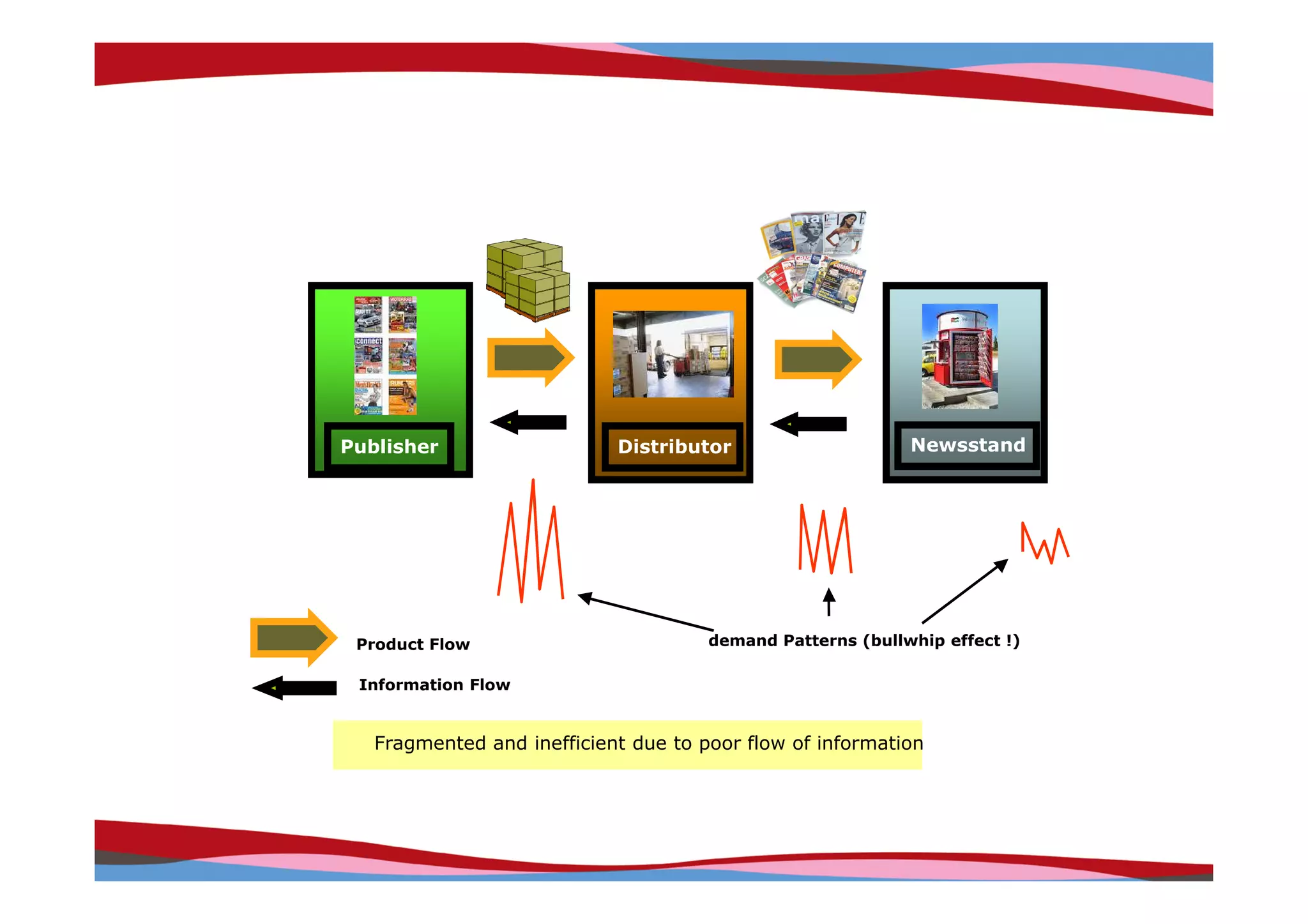

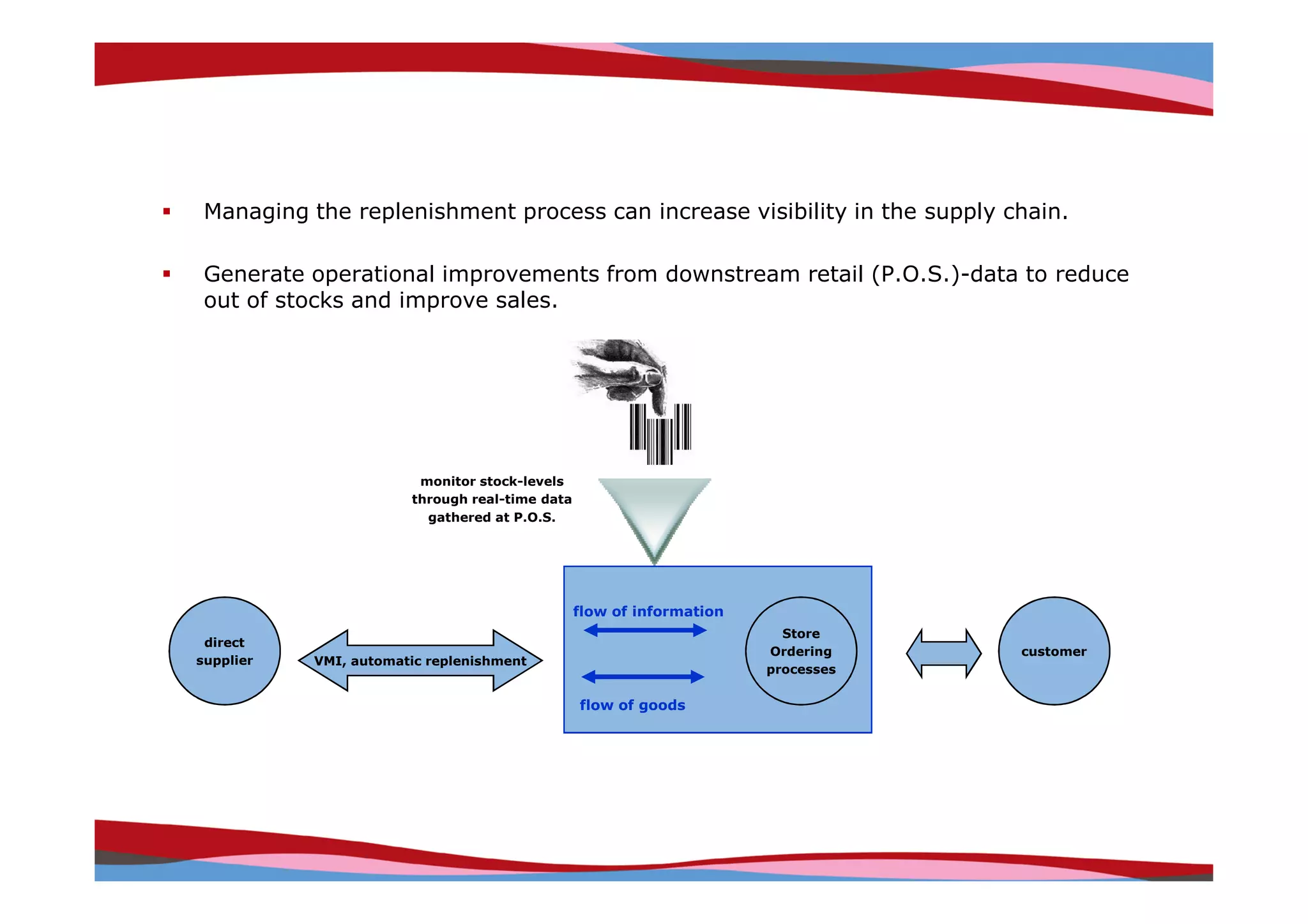

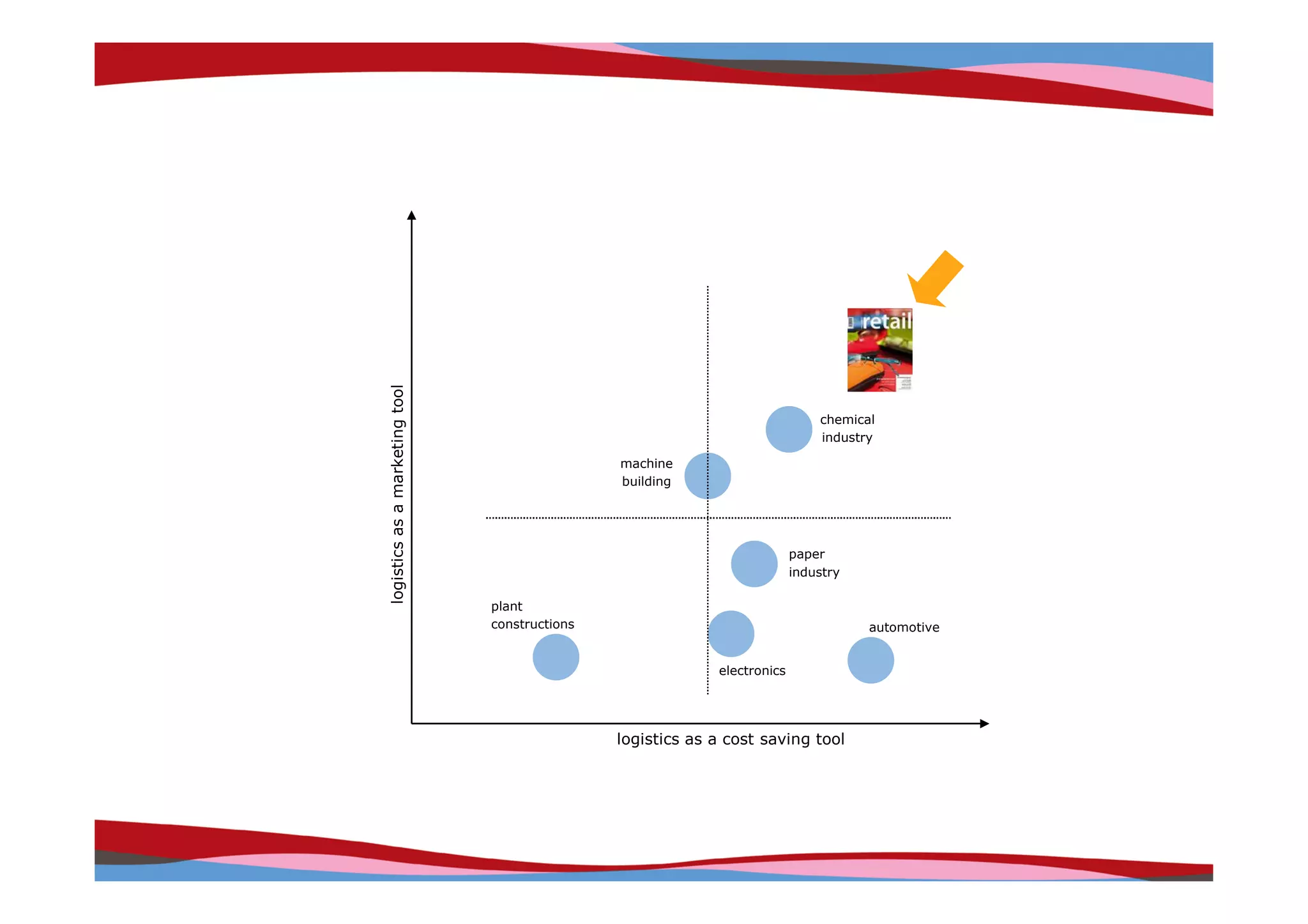

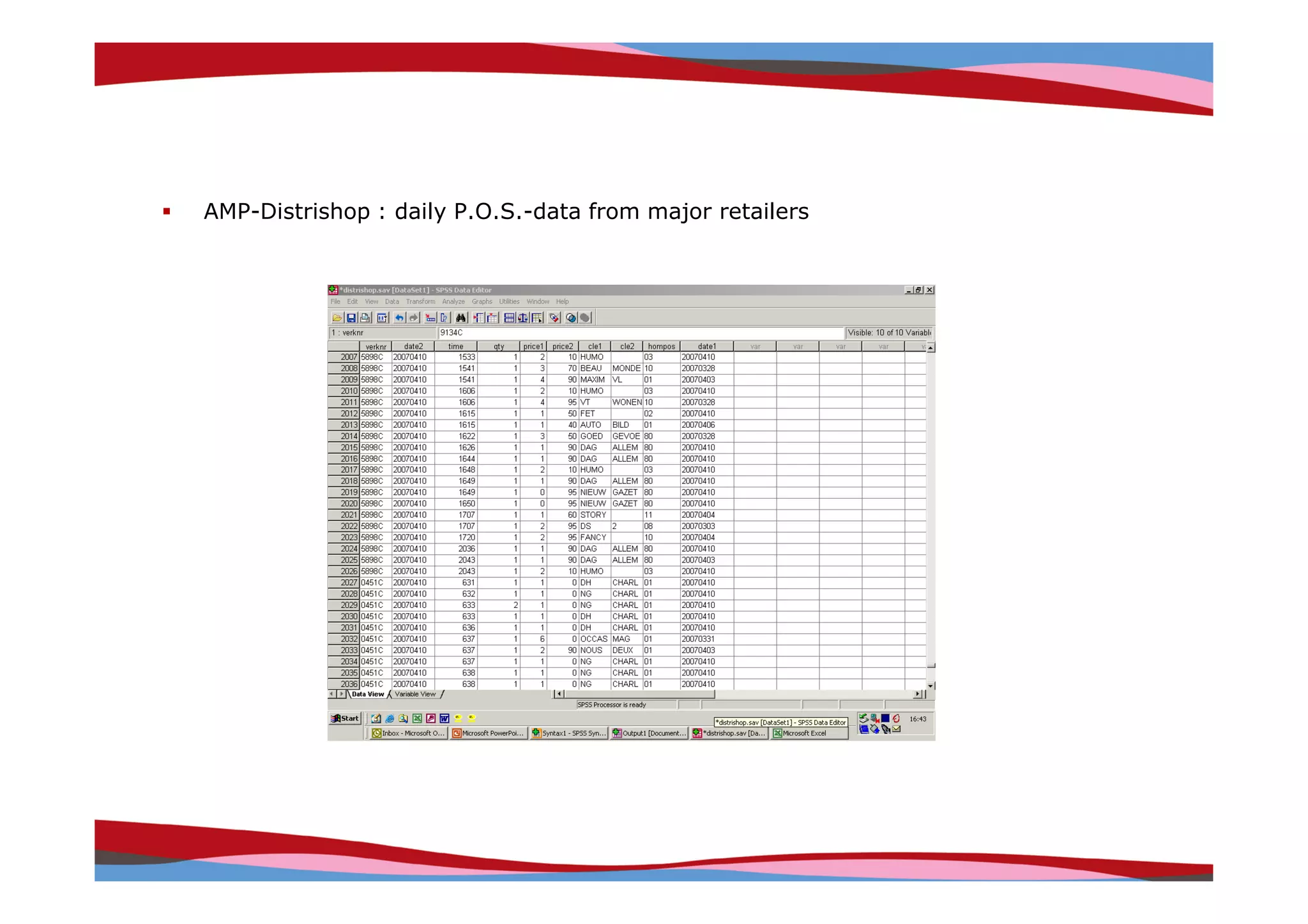

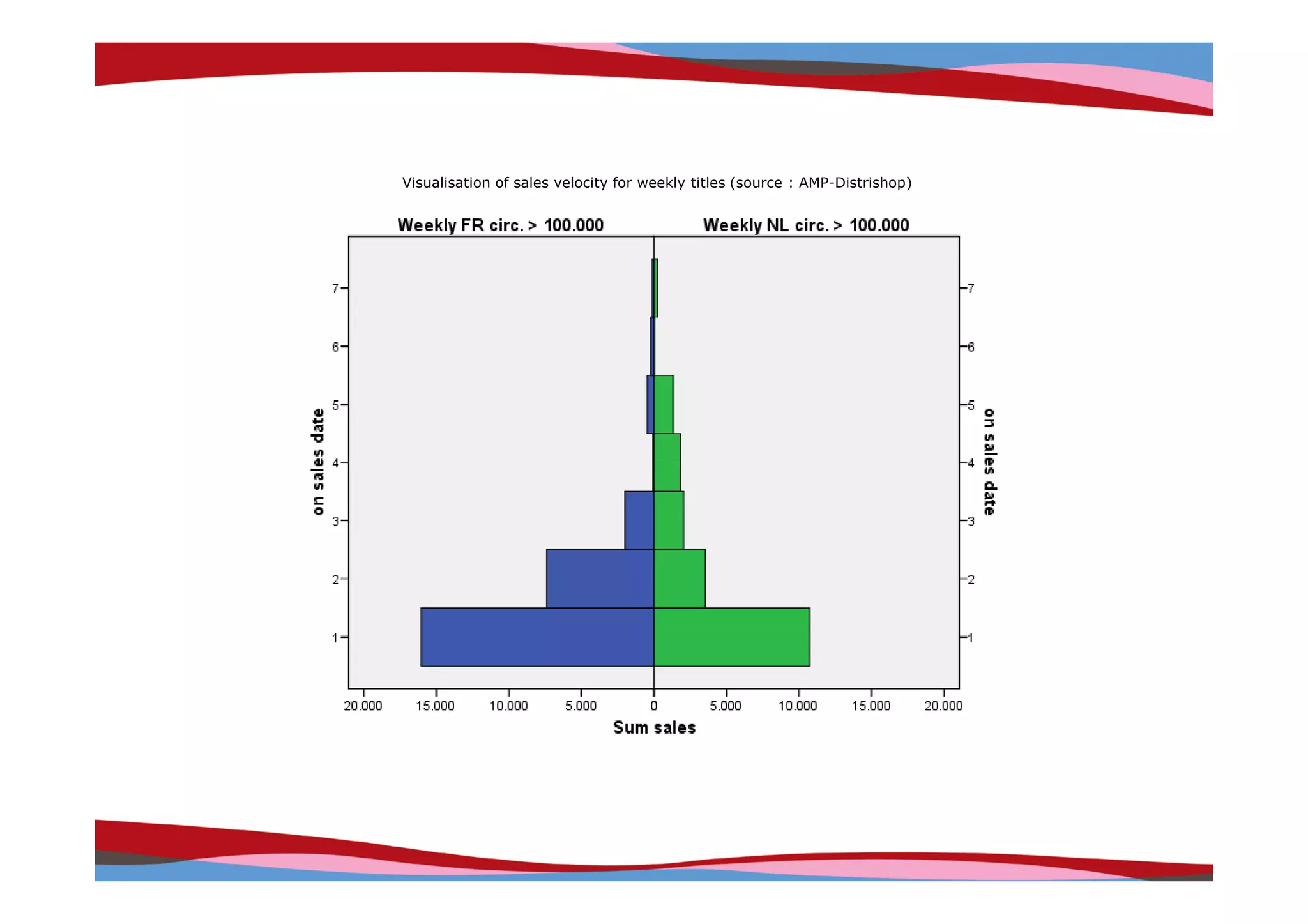

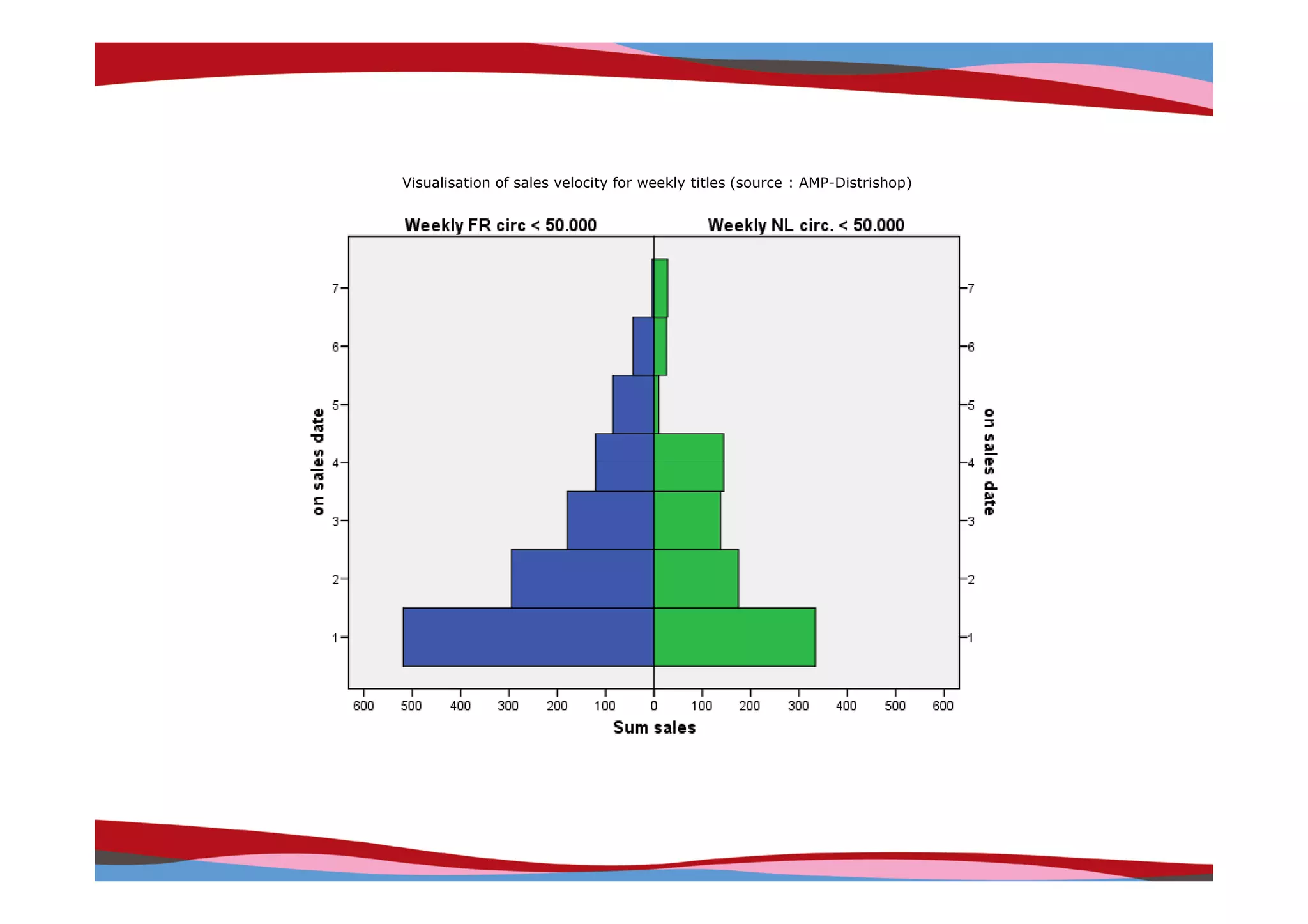

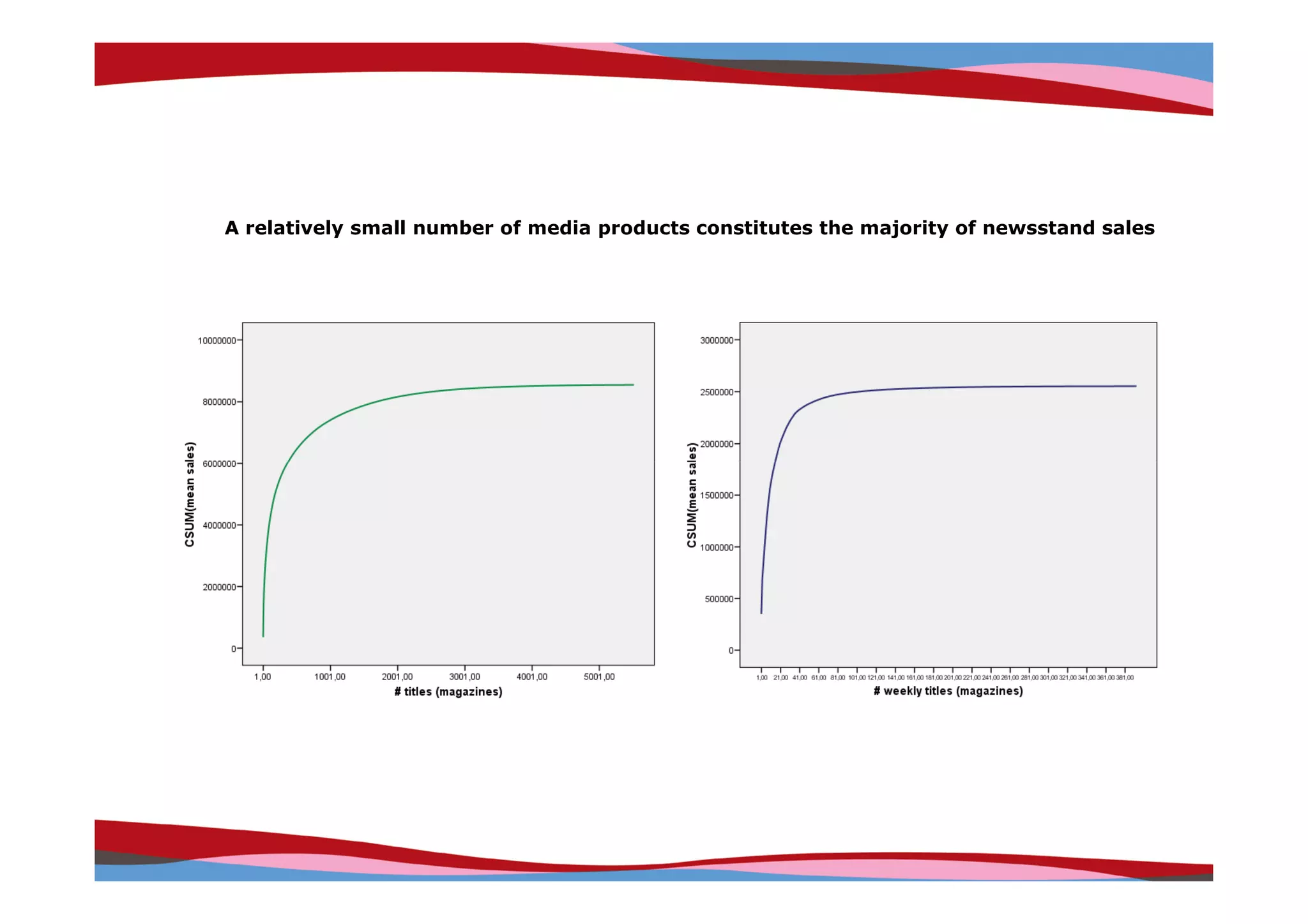

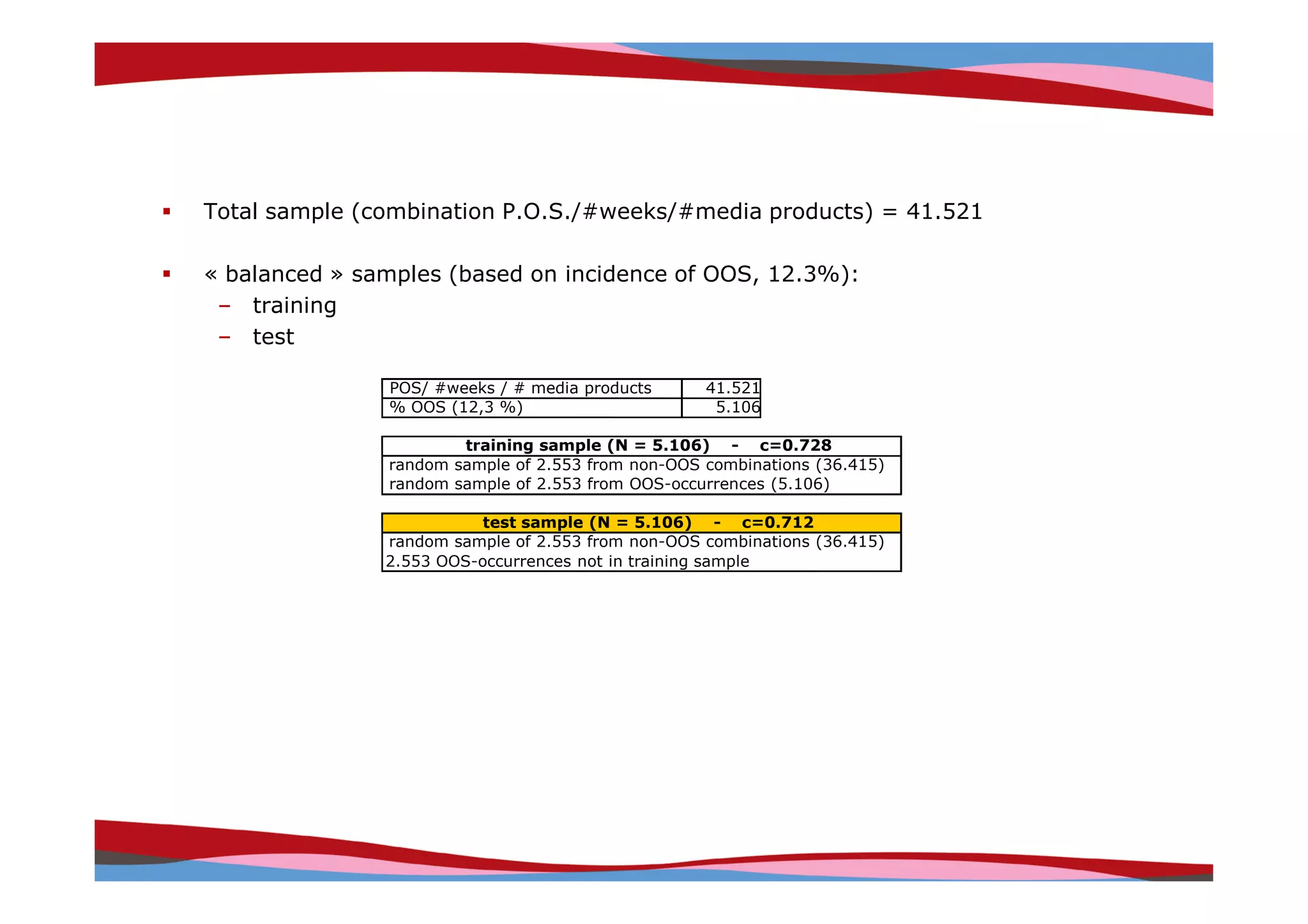

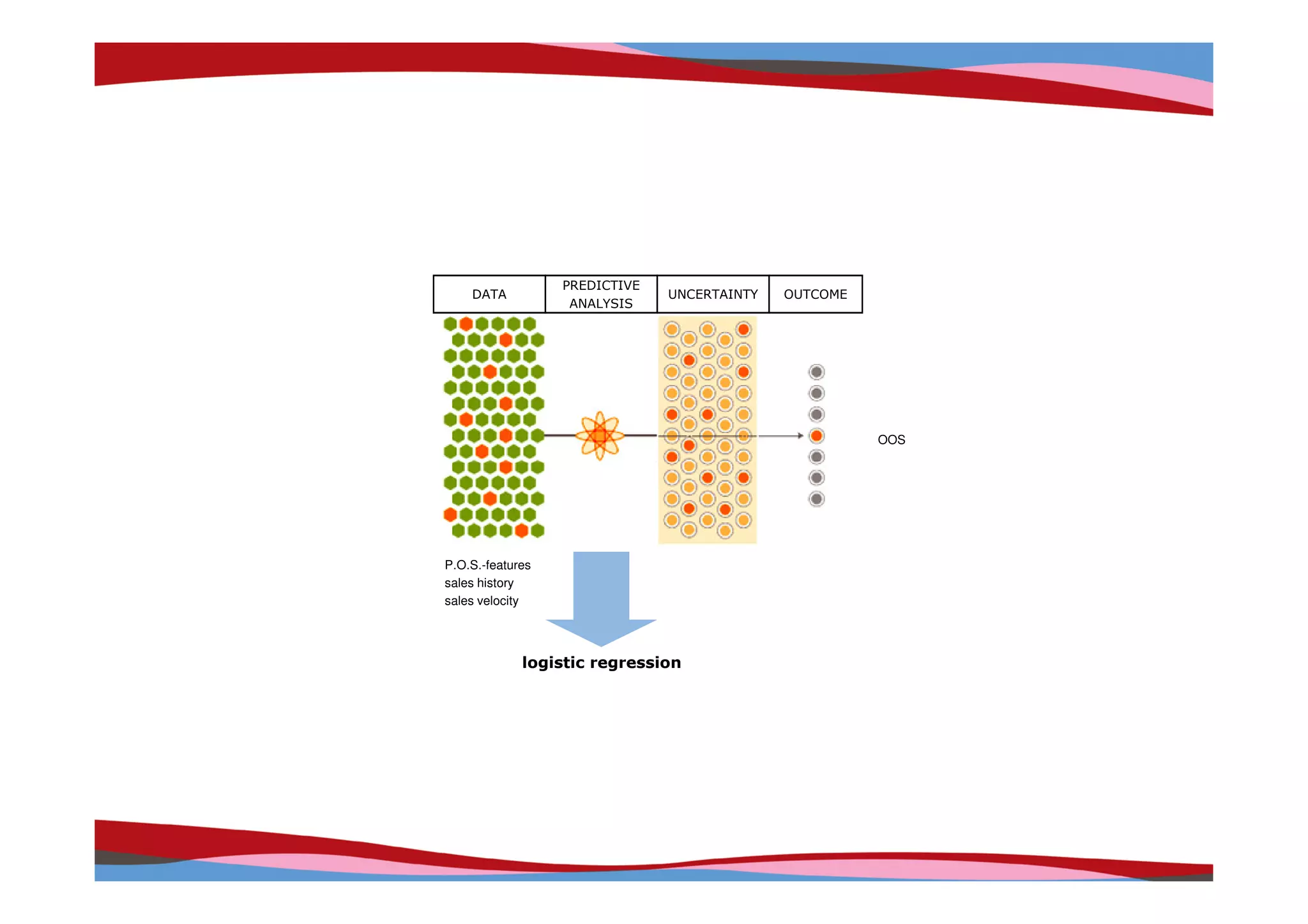

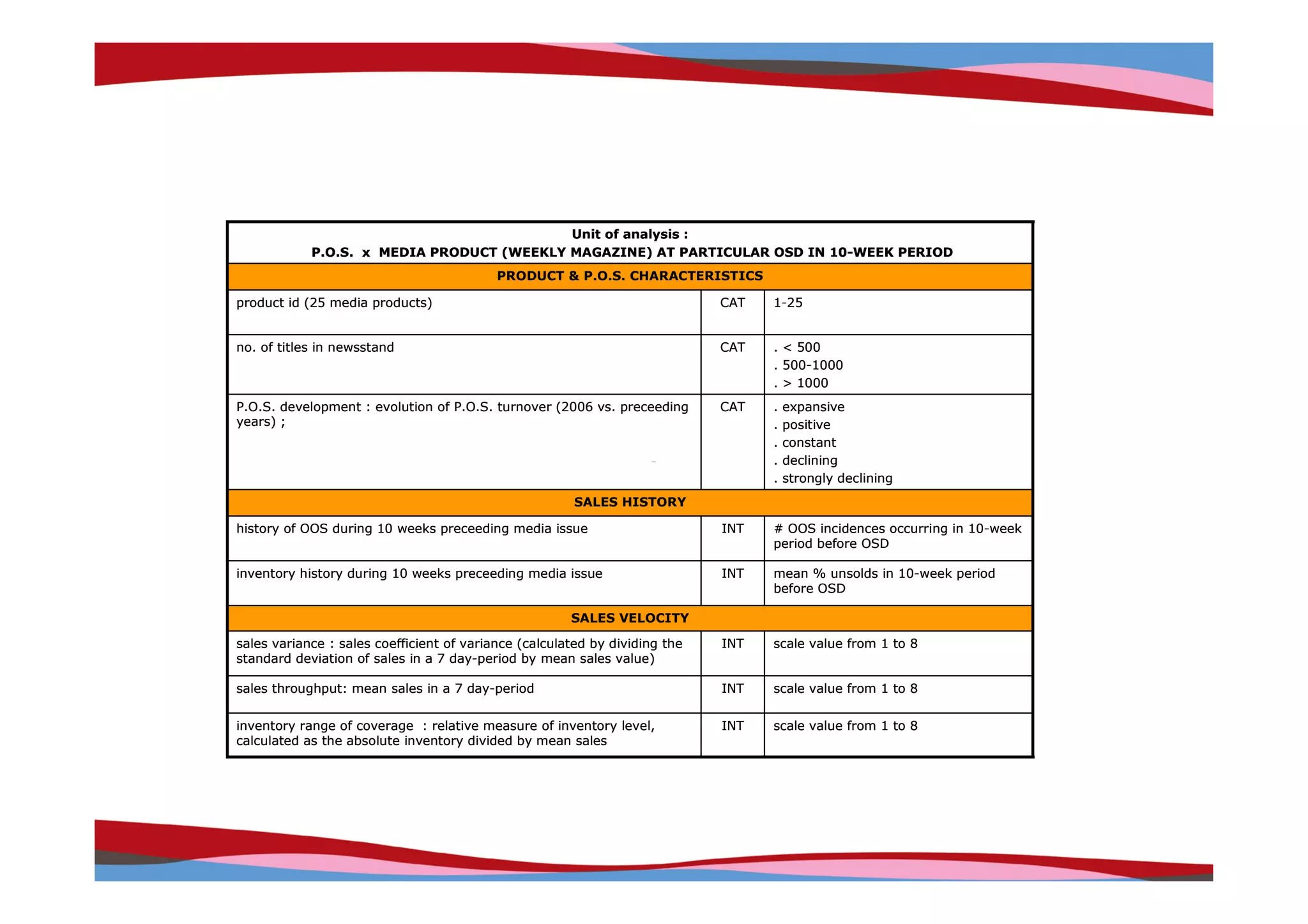

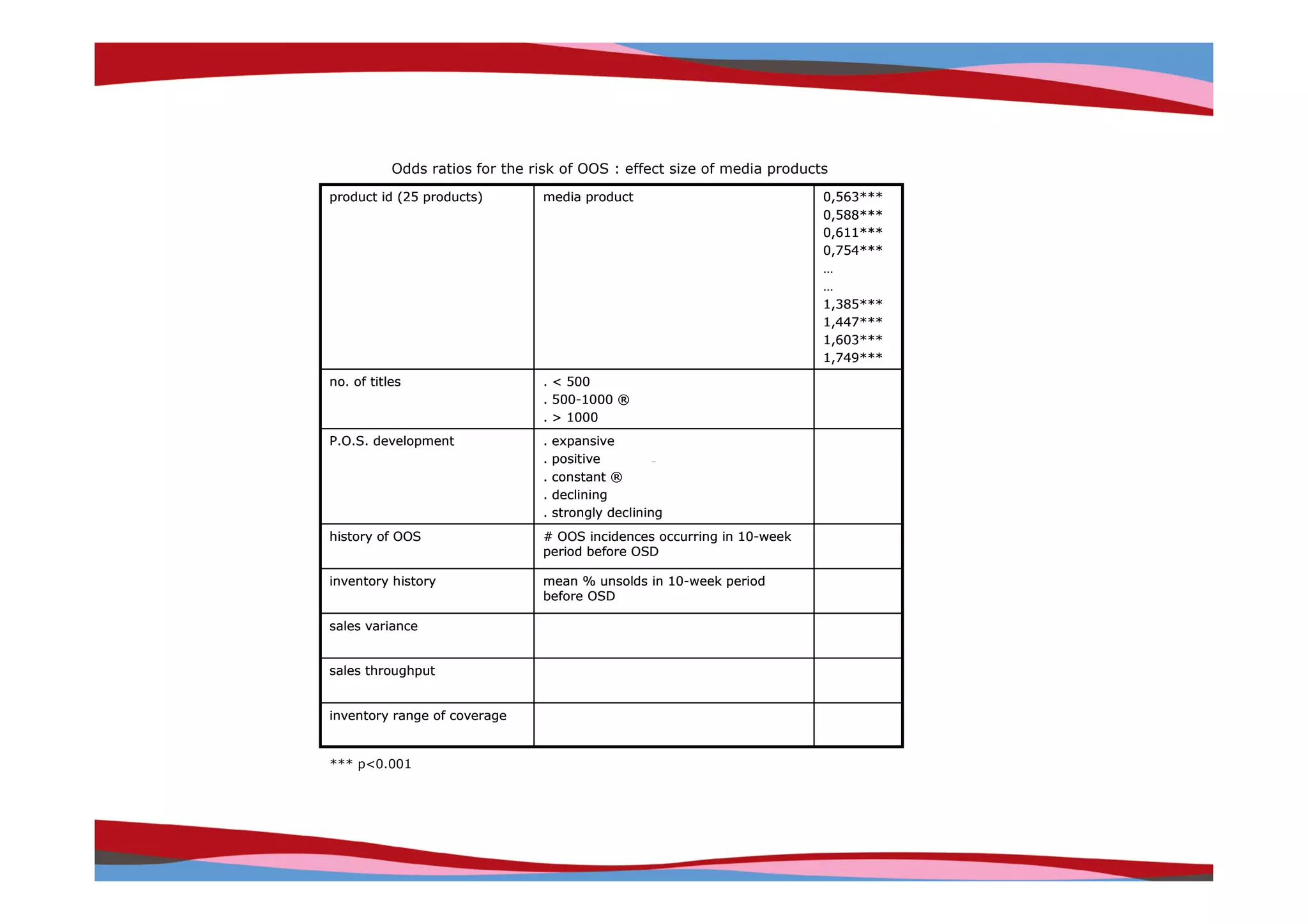

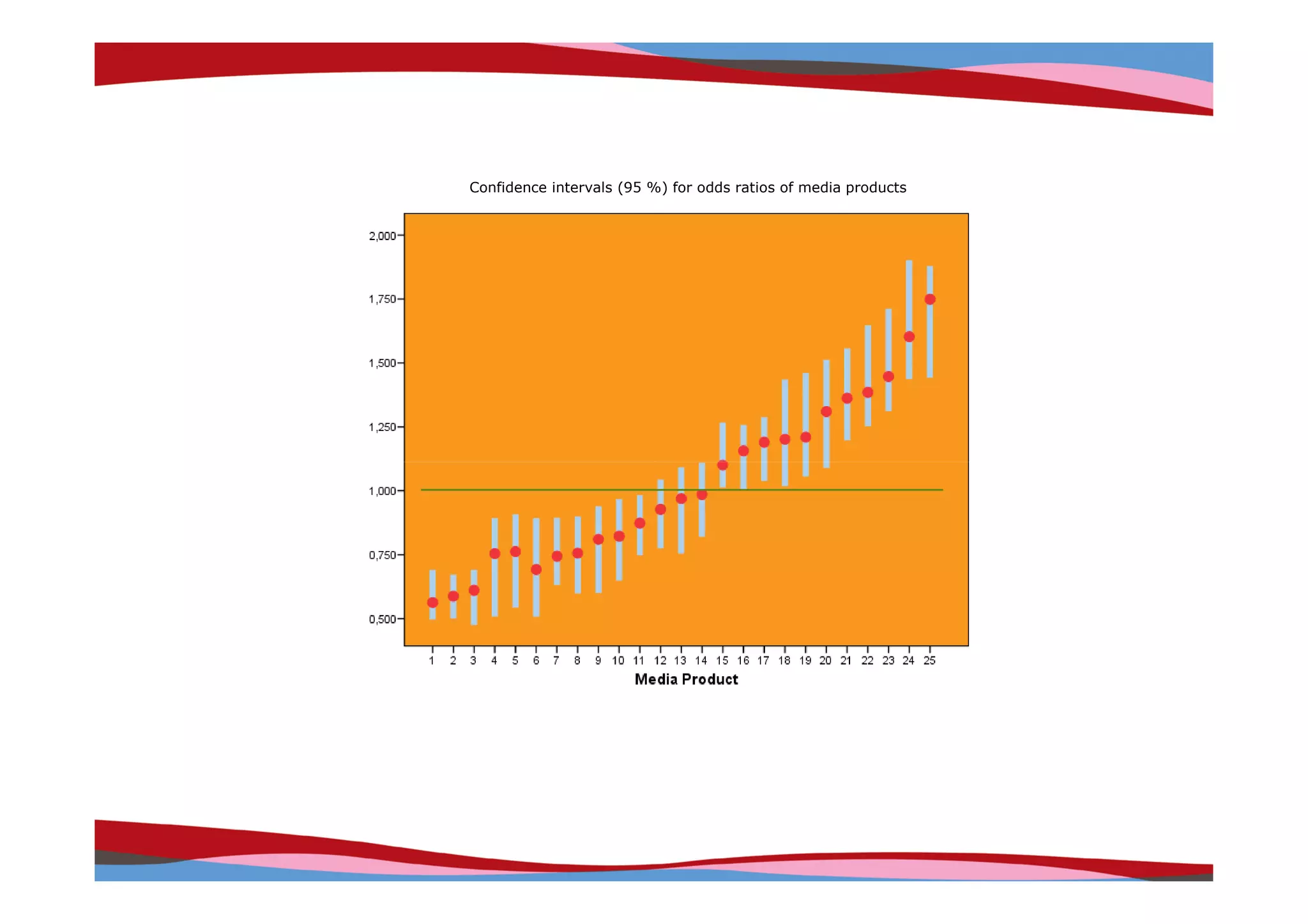

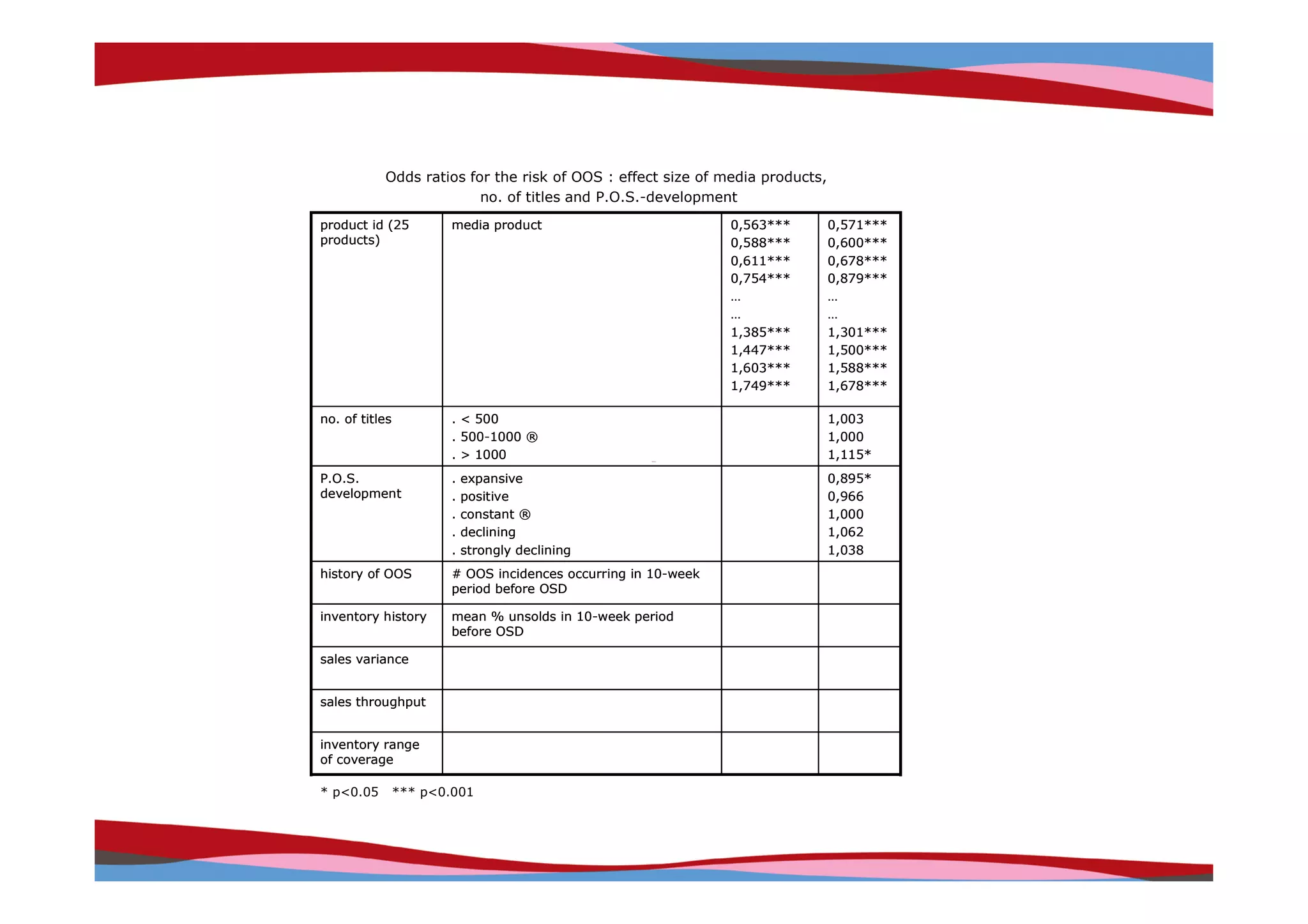

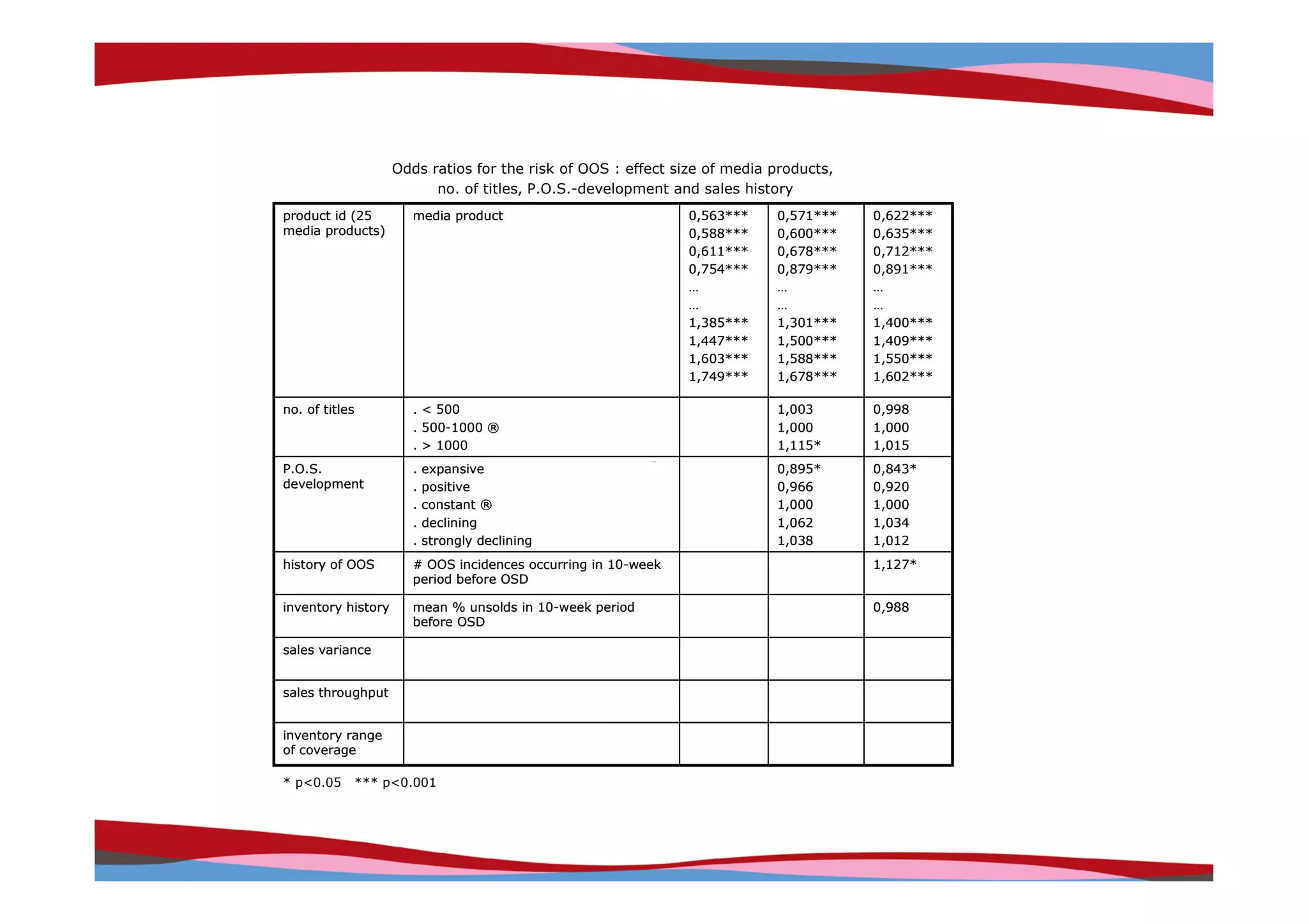

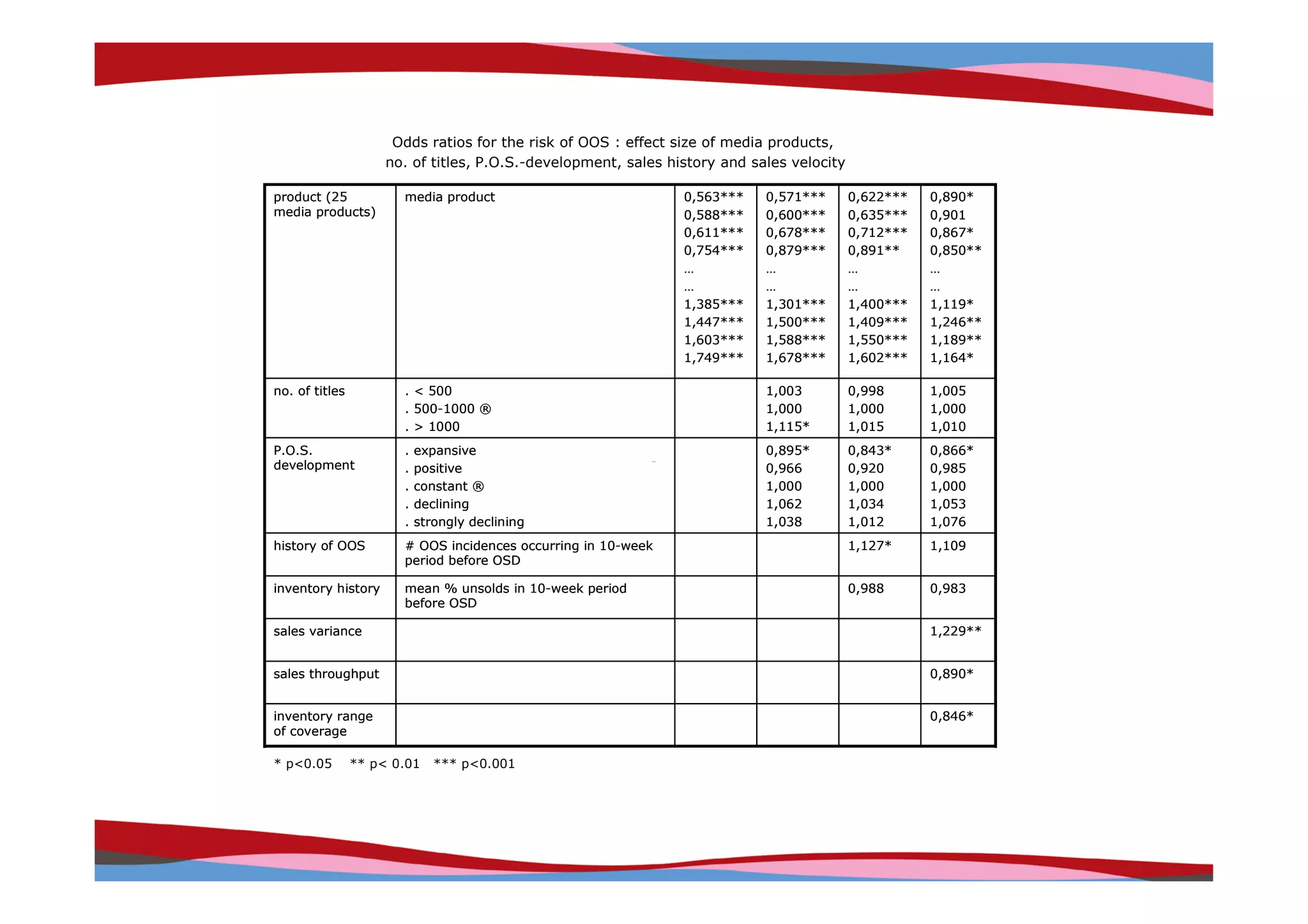

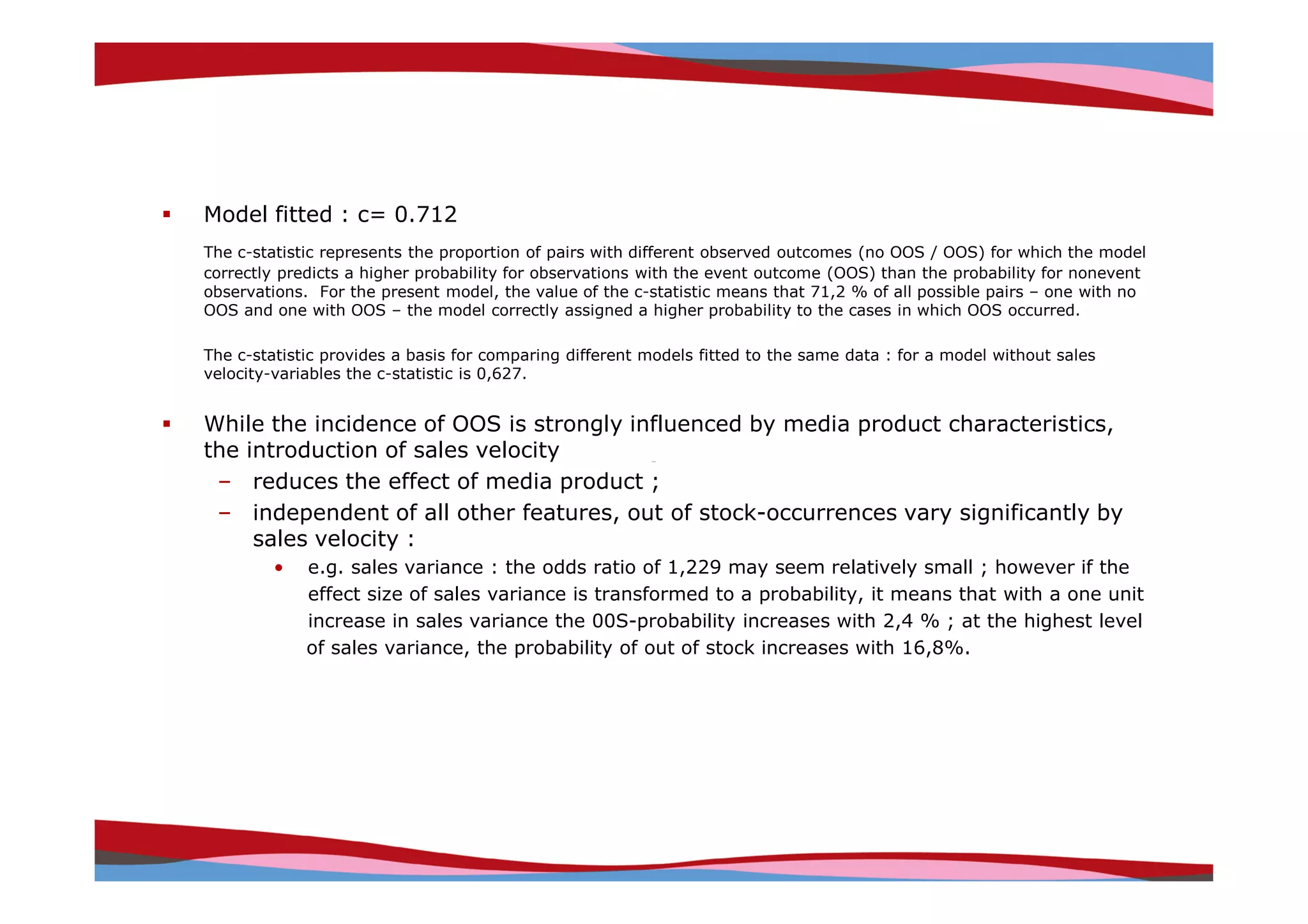

The document discusses using real-time point-of-sale data to predict out-of-stock situations in supply chains. It describes building logistic regression models to analyze relationships between out-of-stocks and variables like product characteristics, store characteristics, sales history, and sales velocity. The models found that sales velocity variables like throughput and variability improved the models' ability to predict out-of-stocks over models without those variables. Predictive analytics on real-time POS data can help minimize inventory levels and improve product availability.