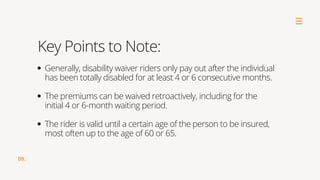

Term life insurance does not cover disability, which is distinct from life insurance that serves beneficiaries after death. While optional disability riders can be added to life insurance policies to waive premiums during disability, they do not provide the comprehensive income protection that standalone disability insurance offers. It is recommended to consult financial advisors to understand the best options for disability coverage.