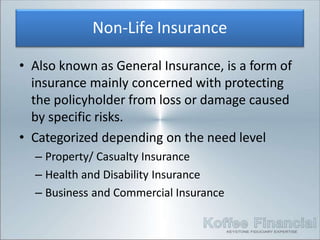

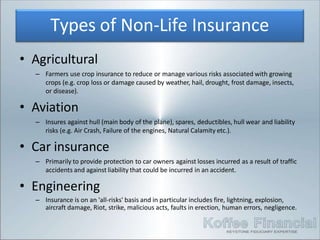

Non-life insurance, also known as general insurance, protects policyholders from various risks and losses. It is categorized based on need into property/casualty, health/disability, and business/commercial insurance. Some common types of non-life insurance include agricultural insurance for crop losses, aviation insurance for aircraft damage, car insurance for traffic accidents, fire insurance for property damage, health insurance for medical costs, home insurance for home damage, marine insurance for cargo shipment losses, motor insurance for vehicle accidents, shop/office insurance for business losses, and travel insurance for expenses while traveling abroad. Premiums paid for health insurance are eligible for tax deductions in India.