More Related Content Similar to NewBase 24-October -2022 Energy News issue - 1560 by Khaled Al Awadi_compressed.pdf (20) More from Khaled Al Awadi (20) 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 1

NewBase Energy News 24 October 2022 No. 1558 Senior Editor Eng. Khaed Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

Egypt Global Climate Summit Is Heading for a Geopolitical Hurricane

Bloomberg + NewBas

The last time world leaders got together for a climate summit, the backdrop was thoroughly

menacing. A pandemic had decimated national budgets. Poor countries were up in arms over the

hoarding of Covid-19 vaccines by the same wealthy nations whose fossil fuel consumption did most

to warm the planet.

Relations between the two largest emitters, the US and China, had devolved into zero sum

skirmishes over everything from trade to Taiwan.

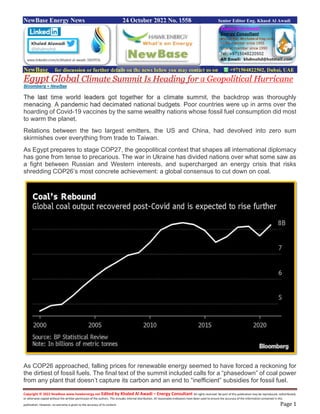

As Egypt prepares to stage COP27, the geopolitical context that shapes all international diplomacy

has gone from tense to precarious. The war in Ukraine has divided nations over what some saw as

a fight between Russian and Western interests, and supercharged an energy crisis that risks

shredding COP26’s most concrete achievement: a global consensus to cut down on coal.

As COP26 approached, falling prices for renewable energy seemed to have forced a reckoning for

the dirtiest of fossil fuels. The final text of the summit included calls for a “phasedown” of coal power

from any plant that doesn’t capture its carbon and an end to “inefficient” subsidies for fossil fuel.

2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 2

A year later, rampant energy price inflation has combined with a protracted energy crunch to revive

demand for coal and put subsidies for fuel of any kind back on political agendas.

“COP27 is to be convened while the international community is facing a financial and debt crisis, an

energy-prices crisis, a food crisis, and on top of them the climate crises,” says Egyptian Foreign

Affairs Minister Sameh Shoukry, who’s also the conference’s president. “In light of the current

geopolitical situation, it seems that transition will take longer than anticipated.”

The UK wrapped up its hosting duties at

COP26 with a claim to have kept alive the

Paris Agreement’s goal of capping warming

at 1.5C above preindustrial levels. Those

gains have now been at best stalled or at

worst reversed by the wartime logic brought

on by the invasion of Ukraine.

Russia’s President Vladimir Putin has

turned Europe’s energy spigot into an

economic weapon in response to sanctions,

and major developed economies faced with

suddenly scarce natural gas supplies are

racing to open up old coal-fired power stations.

The European Union voted in July to reclassify natural gas — in addition to nuclear power — as a

climate-friendly fuel, improving prospects for investment.

The boost to fossil fuels may well prove temporary. The imperative for Europe to end its dependency

on imported gas to heat homes and power industries has never been so clear. At the same time,

the sheer cost of gas—as high as 10 times pre-crisis levels—should create a powerful incentive to

look for alternatives, and the cheapest option will often be solar or wind power.

US President Joe Biden has passed one of the most significant pieces of climate legislation to date.

That will only accelerate on-the-ground growth in renewables, which already outpaces the

expansion of power generation as a whole.

Yet it’s far from a given that either the war or the recent U-turn toward fossil fuels will be a blip. Now

that Russia is intensifying its war effort with a recently announced mobilization, the race is on to

lease or build new liquefied natural gas terminals all around Europe.

If the continent with the most geopolitical pride in its climate commitments is backsliding, it doesn’t

bode well for progress at Egypt’s Sharm El-Sheikh beach resort.

“There doesn’t need to be any more debate about gas,” Bruno Jean-Richard Itoua, the minister of

hydrocarbons of the Republic of Congo, declared in September at an oil and gas conference that

included Mauritania, Senegal, Gambia, Guinea-Bissau, and Guinea-Conakry. “We need to start

producing as much as we can now.” Other African officials at the event echoed this up-with-fossil-

fuel sentiment.

“A lot of countries now say it is hypocritical” to call for forcing out dirty energy sources, says Bill

Hare, chief executive and senior scientist for Climate Analytics, a Berlin-headquartered think-tank.

“So you are seeing this really big push to renovate oil and gas projects that have been on the back

burner for years in Africa and Australia, far exceeding the level required for the European gas crisis.”

For every renewable producer pressing the case for an accelerated transition, Hare sees a

traditional energy company urging investment in a time of crisis. “I have rarely seen such a

3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 3

concerted effort by the oil and gas industry to, in one way or another, push back against the climate

agenda,” he says.

Al Gore, the former US vice president and climate activist, warned late last month, that it was

essential for governments to avoid signing long-term contracts for fossil fuels in a rush to plug short-

term gaps caused by Russia’s war. Subsidies that support fossil fuel use doubled from 2020’s Covid-

induced low, to 2021, and continue to rise sharply this year, according to a September report from

the Organization for Economic Cooperation and Development, an inter-governmental think tank in

Paris.

There are other thorny issues that

will be discussed at this year's

climate summit, the first to be

hosted by an African country in six

years. Egypt is planning to focus

this year’s COP meeting on how

developing nations can get

funding to adapt to rising

temperatures and finance the

transition to green energy. It’s also

prioritizing loss and damage, a

term for compensation for nations

that did little to release

greenhouse gases but are on the

front lines of its effects.

Money to help less-developed

nations mitigate and adapt to the

impacts of climate change is still

missing. Rich countries had agreed to provide $100 billion annually by 2020 and have fallen short

by billions of dollars, pushing the target back to 2023.

The Egyptian hosts are contending with inflation that spiked to 15% at the end of September from

5.9% at the start of the year. The national budget is being consumed by the need to provide basic

food necessities, widening the current-account deficit in the first three months of this year by more

than half, to $5.8 billion.

Shoukry wants COP27 to agree on additional sums to be transferred from rich to poor nations after

2025. The latest estimates to finance developing nations’ climate goals are in the scale of $6 trillion

through 2030, according to the OECD.

But with rich and poor economies alike grappling with rising inflation, falling revenue, and often

political upheaval, finding that kind of money looks more difficult by the day. Shoukry acknowledged

those concerns and called on governments to rise to the financial challenge, as they did during the

pandemic.

Preliminary meetings held earlier this year in Bonn to discuss technical issues ahead of COP27

already saw flare-ups between the rich and poor camps, in particular over loss and damage. Those

tensions are likely to be in evidence again at Sharm El-Sheikh.

“Rich nations have exploited and reaped the economic benefits of fossil fuels for decades,” says

Gabriel Obiang Lima, Equatorial Guinea’s oil minister, describing calls on Africa to hold back on

using hydrocarbons as simply unfair. “Now is our time to develop and monetize our resources, and

developed countries should understand.”

4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 4

UAE: ADNOC Drilling delivers new world record for the longest well

Source: ADNOC

Abu Dhabi National Oil Company (ADNOC) has announced that a new world record for the longest

oil and gas well has been set at its Upper Zakum Concession.

Stretching 50,000 feet, the well is around 800 feet longer than the previous world record set in 2017

and supports ADNOC’s efforts to expand production capacity of its lower carbon oil and gas

resources to help meet the world’s growing demand for energy.

ADNOC Drilling drilled the oil and gas well from Umm Al Anbar, one of ADNOC Offshore’s artificial

islands.

ADNOC Drilling delivers new world record for the longest well

This extraordinary feat of engineering is part of an extended reach well project designed and led

by ADNOC Offshore, in collaboration with its Upper Zakum strategic international partners,

ExxonMobil and INPEX/JODCO.

The extended reach wells will tap into an undeveloped part of the giant Upper Zakum reservoir with

the potential to increase the field’s production capacity by 15,000 barrels of oil per day, without the

need to expand or build any new infrastructure.

Abdulrahman Abdullah Al Seiari, ADNOC Drilling CEO, said: 'This incredible achievement is in line

with ADNOC Drilling’s quest to deliver increased efficiency for our customers as we continue to

create greater value for our shareholders.

Stretching 50,000 feet, the well is part of ADNOC Offshore’s

extended reach drilling project that could increase Upper Zakum’s

production capacity by 15,000 bpd

Milestone supports ADNOC’s efforts to responsibly expand

production capacity of its lower carbon intensity oil and gas

resources

5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 5

The delivery of this record-breaking well also demonstates our commitment to lower operational

costs, while enabling ADNOC to reach its oil and gas production capacity targets.

'This historic milestone is a credit to the hard

work and dedication of our staff who have

collectively demonstrated how, as a

responsible operator, we are succesfully

maximizing the use of advanced extended

reach, horizontal and directional drilling

methods.'

Umm Al Anbar is one of Upper Zakum’s four

artificial islands, serving as a hub for offshore

drilling and operations.

Ahmad Saqer Al Suwaidi, ADNOC Offshore

CEO, said: 'ADNOC’s pioneering and

innovative use of artificial islands, coupled with

its world leading drilling expertise, is enabling

us to drive growth, maximize value and

minimize the environmental footprint of our

operations. Working with our strategic

international partners, we will continue to push

the boundaries of engineering for the benefit of

the UAE, our partners, and customers around the world.'

ADNOC Offshore perfected the artificial island concept, resulting in significant cost savings and

environmental benefits compared to conventional approaches that traditionally require more

offshore installations and infrastructure.

6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 6

NewBase October 24 -2022 Khaled Al Awadi

NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE

Oil prices drop as Chinese demand data disappoints

Reuters + NewBase

Oil prices slid on Monday after Chinese data showed that demand from the world's largest crude

importer remained lacklustre in September as strict COVID-19 policies and fuel export curbs

depressed consumption.

Brent crude futures for December settlement were down $1.17, or 1.3%, at $92.33 a barrel by 1217

GMT, after rising 2% last week. U.S. West Texas Intermediate crude for December delivery was at

$83.65 a barrel, down $1.40, or 1.7%.

Although higher than in August, China's September crude imports of 9.79 million barrels per day

were 2% below a year earlier, customs data showed on Monday, as independent

refiners curbed throughput amid thin margins and lacklustre demand.

"The recent recovery in oil imports faltered in September," ANZ analysts said in a note, adding that

independent refiners failed to utilise increased quotas as ongoing COVID-related lockdowns

weighed on demand.

Oil price special

coverage

7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 7

Uncertainty over China's zero-COVID policy and property crisis are undermining the effectiveness

of pro-growth measures, ING analysts said in a note, even though third-quarter gross domestic

product growth beat expectations.

Brent rose last week despite U.S. President Joe Biden announcing the sale of a remaining 15 million

barrels of oil from the U.S. Strategic Petroleum Reserves, part of a record 180 million-barrel release

that began in May.

Biden added that his aim would be to replenish stocks when U.S. crude is around $70 a barrel.

But bank Goldman Sachs said the stocks release was unlikely to have a large impact on prices.

"Such a release is likely to have only a modest influence (<$5/bbl) on oil prices", the bank said in

a note.

U.S. energy firms added oil and natural gas rigs last week for the second week in a row as relatively

high oil prices encourage firms to drill more, energy services firm Baker Hughes Co said in a report.

As much as 15 million barrels of crude oil sold from the U.S. SPR

The U.S. Department of Energy (DOE) announced a notice of sale of as much as 15 million barrels

of crude oil from the Strategic Petroleum Reserve (SPR) on October 18, 2022, to help address the

market supply disruption caused by Russia’s full-scale invasion of Ukraine and to help lower energy

costs. The sale was held on October 19, 2022, for delivery in December 2022.

This sale will complete the 180 million barrel sale of crude oil from the SPR that President Biden

announced in the spring of 2022 and is part of a larger effort to ensure an adequate supply of

petroleum in response to Russia’s full-scale invasion of Ukraine.

The SPR was established in the 1970s to reduce the effects of unexpected oil supply reductions.

The reserve was designed to hold up to 714 million barrels of crude oil across four storage sites

along the Gulf of Mexico, where much of the U.S. petroleum refining capacity is located. One of the

SPR’s core missions is to hold enough oil stocks to fulfill U.S. obligations under the International

Energy Program, the 1974 treaty that established the International Energy Agency (IEA).

8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 8

We survey SPR inventory levels each week in our Weekly Petroleum Status Report. On October

14, 2022, the SPR held 405 million barrels of crude oil, the lowest inventory level the SPR has held

since June 1984. SPR crude oil stocks have been declining in recent years, largely because

of legislated drawdowns authorized in bills passed in previous years.

On October 18, the DOE finalized a rule laying out how it plans to replenish the SPR. The rule allows

fixed-price purchases of crude oil when the price of West Texas Intermediate (WTI) crude oil is at

or below about $67 to $72 per barrel.

Crude oil can be released from the SPR under four conditions: emergency drawdowns, test sales,

exchange agreements, and nonemergency sales. This announced sale is part of the emergency

drawdown announced earlier this year. Before 2022, the most recent emergency sale was in 2011,

when IEA members collectively released 60 million barrels in response to disruptions in Libya.

Test sales are relatively rare: the most recent test sale occurred in 2014. In contrast, the SPR has

released crude oil under exchange agreements 13 times since 1996, most recently after Hurricane

Ida in September 2021. In these exchange agreements, crude oil is released to private companies

and repaid in kind by specified dates with additional barrels, similar to monetary interest on a loan.

Congress has also authorized nonemergency sales of SPR crude oil to respond to lesser supply

disruptions or to raise revenue for the U.S. Treasury. For example, the Fixing America’s Surface

Transportation Act, passed in 2015, and the Bipartisan Budget Act of 2018 collectively call for the

sale of more than 160 million barrels of crude oil from the SPR in fiscal years 2022 through 2027.

The World’s Oil Buyers Are Being Crushed by a Surging Dollar

Brent oil has dropped more than 30% from this year’s high, but you wouldn’t know it if you live in

Paris, Mumbai or Accra.

The decline in the global oil benchmark from nearly $128 a barrel has dovetailed with a jump in the

dollar of about 15% over the same period. That means fuel prices remain a significant factor driving

up the cost of living across most of the world.

9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 9

Oil-demand powerhouses like China, India and the European Union have all seen smaller real-term

declines in crude prices than benchmarks would suggest. And for some emerging markets like Sri

Lanka, the impact of a spiraling oil price and collapsing currency has already shown up in the form

of near-total economic collapse.

“A stronger dollar is a headwind for oil consumer nations whose currencies are not linked to the

greenback,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “Over the last 12

months, oil prices have increased much more in local currency terms.”

There’s no easy fix. Lifting interest rates to bolster currencies risks slowing already-fragile

economies, while developing countries need to keep an eye on dollar reserves.

Euro-zone countries are highly dependent on imports for their oil. With next to no local crude

supplies, each of the currency bloc’s five biggest economies -- Germany, France, Italy, Spain and

the Netherlands -- is at least 90% dependent on foreign purchases to run refineries.

Against that backdrop, the dollar denomination of oil has proven to be a particular headache for

European Central Bank officials in what has already been a testing year. The squeeze on energy

supplies from Russia’s moves to cut gas deliveries has driven huge increases in consumer prices,

running at a record 9.9% in September.

Asian countries have been feeling similar pain. Through August, the value of China’s oil imports

was up 50% from a year earlier, despite overall volumes being lower as the country wrestles with

restrictions to stop the spread of Covid-19.

Bank of Korea Governor Rhee Chang-yong complained last month that his currency’s weakness is

canceling out the benefits of lower oil prices. Both Korea and Japan have at times sought to shield

10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 10

consumers from the pain of higher fuel prices by offering subsidies -- effectively transferring some

of the burden to the government.

The strain of the strong dollar has prompted India to reach out to trade partners including Saudi

Arabia, Russia and the UAE to shift deals to local currencies. The rupee has fallen about 11%

against the dollar this year.

“If crude oil prices persist at current levels or rally further, this could result in trade deficits remaining

wide, leading to further depreciation pressure on the Indian rupee,” said Divya Devesh, a currency

strategist at Standard Chartered.

Though pressure from the dollar is widespread, emerging economies are feeling the most acute

pain. When priced in Ghana’s cedi, not only is Brent oil above where it was trading in March, but at

a record.

Spiraling fuel prices and foreign exchange shortages is creating a toxic mix for some. Sri Lanka

recently shut its only oil refinery because it couldn’t pay for crude. The country effectively went

bankrupt over the summer as it struggled to finance food and fuel imports.

While developed countries have more leeway to absorb currency shifts, “there are definitely

emerging markets that are going to see balance-of-payments problems as a result of high oil prices,”

said Caroline Bain, chief commodities economist at Capital Economics.

--With assistance from Heesu Lee, Clarissa Batino, Michael Heath, Craig Stirling, Zoe Schneeweiss,

Sarah Chen, April Ma, Toru Fujioka, Karthikeyan Sundaram, Debjit Chakraborty and Sam Kim.

11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 11

NewBase Specual Coverage

The Energy world –October -24 -2022

CLEAN ENERGY

EU: LNG Market Shows the Strains of Replacing Russian Gas

Bloomberg

Europe has done a better job replacing Russian gas supplies than many people were expecting –

that’s why prices have fallen by two thirds since August.

But the global market for liquefied natural gas, which has been so vital for filling the gap created by

President Vladimir Putin’s supply squeeze, is showing signs of strain from Spain to China.

So much LNG has been flowing into Europe to refill storage tanks for winter that the region’s import

facilities are struggling to keep up. At least seven tankers laden with LNG are moored off Spain’s

southwest coast waiting to unload, while in the UK another two are anchored near the country’s Milford

Haven terminal, according to ship-tracking data.

That might seem like a welcome problem, but Europe should still be taking in every molecule of fuel

it can find. If Spain’s Enagas SA is forced to limit the number of cargoes its system handles, that’s

a failing of infrastructure that could deprive the region of gas that would be desperately needed later

in the winter when colder weather arrives.

12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 12

Europe has been expanding its LNG import capacity as best it can. Germany, its largest gas

consumer, is rushing to install at least two terminals for this heating season. But the size and speed

of the shift required is creating significant bottlenecks.

As LNG tankers sit idle off the shores of Europe, Asian consumers of the fuel are struggling to find

ships to serve their needs. The cost of hiring these vessels has already jumped to unprecedented

levels, and could surge another 25% to 50% according to ship owners, brokers and traders.

The escalating ship shortage could create problems for Asian buyers if temperatures suddenly drop

this winter—a possibility mooted by some analysts for China. The risk that the global LNG supply

chain could be found wanting is already spurring protective measures.

China told its state-owned gas importers to stop reselling LNG to buyers elsewhere in order to

ensure its own supply for the winter heating season.

In addition to these restrictions, there have been several supply disruptions this month. Nigeria LNG

Ltd. said it would be temporarily unable to fufill supply contracts from its Bonny Island export facility

due to flooding. Malaysia’s Petronas halted flows from its plant two weeks ago.

While Europe may be drowning in LNG right now, vital supplies could drain away from the region if

supply chains break down when colder weather arrives.

13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 13

Europe Gets a Breather From Crisis - For Now

When European natural-gas futures spiked in August to 342 euros a megawatt-hour – just shy of a

record – few would have predicted a price plunge when the weather starts to turn cold.

Yet, November is less than two weeks away, and benchmark prices are trading at a four-month low

near 115 euros, about a third of the summer peak. What gives?

Gas supplies, for starters. Stockpiles on the continent are more than 92% full, higher than the five-

year average, according to data from Gas Infrastructure Europe. In Germany, the region’s largest

economy, that level is now 96%. That’s largely due to record levels of liquefied natural gas to replace

lost pipeline flows from Russia.

Mother Nature is also lending a hand. Temperatures for much of the continent are set to be higher

than usual over the next two weeks, according to forecaster Maxar Technologies. Europe

could avoid a deep freeze altogether this winter, easing demand for heating fuel, another estimate

shows.

14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 14

Meanwhile, governments have been racing to put in place emergency measures to lower energy

consumption this winter. Germany on Monday went a step further, temporarily extending the life of

its last three nuclear plants to ease pressure on the power supply through the cold months.

Lower prices are taking some of the pressure off the European Union to act quickly. The

Commission on Tuesday is set to propose a package to tackle the crisis, including steps to avoid

spikes in energy derivatives, according to a draft. It won’t include an immediate cap on gas prices,

a controversial idea due to the potential unintended consequences of such intervention. A final

version could be approved by energy ministers in mid-November.

To be sure, plenty of risks remain. France’s nuclear reactors, plagued by technical problems and

worker strikes, are operating at about half of their capacity and restarts have been delayed.

Recent damage to energy infrastructure – notably the Nord Stream pipeline network linking Russia

and Germany – has exposed the region’s vulnerability to sabotage. Gas prices briefly spiked 20%

15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 15

last week when it initially looked like supplies across Ukraine might have been disrupted due to

Russian missile strikes. It turned out shipments weren’t affected.

Europe’s thirst for LNG has caused a shortage of tankers, pushing shipping rates to unprecedented

levels. An expected cold winter in China could stoke demand for the fuel, leading to higher prices

for the fuel and upending trade flows if cargoes go to Asia instead of Europe.

Germany’s energy regulator has also warned that while near-full gas supplies are good news,

they’re only enough to cover two cold months – and the country needs to keep an eye on the ability

to refill for next winter.

For now, there’s a bit of a respite. Electricity prices have followed gas lower, with German year-

ahead power down more than 60% from its August peak and equivalent French prices down 50%.

But don’t get too comfortable – the official start of winter is still some two months away.

EU Considers Speed Limit to Stop Gas Market Going Off the Rails

The European Union’s constantly evolving quest to limit the economic damage from wild gas prices

has a new goal – curbing volatility.

After weeks of talks about an outright cap on the price of natural gas, the bloc’s latest proposal

focuses on something that may be easier to implement and is already a feature of many other

markets.

16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 16

A temporary mechanism designed by the European Commission would impose a dynamic price

limit for transactions on the Dutch Title Transfer Facility, restricting how far the benchmark index

can move on a given day.

Volatility has certainly been a major issue on the European gas market, surging to unprecedented

levels since Russia invaded Ukraine. Even in recent months, when markets have been calmer and

prices have dropped, the scale of intraday price swings has remained far above pre-crisis levels.

The EU proposal would protect the region’s energy companies from large swings in prices and help

them to secure supply in the medium term, according to a draft of the plan seen by Bloomberg.

However, there’s plenty of evidence that imposing a speed limit on prices isn’t enough by itself to

stop a market going off the rails.

Earlier this year, the market for nickel – a key ingredient in stainless steel – plunged into chaos after

a huge short squeeze focused on Chinese tycoon Xiang Guangda drove the price up by an

unprecedented 250% in little more than 24 hours last week.

The London Metal Exchange responded to the turmoil by limiting daily price moves to 5%. When

trading restarted, nickel futures immediately slumped to their daily limit and the market was

suspended again. Liquidity collapsed because nobody was willing to buy at the limit-down price.

Instead of calming the market, the daily trading limits exacerbated the crisis, prompting some traders

to vow never to trade nickel on the exchange again.

17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 17

Diesel Deepens Europe’s Energy Woes

Natural gas and electricity prices have so far grabbed the headlines in Europe’s energy crisis. Now

diesel is claiming some of the spotlight.

Trucks guzzle diesel while they’re transporting goods, and factories use it to run heavy equipment,

so the fuel can provide a window into industrial strength. Diesel prices have soared on the continent

just ahead of winter, and a major supply disruption is on the way.

In February, European Union sanctions on seaborne imports of Russian oil products take effect

(following a similar ban on the country’s crude in December) in response to Moscow’s war in

Ukraine. Russia is the region’s single-biggest diesel supplier. For now, other factors are propping

up Europe’s market for the fuel.

Labor strikes in France have halted some of the nation’s biggest refineries, and the government has

been forced to tap strategic reserves. Almost a third of the country’s filling stations face shortfalls,

leading to long lines at the pump.

Europe’s largest refinery, Shell Plc’s Pernis plant in the Netherlands, suffered a

minor malfunction this week, sending jitters through the market. Some of the continent’s plants are

already undergoing seasonal maintenance, reducing fuel supplies.

In addition, diesel inventories in independent storage at the Amsterdam-Rotterdam-Antwerp trading

hub are at the lowest level for the time of year since at least 2007, data from Insights Global show.

18. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 18

High prices in Europe are helping to pull in shipments from the Middle East and Asia, but there are

limits in covering the supply gap. Industrial customers have been substituting oil for gas, adding to

demand. While imports from the US have ramped up in recent months, stockpiles there are low as

well.

That all spells bad news for Europe, which is already seeing the highest inflation in decades.

Governments faced with the prospect of soaring gas and power costs this winter are racing to stave

off recession. If diesel prices remain high, that task becomes even more difficult.

EU’s Replacement for Russian Gas May Soon Get More Expensive

Europe has replaced much of its Russian natural gas imports with cargoes of the liquefied form of

the fuel from the global market. Forecasts of a cold winter in China suggest those supplies are about

to get more expensive.

China is likely to see a small gas supply deficit in December, which could quickly balloon in January

if frigid temperatures were to combine with an easing of Covid-Zero policy measures, according to

a joint report from Sinopec and BSC Energy Consulting.

19. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 19

After taking less liquefied natural gas this year than last, Chinese fuel importers are now showing

renewed interest in buying LNG shipments for winter, and that could be bad news for Europe.

“Europe’s high LNG imports in recent months have partially been made possible by low LNG imports

into China,” Morgan Stanley said in a note dated Oct. 12. Reduced competition for the fuel meant

prices have declined since August despite greater European buying.

20. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 20

That extra LNG is the key to how Europe managed to refill its gas storage over the summer despite

an ever-tigher squeeze on Russian supplies. On average the region’s storage facilities are 91% full,

above the five-year average for many countries after a lean year in 2021.

This ample storage gives consumers some reassurance that they can make it through winter without

significant volumes of Russian gas – but it’s no guarantee. The CEO of Russian gas monopoly

Gazprom PJSC warned on Wednesday that European households could still freeze during a severe

cold snap.

“Winter can be relatively warm, but one week or even five days will be abnormally cold and it’s

possible that whole towns and lands, god forbid, will freeze,” Gazprom Chief Executive Officer

Alexey Miller said at Russian Energy Week in Moscow.

When winter is over, depleted gas stores will need refilling. Miller made it sound unlikely that this

would be done with Russian gas.

“What will happen by the time of gas injection” into storage before winter of 2023 and 2024, Miller

asked. “It will be clear then that the energy crisis has come not for a short period of time.”

So European traders will be closely watching the Communist Party’s twice-a-decade leadership

congress that begins in Beijing on Sunday, when companies may receive guidance on the nation’s

energy security strategy, potentially spurring more LNG purchases.

21. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 21

Europe’s ‘Accident’-Prone Energy Infrastructure Causes Concern

Another crucial piece of Europe’s energy infrastructure has been damaged, raising concerns about

the continent’s ability to get through the winter.

Part of the key Druzhba oil pipeline from Russia to Germany was shut after a leak was discovered

along the route through Poland. Polish authorities believe - for now, at least - that it was likely an

accident, though an investigation is under way.

Last month, the Nord Stream natural gas pipeline system - also linking Russia to Germany - was

damaged by several, near-simultaneous explosions in the Baltic Sea. European and US officials

suspect sabotage, but even if it turns out to be an accident, it’s a serious setback for the region’s

energy supply, ensuring that the network has little chance of returning to service any time soon.

And this past weekend, railways in northern Germany were halted for several hours after cables

needed for the safe operation of trains were severed. The transport minister described the episode

as sabotage and said he couldn’t rule out foreign involvement, though no suspects have been

identified.

22. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 22

The true cause of these incidents may never be known, but they are a reminder of how little margin

for error Europe has this winter. The region is racing to stockpile fuel, import liquefied natural gas

and prevent the crisis from morphing into a full economic meltdown. But those steps may not be

enough if energy prices soar as temperatures drop.

EU energy ministers are meeting in Prague Wednesday to discuss how to protect consumers.

They’re fully aware that the one remaining gas link to the bloc from Russia runs right through a war

zone.

And they’re increasingly concerned about energy security, due to supply cuts from Russia and signs

pointing to increasing violence in the region. President Vladimir Putin has threatened more attacks

in Ukraine - following a missile blitz in recent days - after the main bridge linking Crimea to Russia

was damaged by a severe explosion.

Germany’s Changing Stance

Europe may finally be pulling together for a pandemic-scale response to the energy crisis.

In a dramatic U-turn, Germany is now willing to back common borrowing by the European Union to

help cushion the impact of the crunch as countries prepare massive spending to get through the

winter with just the bare minimum Russian gas, Bloomberg News reported. The stakes are only

increasing as President Vladimir Putin steps up the war in Ukraine by hitting civilian targets around

the country, raising risks for the last remaining route that carries Russian gas to western Europe.

Economies around the bloc have already been hit hard, and any further disruption to supply could

easily push them into recessions and make rolling blackouts a reality. Inflation is running at the

highest in decades, factories are being forced to shut because energy is too expensive and

households bills are piling up. The strain on most countries is immense, but especially more so on

those that don’t have the financial power of the bigger nations.

Some government officials have been calling for a Covid-style response, recalling the EU’s unified

response to the pandemic, when governments issued debt for a massive recovery fund to benefit

countries most in need. But Berlin had been resisting such a move, saying the energy crisis was a

supply issue because of dwindling

Russian shipments, unlike the demand

shock brought by Covid which required

public funds to stimulate economies.

Germany’s support plans outstrip any

other in the EU, and the country has faced

an outcry over its €200-billion ($194-

billion) national energy-aid program, with

leaders saying it risks economic

imbalances in the bloc. A panel also

recommended this week that Chancellor

Olaf Scholz’s

administration subsidize most gas

consumption, which could take about

€100 billion from the overall support

package. It may cause concern in

Brussels, and German Deputy Energy

Minister Patrick Graichen expects a push

back from the EU.

23. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 23

All of these come just as the official heating season gets underway. While gas reserves are fuller

than normal and warm weather has kept demand low, it could all quickly change if a cold snap kicks

in and drains the buffer. More worryingly, replenishing those reserves at the end of winter for next

year will be much harder in the absence of Russian supplies. That means next winter could

potentially be even worse, and the severity of the pain will depend on how the EU responds.

Global Repercussions

There were growing signs on Monday that European countries have a chance of protecting their

economies from the Russian energy squeeze.

An advisory group to the German government recommended that the state subsidize as much as

80% of natural gas consumption for households and companies early next year as part of a 200

billion-euro ($194 billion) aid package.

The proposal came as European gas prices fell to the lowest level in more than three months thanks

to relatively warm weather and the highest seasonal imports of liquefied natural gas since 2016.

The volume of the gas held in the region’s storage facilities is still rising, offering a crucial protection

against further disruptions to Russian supply or severe cold weather.

These developments raise the hope that Europe could be spared from the worst-case scenarios for

a winter energy crisis. But such an outcome could come at the expense of consumers in developing

countries.

24. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 24

“Europe’s gas inventories are in a strong position ahead of winter thanks to forced stockpiling,”

analysts at Bank of America Corp. said in a note.

The continent has increased LNG imports by 35 million tons, or more than 50% so far this year to

offset the loss of Russian pipeline gas, the bank said. At the same time, Asian consumption of the

fuel declined by 17 million tons, or 8%.

This competition drove LNG prices to record levels in August, but they have since fallen by more

than 50% amid fears about the weakening global economy. But the market remains strong and

Bank of America warned that a cold snap in either Europe or Asia could create “chaos in the LNG

markets once again.”

There’s also an environmental downside to the action Europe has taken to protect its economy from

the energy crisis. Asian consumers priced out of the LNG market have turned to coal and oil, and

are likely to keep using more of those dirtier fuels into 2023, the bank said.

Fractures Across Europe

Fractures are emerging in Europe’s approach to the energy crisis.

It was always going to be difficult for the continent to mount a unified response, given how differently

each country will be affected by Russia’s squeeze on gas exports. But splits are emerging before

the region has even faced the full challenges of winter.

The biggest divide is between the UK and the rest of Europe. That’s often the case on more than

just energy policy, but the difference was particularly stark on Friday.

As the front page of just about every national newspaper in Britain warned of the risk of blackouts

this winter, The Times reported that Prime Minister Liz Truss had blocked a public-awareness

25. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 25

campaign to encourage energy saving because she was “ideologically opposed” to interventions

into people’s daily lives.

Across the channel, the French government was doing the opposite, unveiling a sweeping plan to

reduce energy consumption by as much as 10%. From offices to residential buildings and shopping

malls to ski resorts, the country will be told to dim lights and turn down thermostats in a bid to avoid

shortages.

The vast policy difference belies the deep interconnections between the countries’ energy markets.

Several power cables and gas pipelines pass beneath the body of water that separates the British

Isles from continental Europe.

In normal circumstances, these conduits would distribute energy from one market to another,

ensuring everyone has enough to get by. The big question is whether that will still happen during

the extreme conditions of the coming months if every country is pursuing its own interests.

One potential point of tension is already emerging. The UK government has set its sights on a long-

term contract for Norwegian gas that would prevent any energy shortages this winter. A deal could

come as early as next week.

26. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 26

Norway doesn’t have huge volumes of unused gas sitting around waiting for a buyer. The country

has been pumping flat out since the start of 2022, and its supplies have been crucial for European

nations seeking to replace lost Russian imports.

Any gas volumes secured by the UK would be supplies that could also have gone elsewhere in

Europe.

Gas shipments aren’t the only concern. Germany’s largest power-grid operator has said the country

may have to restrict electricity exports this winter as a last resort to avoid blackouts. Norway,

worried about emptying its hydroelectric reservoirs, has given a similar warning.

The headlines about potential blackouts that dominate UK newspapers on Friday were based on a

National Grid Plc scenario in which power imports from the rest of Europe are shut down.

Low-Hanging Fruit

If you’re in Europe, get used to lunchtime power cuts, shorter showers and darker streets this winter.

Across the continent, governments are taking steps to curb energy demand due to an

unprecedented supply crunch. And much of the low-hanging fruit falls in the area of personal

consumption.

27. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 27

France plans to cut power to water boilers for millions of users - mostly in homes - from noon to 2

p.m. for starting in mid-October. The country’s power-grid operator previously warned that it expects

to ask households, businesses and local governments to curb energy consumption over the next

six months.

Germany is imposing a ban on heating private swimming pools. Finland has proposed that

consumers take shorter showers and cut their time on digital devices. Denmark recommends

running appliances like dishwashers at night and favoring clotheslines instead of tumble dryers.

The crisis - exacerbated by diminishing natural gas supplies from Russia following its invasion of

Ukraine and subsequent sanctions - has made the European Union get serious about energy

efficiency. Governments and power companies want to curb consumption so they don’t have to

resort to rolling blackouts when electricity demand exceeds supply.

The measures extend beyond the household realm. Several countries including France, Germany

and Spain are taking steps to limit heating to 19 degrees Celsius (66 Fahrenheit), especially in

public buildings. Other efforts include cutting the lighting for monuments at night and encouraging

supermarkets and other retailers to turn off illuminated signs after closing time.

Such small measures could also result in big savings. France’s lunchtime halt in electric boilers may

reduce power consumption by as much as 2.5 gigawatts—the equivalent of two to three nuclear

reactors, according to power distribution operator Enedis.

So say goodbye to long, hot showers and grab a sweater for both home and the office. And

remember to turn off the lights behind you!

28. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 28

Testing the Market

European leaders look keen to test whether high prices really are necessary to attract imports and

bolster energy security. Ursula von der Leyen, president of the European Commission, signaled on

Wednesday that she’s still open to discussing a temporary broad cap on the price of natural gas.

It would be part of a broader effort to break the link between the cost of electricity and the high price

of gas. That makes some economic sense, since only a portion of power is generated by burning

fossil fuels and much of it comes from far cheaper sources such as renewables.

However, the region needs to attract much larger volumes of liquefied natural gas this winter to fill

the gap created by lost Russian exports. Two of the biggest players on this market have warned

that capping prices would mean supplies go elsewhere.

“We will do our best to bring gas to Europe where it’s needed, but if the market signal is not there

it’s going to be really challenging,” Shell Plc Chief Executive Officer Ben van Beurden said on

Wednesday.

“LNG comes to Europe because Europeans accept to pay a bit more than Asians, otherwise the

American liquefied natural gas goes to Asia,” TotalEnergies CEO Patrick Pouyanne said last week.

“Capping the European gas market while we fundamentally need to bring in more gas, it’s an idea

that I don’t understand.”

Nevertheless, the European Union is showing that it’s willing to intervene in energy markets in a

way that would have been unthinkable before Russia’s invasion of Ukraine. Shortly after Von der

Leyen spoke, the bloc backed a new package of Russia sanctions that includes support for a price

cap on oil sales to third countries.

29. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 29

NewBase Energy News 24 October 2022 - Issue No. 1560 call on +971504822502, UAE

The Editor:” Khaled Al Awadi” Your partner in Energy Services

NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE.

For additional free subscriptions, please email us.

About: Khaled Malallah Al Awadi,

Energy Consultant

MS & BS Mechanical Engineering (HON), USA

Emarat member since 1990

ASME member since 1995

Hawk Energy member 2010

www.linkedin.com/in/khaled-al-awadi-38b995b

Mobile: +971504822502

khdmohd@hawkenergy.net or khdmohd@hotmail.com

Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas

sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S.

Universities. Currently working as self leading external Energy consultant for the GCC

area via many leading Energy Services companies. Khaled is the Founder of the

NewBase Energy news articles issues, Khaled is an international consultant, advisor,

ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste

management, waste-to-energy, renewable energy, environment protection and

sustainable development. His geographical areas of focus include Middle East, Africa

and Asia. Khaled has successfully accomplished a wide range of projects in the areas

of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor

stations. Executed projects in the designing & constructing of gas pipelines, gas

metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted

& finalized many contracts/agreements in products sale, transportation, operation & maintenance

agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing

for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in

numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is

the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400

popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy,

waste management, plant Automation IA and environmental sustainability in different parts of the world.

Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program

broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see

contact details above.

30. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 30

31. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 31

32. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 32

33. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed,

or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this

publication. However, no warranty is given to the accuracy of its content. Page 33