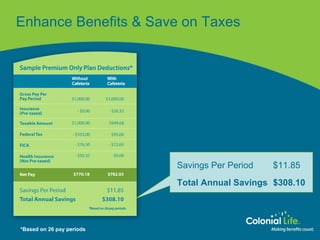

Rising health care costs are putting pressure on businesses to provide adequate medical coverage for employees and making coverage increasingly expensive for employees. The document discusses various insurance options that can help address these rising costs, including hospital indemnity insurance, accident insurance, critical illness insurance, disability insurance, and life insurance. It also discusses how these additional benefits can help attract and retain employees while providing tax savings for businesses.