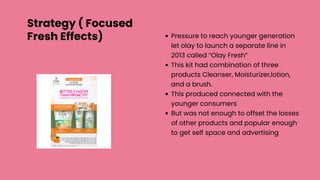

The document discusses the competitive landscape of the global skincare market, highlighting key players such as Procter & Gamble's Olay, L’Oréal, and Neutrogena, along with market trends and consumer behaviors, particularly in China and the U.S. It examines the challenges Olay faced in maintaining its brand identity and consumer appeal amid rising competition from direct-to-consumer brands and Korean beauty products. Strategies proposed for Olay included optimizing its product portfolio, targeting younger demographics, and reducing product confusion to revitalize brand sales.