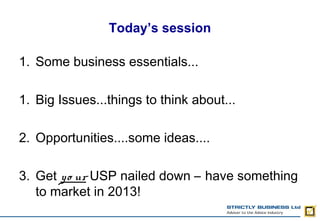

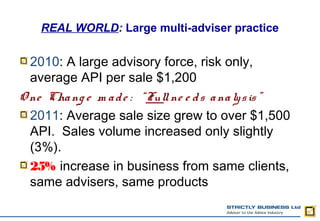

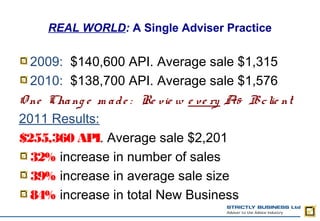

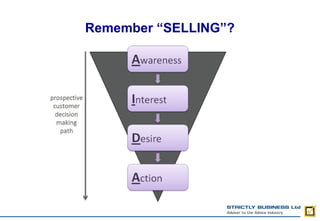

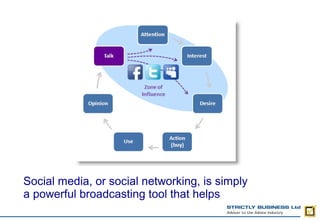

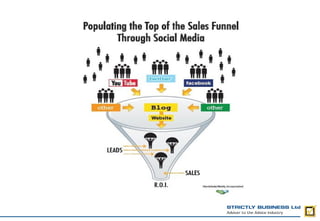

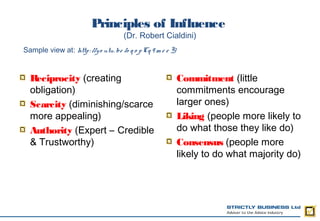

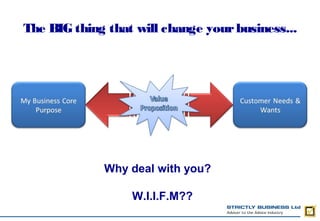

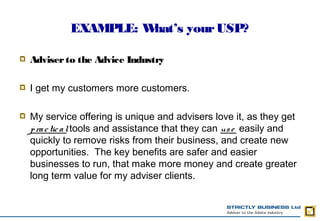

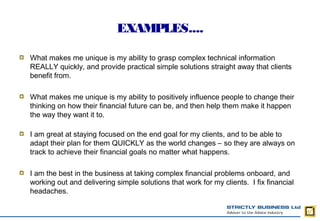

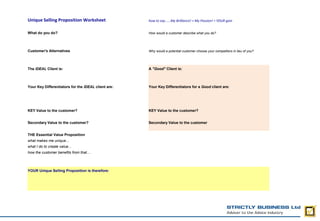

The document discusses opportunities for financial advisors to improve their businesses in 2013. It recommends that advisors get their unique selling proposition solidified to help market themselves. It also suggests focusing on opportunities like reviewing all clients to find additional needs, implementing a full needs analysis for new clients to increase average sale sizes, and leveraging principles of influence like reciprocity and consensus to improve marketing. The document emphasizes developing an "advice business" model that focuses on solutions rather than products or hours worked. It encourages advisors to believe in the value they provide to customers.