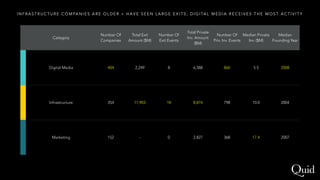

Quid provides interactive visual maps to help users navigate vast amounts of information and uncover hidden relationships across various sectors, such as the online video market. The document details the online video landscape, categorizing companies involved in digital media, infrastructure, and marketing, along with their investment trends and exit events. It highlights the growth and maturity of infrastructure companies, which have seen significant exits while digital media companies exhibit high activity.