The State of Mobile Advertising Growth

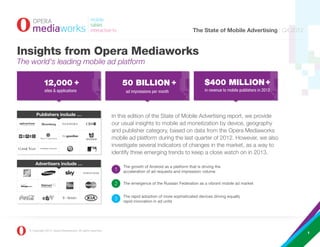

- 1. The State of Mobile Advertising | Q4 2012 Insights from Opera Mediaworks The world's leading mobile ad platform 12,000 + 50 BILLION + $400 MILLION + sites & applications ad impressions per month in revenue to mobile publishers in 2012 Publishers include … In this edition of the State of Mobile Advertising report, we provide our usual insights to mobile ad monetization by device, geography and publisher category, based on data from the Opera Mediaworks mobile ad platform during the last quarter of 2012. However, we also investigate several indicators of changes in the market, as a way to identify three emerging trends to keep a close watch on in 2013. Advertisers include … The growth of Android as a platform that is driving the acceleration of ad requests and impression volume The emergence of the Russian Federation as a vibrant mobile ad market The rapid adoption of more sophisticated devices driving equally rapid innovation in ad units © Copyright 2013, Opera Mediaworks. All rights reserved. 1

- 2. The State of Mobile Advertising | Q4 2012 Q4 was a record quarter The fourth quarter represented more than a two-times increase in impressions Opera Mediaworks is the and revenue to publishers compared to any other quarter in 2012. This reflects world’s leading mobile advertising the magnitude of marketing and advertising spend during this quarter, platform, helping to power associated with the seasonal impact of holiday shopping. the global mobile economy. We improve efficiency, through technology, innovation, transparency and trust, to create an open and vibrant marketplace for publishers and advertisers across the Growth in Total Requests and Revenue to Publishers globe. Opera Mediaworks includes AdMarvel, an ad-serving and mediation platform; Mobile Theory, a premium mobile ad network in the US; and 4th Screen Advertising Ltd., a premium ad network in the 240% United Kingdom. Also included are impressions served within Opera mobile properties, including the Opera 220% Mini Smart Page and the Opera Mobile Store. Opera % of Q1 Revenue & Requests Mediaworks is a member of the Opera Software 200% family of companies. 180% Opera, Opera Software, Opera Mini and 'O' logo are trademarks of Opera Software ASA. 160% 140% 120% 100% Q1 Q2 Q3 Q4 Requests Revenue © Copyright 2013, Opera Mediaworks. All rights reserved. 2

- 3. The State of Mobile Advertising | Q4 2012 iOS is still the top OS in monetization — but Android Traffic Share (mobile phone OS) takes the lead in mobile phone impression volume OS Share % of traffic % of revenue When it comes to monetization, iOS continues to outperform other device platforms. It leads the group with the highest average eCPM and provides Android 30.94% 29.97% the greatest percentage of publisher revenue. iOS 41.91% 51.02% - iPhone 29.08% 37.28% However, with steady increases throughout 2012, Android emerged late in the year as the leading mobile phone OS as measured by impression volume. - iPad 5.82% 10.49% The growth in Android impressions was partly driven by the introduction of the - iTouch 7.01% 3.26% Samsung Galaxy S III, a device that now accounts for 9% of all Android traffic. RIM 3.74% 4.12% Symbian 9.01% 1.69% Other 14.40% 13.20% iOS Android Other Symbian RIM 41.91% 30.94% 14.40% 9.01% 3.74% © Copyright 2013, Opera Mediaworks. All rights reserved. 3

- 4. The State of Mobile Advertising | Q4 2012 Music, Video & Media is #1 Category for impression volume Among all publisher categories, Arts & Entertainment now generates the most revenue % of Revenue (17.18%), taking a thin lead over Music, Video and Media (17.15%). However, in terms % of Impressions of impression volume, Music, Video and Media is No. 1, with 21.4% of all impressions. Business & Finance continues to produce the most revenue per impression. Social Business, Finance & Investing Site Category Music, Video & Media Games Computers & Electronics Social News & Information Business, Finance & Investing Sports Music, Video & Media #1 Impressions Arts & Entertainment Games Health, Fitness & Self Help Computers & Electronics Other News & Information Sports Arts & Entertainment Health, Fitness & Self Help Other #1 Revenue 0 6.25 12.5 18.75 25 © Copyright 2013, Opera Mediaworks. All rights reserved. 4

- 5. The State of Mobile Advertising | Q4 2012 Ad requests and impression volume is accelerating Top 20 Countries by Impressions across multiple geographies United States Across the Opera Mediaworks platform, North America (USA & Canada) continues to drive the majority of ad requests (64%). Compared to Q3 2012, when North Indonesia America generated 70% of all requests, we can see that the lead is shrinking. United Kingdom Russian Federation India 3.39% Canada 2.20% Italy Mexico Ukraine Japan Vietnam 14.40% Nigeria South Africa Australia 14.61% France 63.96% Africa Germany Middle East Spain Asia Pacific Europe Brazil 1.45% Central & Latin America North America Pakistan Malaysia © Copyright 2013, Opera Mediaworks. All rights reserved. 5 3

- 6. The State of Mobile Advertising | Q4 2012 This shrinking U.S. share of ad requests and impressions is due to the growth in international traffic. Non-U.S. Ad Impressions One of the most noticeable growth markets emerging over the last few months is the Russian Federation. Midway through 2012, the Russian Federation was No. 7 in our list of markets with the most ad requests. It is now No. 4, after ad impressions increased over 60% from the end of Q3 to the end of Q4 2012. This growth closely parallels the uplift in adoption of Android devices in the Russian Federation, which we saw rise over 22% in the same time period. July Aug Sep Oct Nov Dec © Copyright 2013, Opera Mediaworks. All rights reserved. 6

- 7. The State of Mobile Advertising | Q4 2012 Innovative ad units capitalize on enhanced device capabilities As smartphones proliferate and more consumers’ handheld devices contain features such as voice recognition, new-to-market gestures, social sharing and even augmented reality capabilities, the opportunity for creative ad units and campaigns appears limitless. Below are two examples of rich media campaigns we created and executed on our mobile-ad platform that take advantage of the sophisticated features of today’s mobile devices. Madagascar 3 Theater Release This DreamWorks Animation 3D movie was released in the United States in June. The studio sought to generate excitement about the movie with an interactive entertainment experience that let the user play with and learn more about the much-loved characters. With camera overlay, video, animation and social sharing, the rich media execution leveraged the phone’s inherent features to pull the user deep into the experience. Sour Patch Kids – UK Launch Given the 8% growth of pocket candy sales and 15% growth of the “sours” category, Kraft Foods decided to introduce a rebranded version of the well-known U.S. line of candy, Sour Patch Kids, to the U.K. market. The campaign portrayed the concept of “Sour, then Sweet” with animated figures “breaking the glass” on the phone – including a sound effect – only to immediately fix it with Band-Aids. © Copyright 2013, Opera Mediaworks. All rights reserved. 7 3