Embed presentation

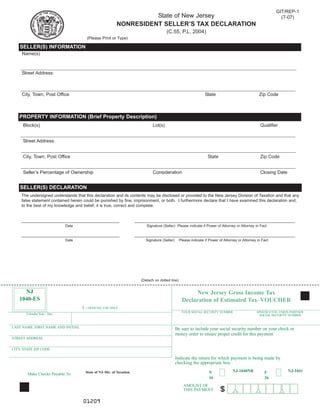

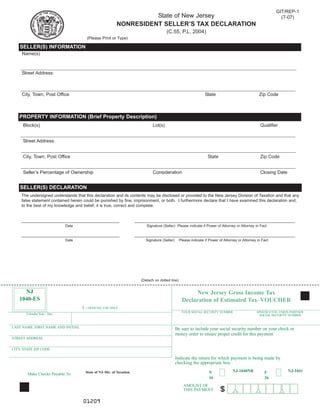

Download to read offline

This document provides instructions for nonresident sellers of property in New Jersey to complete the Nonresident Seller's Tax Declaration form. It explains that the form must be filled out at closing and given to the buyer. It details the information required which includes seller details, property details, ownership percentage and sale price. It states that the bottom portion of the form along with payment must be sent to the New Jersey Division of Taxation. The tax is based on the capital gain from the sale at a rate of 8.97% or a minimum of 2% of the sale price. Failure to submit the required documents and payment will prevent the deed from being recorded.