Embed presentation

Download to read offline

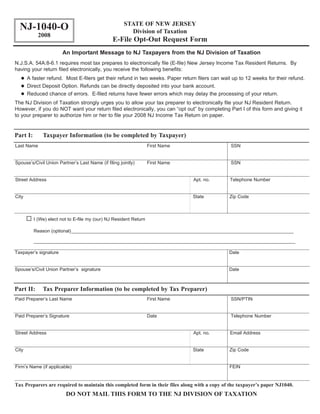

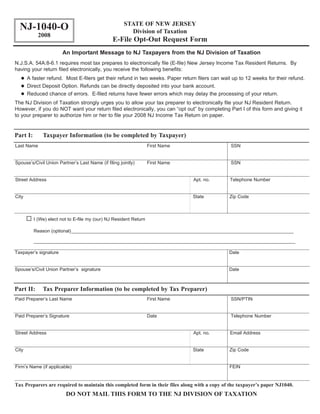

The document is a form from the New Jersey Division of Taxation allowing taxpayers to opt out of electronically filing their state tax return. It notes that most preparers are required to e-file returns due to benefits like faster refunds, direct deposit options, and fewer errors. However, taxpayers can choose to file a paper return instead by completing part I with their information and having their preparer fill out part II to keep the opt-out form on file.