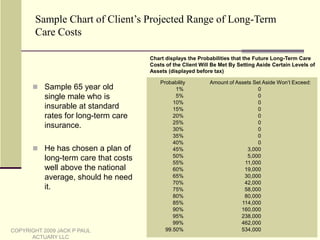

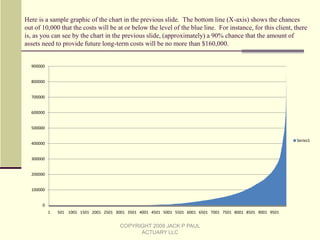

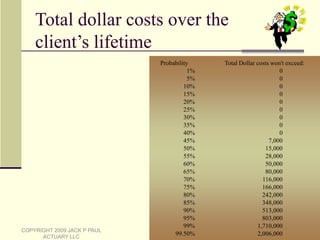

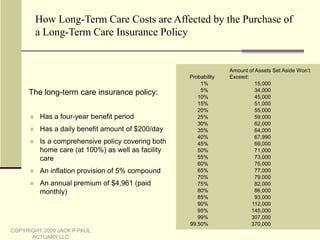

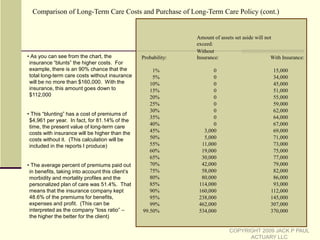

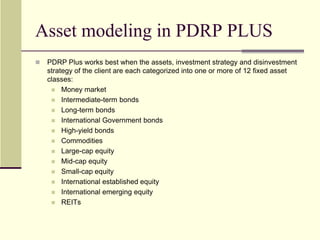

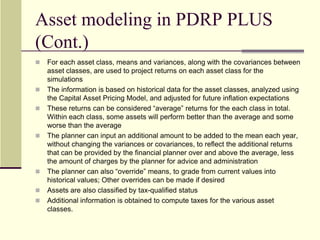

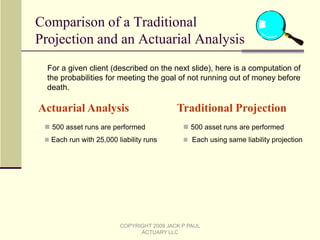

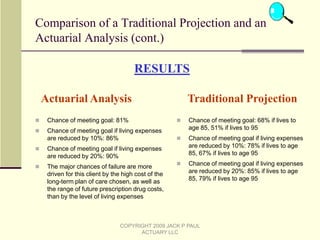

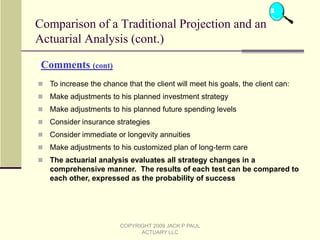

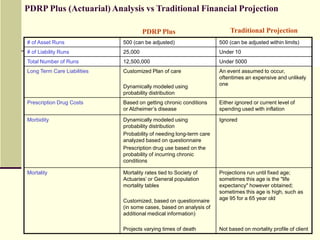

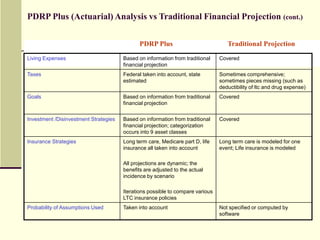

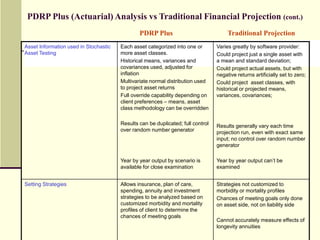

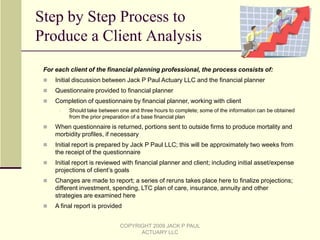

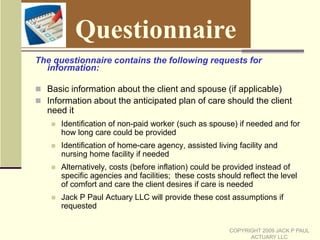

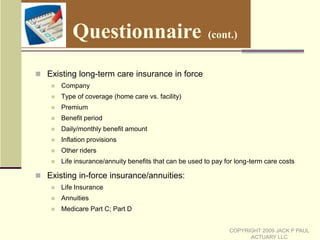

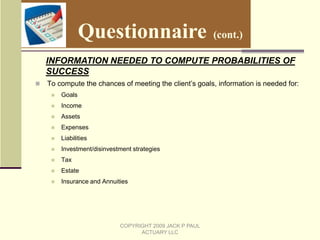

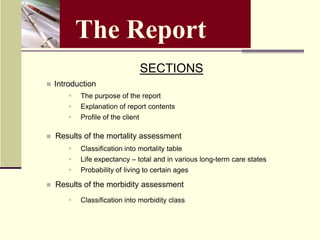

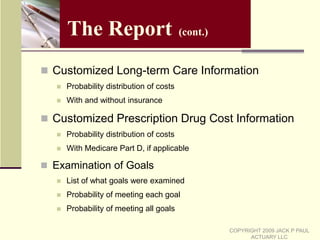

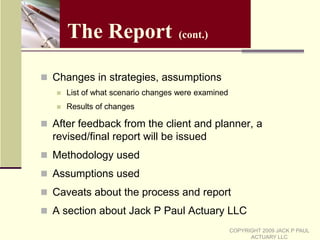

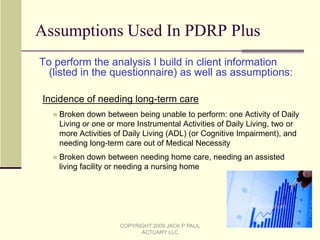

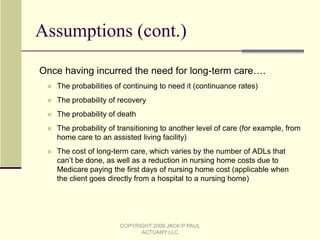

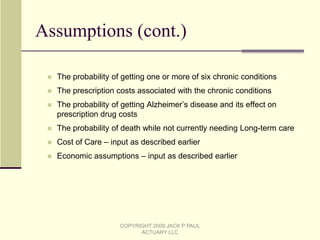

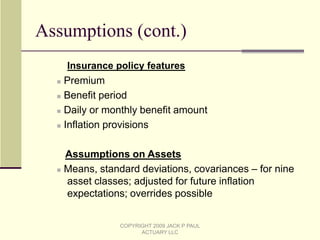

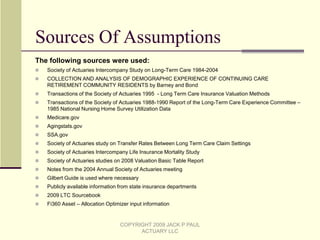

The document outlines a probability distribution tool, PDRP Plus, designed to help financial planners assess clients' retirement risks, particularly related to long-term care and prescription drug costs. This tool combines individual client profiles, asset portfolios, and expense scenarios to calculate the probabilities of achieving financial goals, offering a more accurate analysis than traditional financial planning software. By incorporating customized mortality and morbidity assessments, PDRP Plus enhances decision-making for retirement planning, potentially increasing client satisfaction and planner business opportunities.