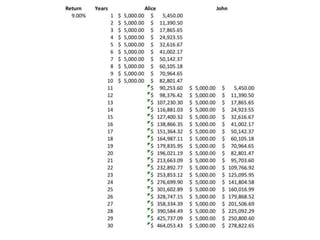

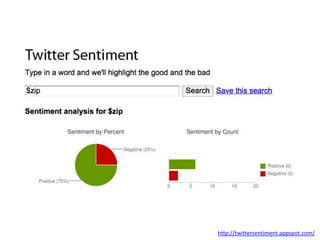

Dave Haeffner discusses the evolution of investing through technology, emphasizing open source investing as a means for individuals to make informed financial decisions. He highlights the power of compound interest and the importance of community intelligence in modern investing. Haeffner encourages individuals to embrace available resources and continually question how technology can solve investment challenges.