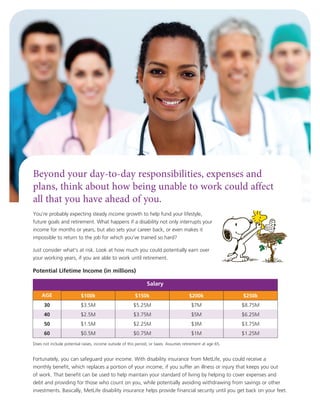

This document discusses the importance of disability insurance. It notes that anyone can become disabled, interrupting their income and career. Disability insurance provides monthly benefits to help cover living expenses if one is unable to work due to illness or injury. The document promotes MetLife disability insurance and notes that it can safeguard income and provide financial security until one recovers. It highlights some benefits of MetLife plans such as high coverage limits and options to increase coverage over time without medical exams.

![The promise of protection is only as strong as the company behind it. As a leading global provider of insurance, annuities

and employee benefit programs serving approximately 100 million customers, MetLife has operations in nearly 50 countries.

MetLife has the experience, commitment and resources to help safeguard the things that matter most to you.

Discover the protection of disability insurance backed by the strength of MetLife.

CLDI24225 L0814386254[0915][All States][DC,PR]

© 2014 METLIFE, INC. PEANUTS © 2014 Peanuts Worldwide

Like most disability insurance policies, MetLife’s policies contain certain exclusions, waiting periods, reductions, limitations and terms for keeping them in force. Ask

your representative about costs and complete details.

For policies issued in New York: These policies provide disability income insurance only. They do NOT provide basic hospital, basic medical or major medical insurance

as defined by the New York State Department of Financial Services. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future

premiums that MetLife expects to return as benefits when averaged over all people with the applicable policy.

The information contained in this document is not intended to (and cannot) be used by anyone to avoid IRS penalties. This document supports

the promotion and marketing of insurance or other financial products and services. Clients should seek advice based on their particular

circumstances from an independent tax advisor since any discussion of taxes is for general informational purposes only and does not purport

to be complete or cover every situation.

MetLife, its agents, and representatives may not give legal, tax or accounting advice and this document should not be construed as such. Clients should confer with

their qualified legal, tax and accounting advisors as appropriate.

All policies, riders and provisions may not be available in all states, at all issue ages and to all occupational classes. Ask your financial professional for complete details.

Eligibility is subject to underwriting approval.

Disability insurance is issued by Metropolitan Life Insurance Company on IDI2000-P/NC, IDI2000-P/NC-ML, IDI2000-P/GR, AH 5-88, IDIP12-01-IDIP12-08, AH 7-96-

CA and AH 8-96-CA.

1

Association and MultiLife discounts are not available for dentists and dental specialists.

2

Specialty Your Occupation language is available with MetLife Income Guard. For states and products where Specialty Your Occupation language is not approved for use, a Your

Occupation rider may be available. Ask your financial professional for complete details. MetLife will consider the material and substantial duties you are performing, including those of

a professionally recognized specialty (or specialties, if more than one) in medicine or dentistry, immediately prior to the time you become disabled to be the material and substantial

duties of your regular occupation.

3

Restrictions apply. Benefits paid after age 65 are subject to reduction.

Metropolitan Life Insurance Company

200 Park Avenue

New York, NY 10166

metlife.com

• Not FDIC-Insured • Not Insured By Any Federal Government Agency • Not Guaranteed by Any Bank or Credit Union](https://image.slidesharecdn.com/b430145d-b558-4c2f-b137-ad03fc65da69-150920141209-lva1-app6892/85/Disability-Insurance-Brochure-Physicians-6-320.jpg)