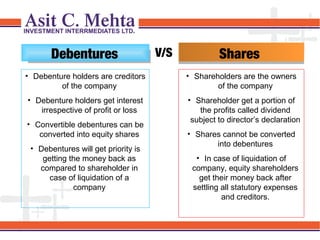

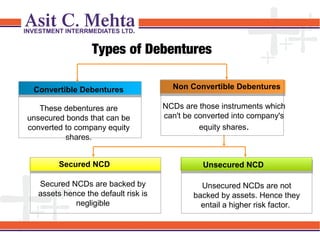

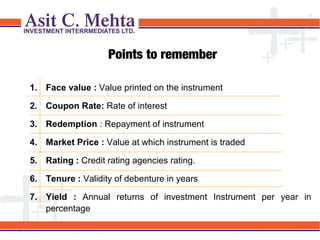

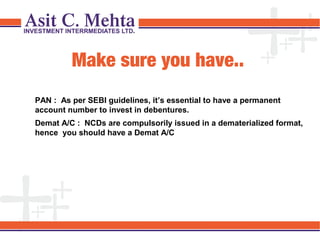

Non-convertible debentures (NCDs) are debt instruments used by companies to raise money, paying fixed interest and prioritizing debenture holders over shareholders in liquidation. There are various types of debentures including secured and unsecured NCDs, with the latter having a higher risk. Investors must have a PAN and a demat account to invest in NCDs, which are traded on stock exchanges and rated by credit rating agencies.