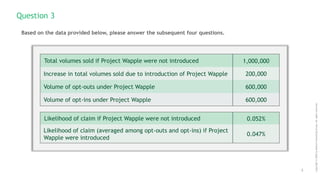

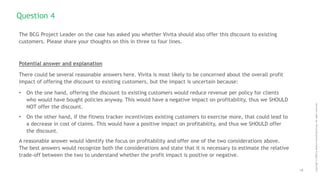

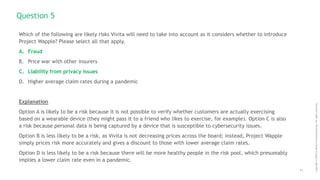

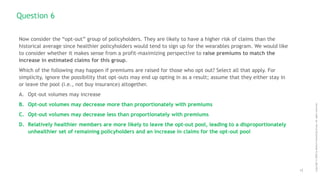

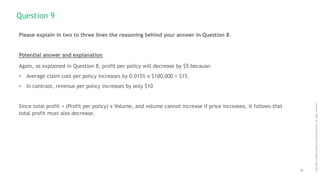

Vivita, a major Asian insurer, is considering a program called Project Wapple to offer discounts to customers who purchase a fitness tracker and engage in moderate physical activity. This would allow Vivita to more accurately price their term life insurance policies based on individual risk levels. Forecasting the impact on claims rates and profits for different customer groups would help Vivita determine if the program should be implemented. Estimates suggest it could decrease average claims and increase annual profits by around $3.6 million if adopted.