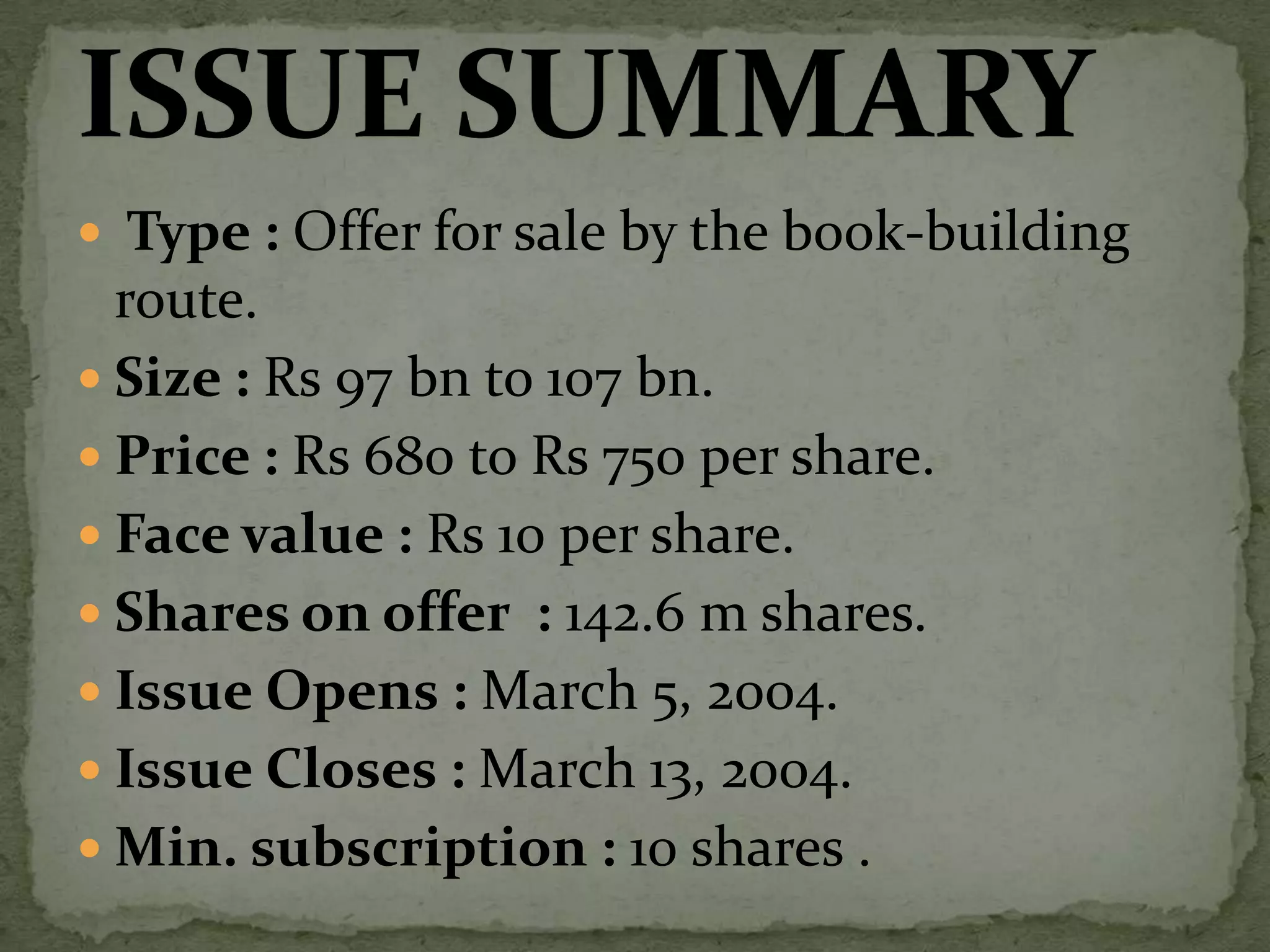

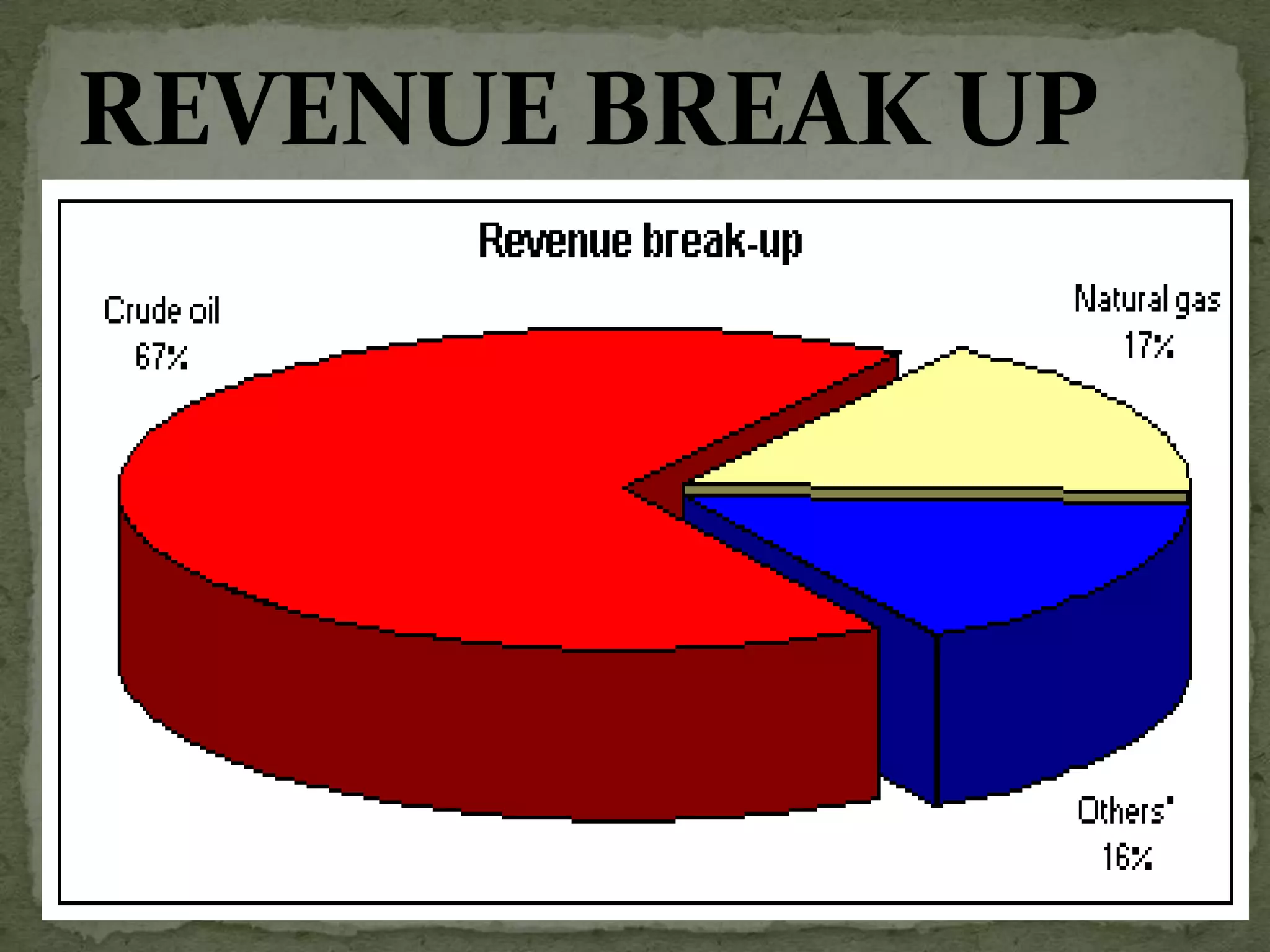

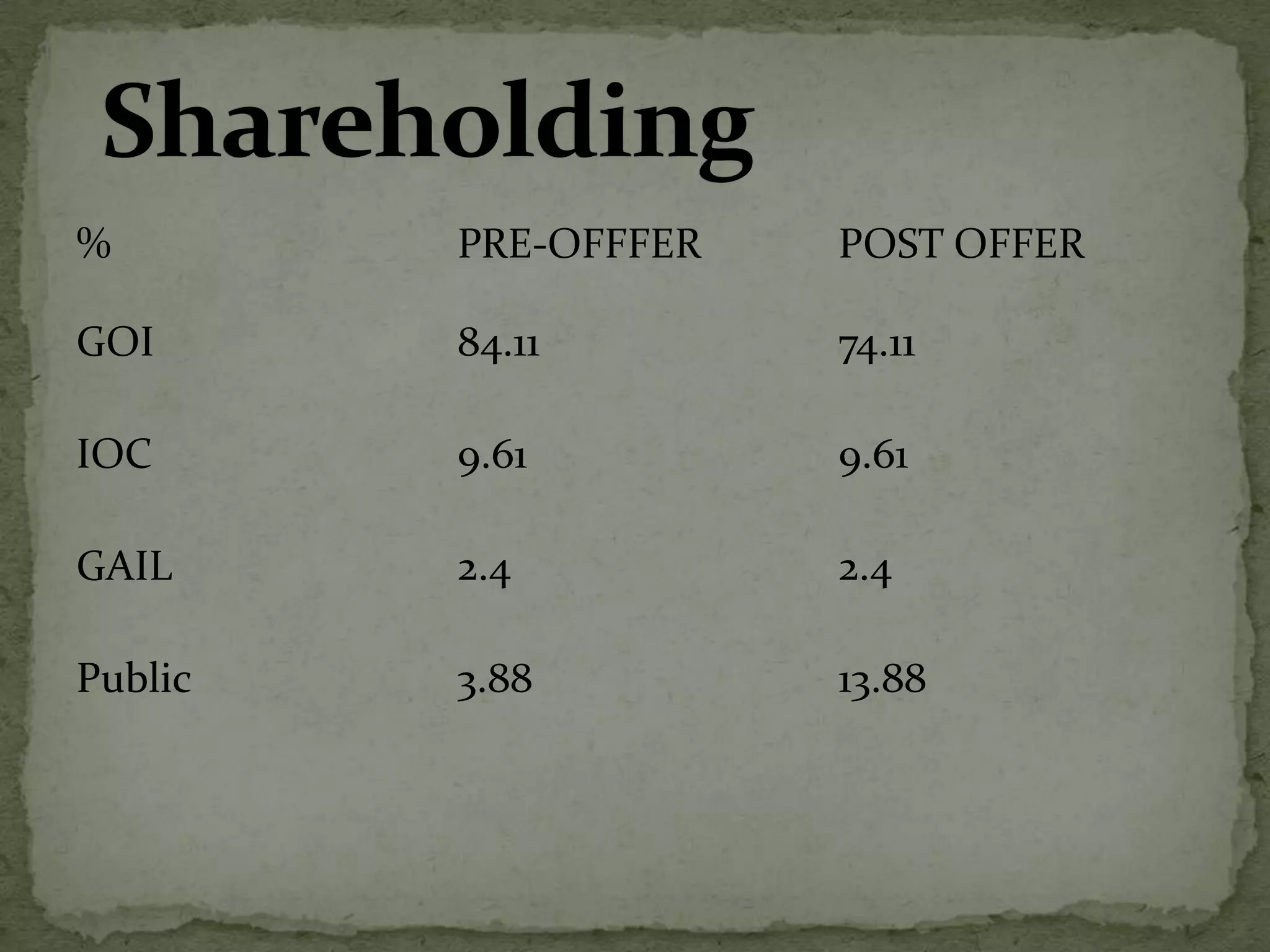

This document summarizes the initial public offering of Oil and Natural Gas Corporation (ONGC), India's largest oil and gas exploration and production company. ONGC was founded in 1956 and is headquartered in New Delhi. The IPO involved the sale of 142.6 million shares at a price between Rs. 680-750 per share to raise between Rs. 97-107 billion. Post-IPO, the Government of India's stake in ONGC would be 74.1%.