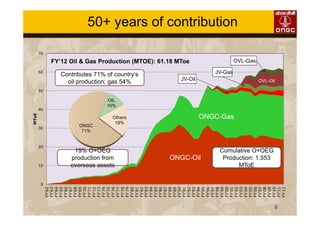

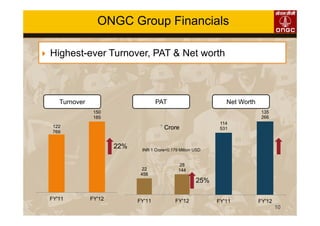

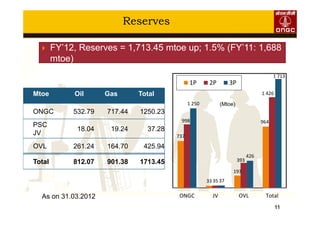

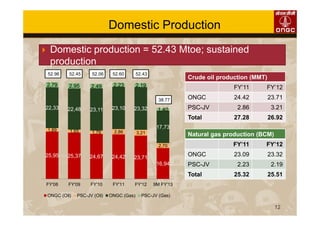

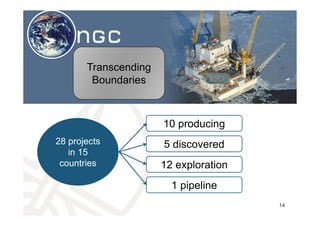

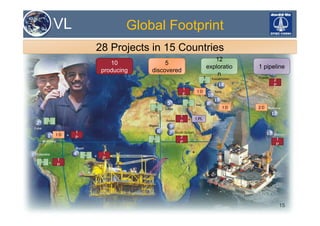

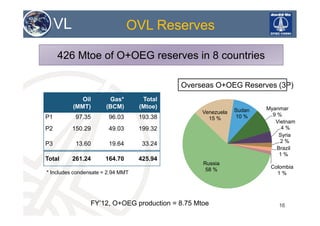

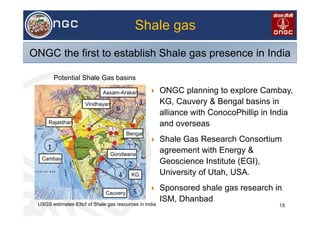

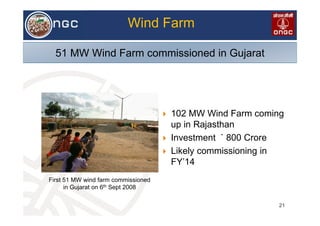

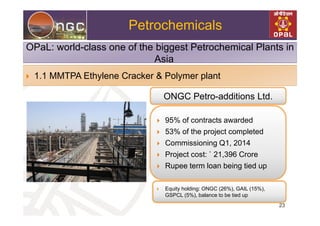

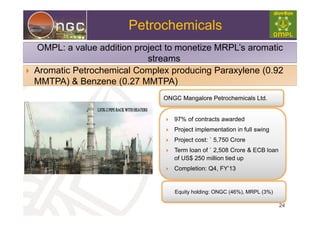

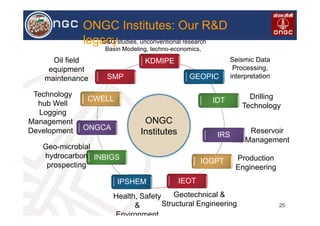

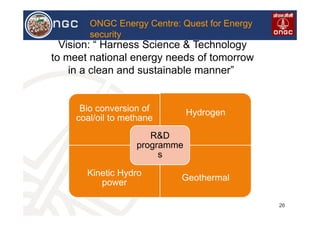

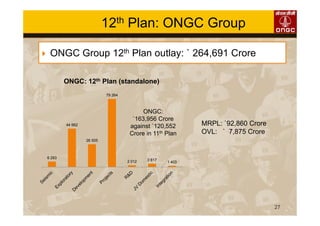

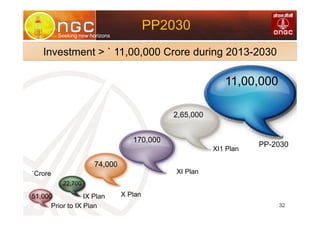

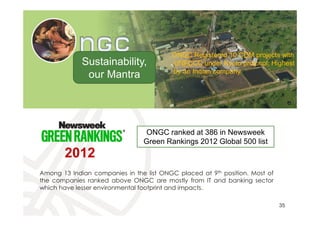

This document provides an overview of ONGC (Oil and Natural Gas Corporation), India's national oil company. It discusses ONGC's operations including exploration and production, refining, LNG, power and new energy sources. It highlights ONGC's financial performance, reserves, production volumes and describes its domestic and international exploration projects. The document also outlines ONGC's research institutes and future plans outlined in its Perspective Plan 2030 to transform its focus from hydrocarbon to energy security and new investment areas.