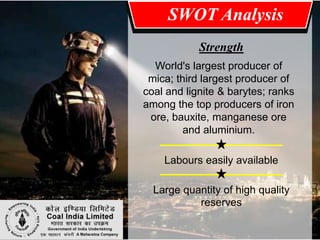

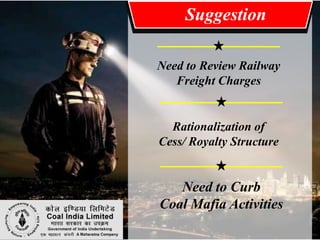

This document summarizes a presentation about Coal India Limited (CIL). CIL is the largest coal producer in the world. It was formed in 1975 by nationalizing private coal mines in India. CIL manages over 200 establishments and training institutes. It has achieved several awards and was granted 'Maharatna' status. Financial highlights from 2010-2011 are provided. The presentation discusses CIL's products, export of coal, organizational structure, SWOT analysis, and concludes with suggestions to address issues in the coal industry.