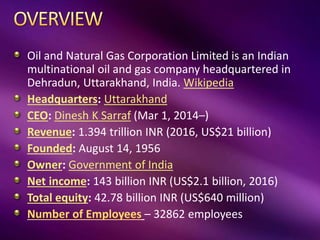

ONGC is an Indian state-owned oil and gas company headquartered in Dehradun, India. It was established in 1956 by the government of India to explore and produce oil and gas in India. ONGC operates both onshore and offshore oil/gas rigs and has international operations through its subsidiary ONGC Videsh. It is ranked as one of the largest national oil companies in the world. ONGC aims to be a global leader in integrated energy and retain its dominant position in India's energy sector through sustainable growth.