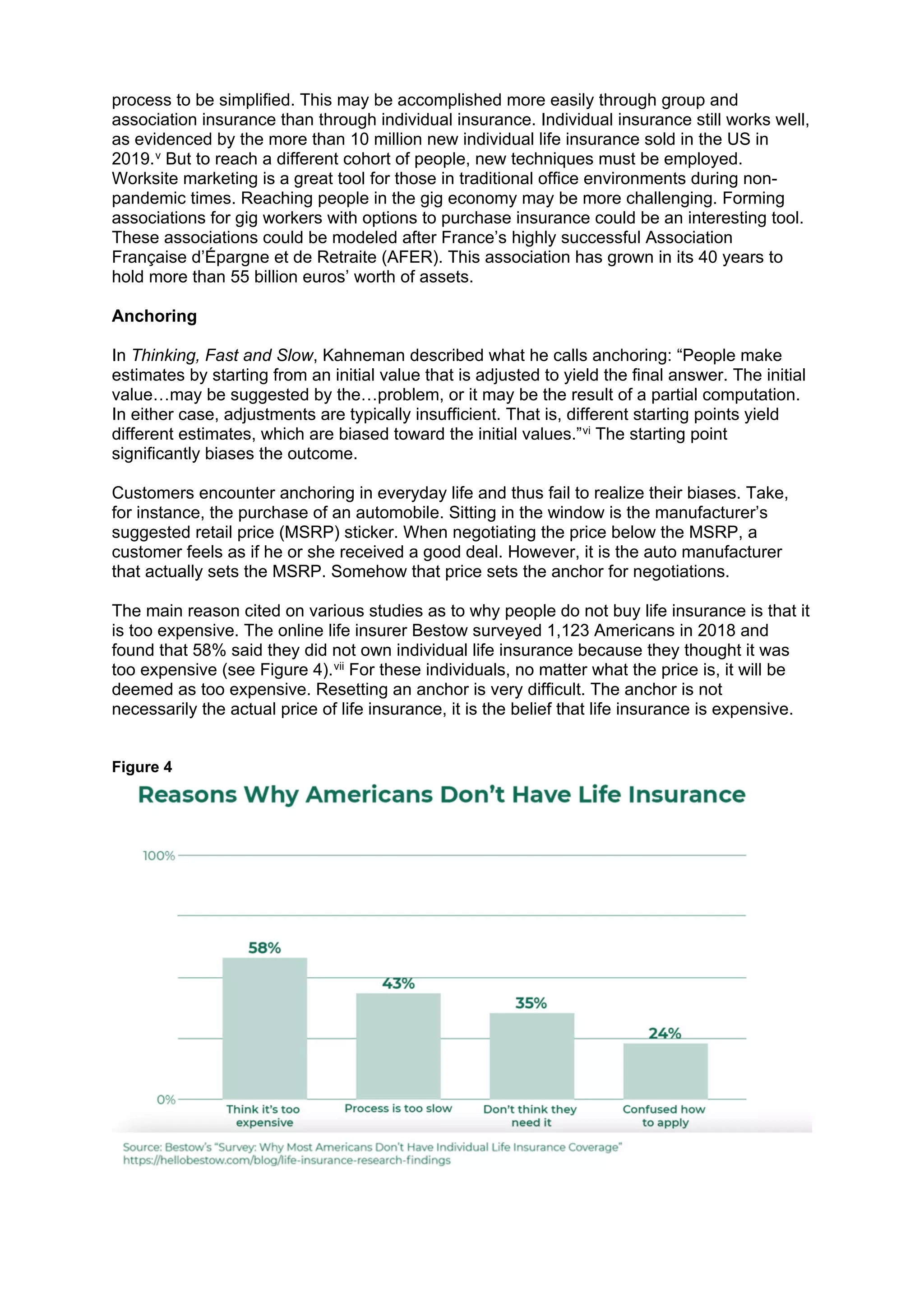

The document discusses the challenges faced by the life insurance industry in product design and the impact of policyholder behavior on sales and profitability. It highlights significant failures in product offerings due to unforeseen behavioral responses, such as own occupations disability policies and term-to-100 plans, which ultimately led to financial losses. The document advocates for a deeper understanding of behavioral economics to improve product appeal and sales strategies in order to address stagnant growth in the life insurance market.