NewBase August 22-2022 Energy News issue - 1540 by Khaled Al Awadi (AutoRecovered).pdf

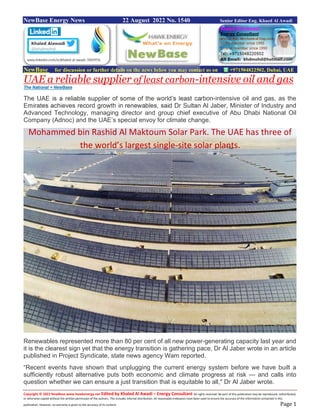

- 1. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 22 August 2022 No. 1540 Senior Editor Eng. Khaed Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE a reliable supplier of least carbon-intensive oil and gas The National + NewBase The UAE is a reliable supplier of some of the world’s least carbon-intensive oil and gas, as the Emirates achieves record growth in renewables, said Dr Sultan Al Jaber, Minister of Industry and Advanced Technology, managing director and group chief executive of Abu Dhabi National Oil Company (Adnoc) and the UAE’s special envoy for climate change. Renewables represented more than 80 per cent of all new power-generating capacity last year and it is the clearest sign yet that the energy transition is gathering pace, Dr Al Jaber wrote in an article published in Project Syndicate, state news agency Wam reported. “Recent events have shown that unplugging the current energy system before we have built a sufficiently robust alternative puts both economic and climate progress at risk — and calls into question whether we can ensure a just transition that is equitable to all," Dr Al Jaber wrote. Mohammed bin Rashid Al Maktoum Solar Park. The UAE has three of the world’s largest single-site solar plants.

- 2. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 A successful energy transition must be built on progress for the economy and the climate together, and "must be based on scientific, economic and engineering facts, appreciate the multiple dilemmas and challenging trade-offs and accelerate the deployment of practical solutions", he said. "And for that, we need an inclusive approach that leverages the experience of all sectors of society and, critically, does not exclude the energy sector." The world was already facing a profound energy-supply crunch as economies began to bounce back from the Covid-19 pandemic. The Russia-Ukraine conflict then made a tight market even tighter and forced countries to reassess their urgent near-term strategic energy needs, the Wam report said, quoting excerpts from Dr Al Jaber's article. “So, the message for governments should be clear: policies aimed at divesting from hydrocarbons too soon, without adequate viable alternatives, are self-defeating. They will undermine energy security, erode economic stability, and leave less income available to invest in the energy transition.” “The strategy needs to appreciate the complexity of energy and industrial systems, and that the scale of the transition required is colossal, requiring greater alignment and collaboration on everything from capital allocation to product design, public policy, and behavioural change,” he said. He said the demand side of the energy system must be closely examined before adopting any strategy for energy transition. While renewable energy investment globally exceeded $365 billion last year, combined investment in energy storage, carbon capture and the hydrogen value chain was only $12bn. "That is not nearly enough," Dr Al Jaber wrote. "The energy transition is estimated to need more than $250 trillion of investment over the next 30 years. Obviously, no single country, much less a single company, can foot this bill. “But financing isn’t the only issue. Energy transitions take time.” While wind and solar accounted for the vast majority of all new power-generating capacity in 2021, they still comprise only 4 per cent of today’s energy mix. As the world’s energy needs grow ever larger, maintaining global energy security will require oil and gas to remain a significant part of the mix for decades to come, the article said. “That is why we must do more now to reduce the impact of oil and gas on the climate,” Dr Al Jaber said. "Producers, governments and the private sector must work together to make sure that each new unit of output is less carbon-intensive than the last." A meaningful energy transition move would require supportive fiscal policies through tax incentives, operational efficiency via technology, greater commitment to reduce methane and flaring and significantly greater investment in carbon-capture technology, he said. “These realities are guiding the UAE approach to the energy transition, which involves continuing to meet global needs today while investing in the new energy systems of tomorrow,” he said. The UAE has three of the world’s largest single-site solar plants, has invested in renewable projects in more than 40 developed and developing countries and plans to increase its renewables portfolio to 100 gigawatts by 2030. “We have also invested in nuclear power and are laying the foundations of the hydrogen value chain, which is key to achieving net-zero emissions,” Dr Al Jaber said.

- 3. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Arabia’s Booming and This Time It Isn’t Only About Oil Bloomberg + NewBase This is Saudi Arabia, the world’s biggest exporter of oil, so it’s no surprise the property market is red-hot as income from a spike in energy prices flows through the economy. Crude is still pivotal for success of crown prince’s overhaul Kingdom’s economy is the fastest growing in the Group of 20. While de facto ruler Mohammed bin Salman has centralized power and increased political repression since being elevated by his father, King Salman, in 2015, he’s also ended or relaxed restrictions on entertainment and how men and women can mix, and is trying to curb a reliance on oil. Ten years ago, many property owners wouldn’t even rent to women, who needed approval of a male guardian for many life decisions. Today, women are entering the labor market in greater numbers, and 30% of Almajdiah’s buyers are female, acquiring investment properties or a home of their own. They’re helping lift an economy transformed by energy markets. As much of the world is fretting about spiraling inflation fueled by Russia’s war in Ukraine and potential recessions, oil averaging more than $100 a barrel this year means Saudi Arabia’s economy is the fastest growing in the Group of 20. People walk beneath advertisements at Boulevard entertainment city in Riyadh. Gross domestic product expanded 11.8% in the second quarter, when the non-oil economy grew 5.4% and is now larger than at the end of 2019, before the pandemic struck. State energy company Saudi Aramco has reported the biggest quarterly adjusted profit of any listed company globally. Billions of dollars are flowing into Saudi coffers and raising state investments, boosting sentiment in a private sector reliant on government contracts.

- 4. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Capital spending jumped an annual 64% in April to June, as the kingdom embarks on a building spree including malls and parks as well as grandiose plans for a new city built from scratch and a luxury tourism development on the Red Sea. Overall spending was 16% higher, even though this year’s initial budget forecast it would fall. Summers typically send Saudi elites off to cooler climes in Europe, but Riyadh’s newest high-end restaurants are packed. At Coya, a Latin American chain, the most popular dinner seatings -- 8:30 to 9 p.m. --- are fully booked a month ahead. Combined cash withdrawals and points of sales transactions, an indicator of consumer activity, have bounced back, increasing an annual 9% in June after a record high in March. Inflation last month was 2.7%, about a third of the rate in the US or eurozone. The Finance Ministry’s trying to break the habit of oil-tracking splurges and cutbacks, flowing stimulus through sovereign funds and into longterm projects like electric-vehicle manufacturing and tourism. The economy is expected to expand 7.6% this year but growth could fall back to 2.5% by 2024, according to a Bloomberg survey of economists. Crude is now around $90 a barrel as global fears over economic downturns and the potential for more supply from Iran if its nuclear deal is resurrected continue to hang over the market. “If there was another collapse in oil prices, there will again be slowing down in activity,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank. “But a number of positive factors are coming together at this point.” Almajdiah caters to affluent professionals who want open-plan homes with abundant natural light. Many Saudis previously preferred houses with high walls and tiny windows to preserve privacy. But the social opening, along with smaller families and tighter budgets, is changing that. The developer’s newest complex is built around shared courtyards and features cafes, gyms and a nursery. The style echoes high-end housing in Dubai, the regional hub Prince Mohammed wants to compete with, announcing plans to double Riyadh’s population and attract millions of expatriates.

- 5. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Bahrain GAC boosts renewable energy output with solar project TradeArabia News Service GAC Bahrain will be installing photovoltaic solar panels on the rooftop of its warehouse in Bahrain Investment Wharf in Al Hidd as part of the wider GAC Group’s commitment to environmental protection and reduce its carbon footprint. For the project, shipping and forwarding agency GAC Bahrain partnered with local renewable energy construction company Al Mannai Projects to install 552 solar panels that will generate approximately 300 KW of power to the meet the facility’s electricity needs. The development is the latest part of the wider GAC’s Group’s commitment to promoting sustainability and accelerating decarbonisation across the wider maritime and logistics industries. GAC Bahrain joins the growing number of GAC offices utilising renewable energy to reduce its carbon footprint. Reducing emissions It is also linked to Bahrain’s Economic Vision 2030, which aims to reduce carbon emissions by 30% through local decarbonisation projects and doubling the development of regional renewable infrastructure. “Our latest solar project is a vital step in our green journey and demonstrates our pledge to use renewable resources in line with the country’s Economic Vision 2030 and the GAC Group’s commitment to adapt and innovate its activities towards a sustainable future,” says Johan Fulke, GAC Bahrain’s Managing Director. Al Mannai Projects is a leading developer of renewable energy technology and is part of the Mannai Group Bahrain, one of the country’s oldest and leading business corporations. Its Renewable Technology division provides solar energy solutions to homes, offices, retail buildings and residential developments across Bahrain. Sustainable power Talal Al Mannai, Chief Executive Officer of Al Mannai Projects, says: “We deliver high-quality, reliable and sustainable solar power across the region, and our designs all meet the strict standards of international and Bahraini Electricity and Water Authority (EWA) standards.” This solar project is in line with the wider GAC Group’s sustainability strategy, which includes a commitment to UN Sustainable Development Goals and a net carbon zero future. As part of its Roadmap to Sustainability, GAC has committed to adapt, innovate and reduce in its activities and engage with local stakeholders to create long-term value towards a sustainable future.

- 6. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 As organisations and governments around the world increasingly look to utilise renewable energy to reduce their carbon output, as well as their dependence on oil and gas, solar energy is proving to be a popular choice for countries across the Gulf Cooperation Council (GCC). Solar energy is regarded as an infinite long-term energy solution and GCC countries look set to benefit from its abundant supply of sustainable electricity. Joint initiative In 2014, Bahrain formed its Sustainable Energy Unit (SEU) as a joint initiative between the Office of the Minister of Electricity and Water Affairs and the United Nations Development Programme (UNDP) to develop a sustainable energy policy and promote renewable energy. Since its establishment, SEU has developed two key policies – the National Energy Efficiency Action Plan (NEEAP) and the National Renewable Energy Action Plan (NREAP) – to deliver the sustainable energy transition envisioned in the Economic Vision 2030 and support the country’s long-term environmental goal of producing 10% of its energy from renewables by 2035.

- 7. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 Egypt to cooperate in electricity, Green energy fields with Slovenia Arab Finance + NewBase Egypt is collaborating with a global entity to set a strategy that targets boosting the contribution of renewable energy to the energy mix to over 42% by 2035 .Egyptian Ministry of Electricity and Renewable Energy is considering cooperation with Slovenia in the fields of electricity, new energy, and green hydrogen, according to an official statement on August 15th. This was announced during a meeting between Minister of Electricity Mohamed Shaker and the Ambassador of Slovenia to Cairo Mateja Prevolšek to discuss ways to reinforce cooperation between the two countries. Several actions have been taken to encourage the private sector to participate in the new renewable energy projects, mainly wind energy and solar power, Shaker said. Shaker added that Egypt is collaborating with a global entity to set a strategy that targets boosting the contribution of renewable energy to the energy mix to over 42% by 2035. The government is also cooperating with global companies to begin the necessary talks and studies to implement trial projects for green hydrogen production, he noted. The consulting works to set the national strategy for hydrogen is being concluded, he pointed out. For her part, Prevolšek expressed the interest of the Slovenian government in cooperating with Egypt in the field of electricity and renewable energy.

- 8. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 US Oil Exports Propel Supertanker Rates to Two-Year High Bloomberg + NewBase Giant supertankers that haul crude oil across the globe are making the most money in more than two years, buoyed by swelling shipments from the US and the Middle East. Benchmark earnings for very large crude carriers neared $40,000 a day on Wednesday to hit the highest level since June 2020. Assessments in the industry-standard Worldscale system have jumped almost 40% in a little over a week. Shipowners said the spike was due to an uptick in loadings from the Middle East and the US Gulf. While demand for tankers collapsed when producers cut output early in the pandemic, record US crude exports and a ramp-up in flows from the Organization of Petroleum Exporting Countries are once again boosting volumes of oil at sea. In addition, redirection of Russian crude flows has upended trade routes and lengthened journeys, further stretching the global fleet. “We now see frenetic activity in all key basins and rates are moving up quickly,” said Lars Barstad, chief executive officer of Frontline Management AS, which runs the ships of one of the world’s largest tanker companies. “Global oil supply has reached a pivotal point with US production, SPR releases and lastly healthy Saudi volumes,” while the rerouting of Russian flows is also boosting the distances ships are covering, according to Barstad.

- 9. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 Several other oil tanker sectors have turned steadily more bullish in recent months. Refined product vessels are seeing their strongest market since at least 1997, while smaller crude oil tanker rates have strengthened as a side-effect of Russia’s war in Ukraine. While US exports have been volatile, they touched a record last week at five million barrels a day, according to Energy Information Administration data. Oil flows from the Middle East jumped sharply in July, according to tanker-tracking data compiled by Bloomberg. Shares in tanker companies have been steadily rallying in recent weeks. Euronav NV is trading at its highest level since 2010, while Frontline Ltd. and International Seaways Inc. are near the highest since 2020.

- 10. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 U.S. Gas supplies reports a smaller-than-expected weekly rise EIA - Myra P. Saefong The U.S. Energy Information Administration reported on Thursday that domestic natural-gas supplies rose by 18 billion cubic feet for the week ended Aug. 12. That compared to an average forecast for an increase of 34 billion cubic feet from analysts polled by S&P Global Commodity Insights. Total working gas stocks in storage stand at 2.519 trillion cubic feet, down 296 billion cubic feet from a year ago and 367 billion cubic feet below the five-year average, the government said. Following the data, September natural gas NGU22, -2.96% was up 25.8 cents, or 2.8%, at $9.502 per million British thermal units. Prices, which traded at $9.349 before the supply data, looked to top Tuesday's settlement of $9.329, which was the highest since August 2008. Summary Working gas in storage was 2,519 Bcf as of Friday, August 12, 2022, according to EIA estimates. This represents a net increase of 18 Bcf from the previous week. Stocks were 296 Bcf less than last year at this time and 367 Bcf below the five-year average of 2,886 Bcf. At 2,519 Bcf, total working gas is within the five-year historical range.

- 11. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 NewBase August 22 -2022 Khaled Al Awadi NewBase for discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Oil falls on concerns economic slowdown may dent fuel demand Reuters + NewBase Oil prices fell on Monday, ending three days of gains, on fears aggressive U.S. interest rate hikes may lead to a global economic slowdown and dent fuel demand. Brent crude futures for October settlement declined $1.23, or 1.27%, to $95.49 a barrel by 0054 GMT, with concerns over slowing demand in China because of a power crunch in some areas also weighing on prices. U.S. West Texas Intermediate (WTI) crude futures for September delivery, due to expire on Monday, was down $1.12, or 1.2%, at $89.65 a barrel. The more active October contract was at $89.29, down $1.15, or 1.3%. Oil price special coverage Investors to focus on comments by Fed Chair Powell due Friday Dollar keeps climbing amid Fed rate hike forecasts Leaders of U.S., UK, France, Germany discuss Iran nuclear issue

- 12. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Both Brent and WTI climbed for a third straight day on Friday, but fell about 1.5% for the week on a stronger dollar and demand fears. "Investors were worried that a possible steep rate hike by the Fed would cause an economic slowdown and sap fuel demand," said Hiroyuki Kikukawa, general manager of research at Nissan Securities. "China's power restriction in some regions is also a concern as it could affect economic activity," he added. China's southwestern province Sichuan began limiting electricity supply to homes, offices and malls last week because of a severe power crunch driven by extreme heat waves and drought, according to state media and one power company. Strength in the U.S. dollar , which was hovering at around a five-week high, also weighed on crude prices because it makes oil more expensive for buyers in other currencies. Investors will be paying close attention to comments by Fed Chair Jerome Powell when he addresses an annual global central banking conference in Jackson Hole, Wyoming, on Friday. U.S. central bank officials have "a lot of time still" before they need to decide how large an interest rate increase to approve at their Sept. 20-21 policy meeting, Richmond Federal Reserve President Thomas Barkin said on Friday. The Fed is seen as having more room to hike rates than central banks of other large economies which are more fragile. Meanwhile, the leaders of the United States, Britain, France and Germany discussed efforts to revive the 2015 Iran nuclear deal, the White House said on Sunday, though no further details were provided. The European Union and United States said last week they were studying Iran's response to what the EU has called its "final" proposal to revive the deal, under which Tehran curbed its nuclear program in return for economic sanctions relief. Europe’s Gas Price Is Now Equivalent To $410 Per Barrel Of Oil By Tsvetana Paraskova - Heatwaves across the globe have weighed on natural gas supplies. Countries are bracing for natural gas shortages this winter. Natural gas prices across the globe are soaring, with European prices now trading at what would be an equivalent of $410 per barrel of crude oil. Heatwaves this summer and expected natural gas shortages this winter are driving gas prices higher and higher. Europe's benchmark gas prices surged by 14% in just three days to a fresh record-high, continuing the upward trend from recent weeks, as gas demand for power generation is high amid heatwaves and Russian pipeline supply remains at low levels, while the EU scrambles to fill gas storage ahead of the winter that would see energy and gas rationing, industries shutting down production, and households paying sky-high prices for heating and electricity. Europe is in the most precarious position, but natural gas prices are rallying in the United States and Asia, too. Gas demand for power is high, and production is flat in America, while major Asian buyers are back on the LNG market to secure supplies for the winter.

- 13. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 As LNG is now a global commodity, benchmark gas and spot LNG prices are soaring all over the world. And they could jump even higher when the heating season approaches. Europe's Gas Price Is Now Equivalent To $410 A Barrel Oil Europe's benchmark gas prices at the Dutch TTF hub rallied 14% between Monday and Wednesday, jumping by 6% on Wednesday at a new record of $240 (236 euro) per megawatt-hour. Gas prices have already doubled since June, when Russia first reduced supply via Nord Stream, the key pipeline carrying gas to Europe's biggest economy, Germany. The European gas benchmark now trades at what would be an equivalent of $410 per barrel of crude oil, which highlights "the debilitating economic impact on the region," Ole Hansen, Head of Commodity Strategy at Saxo Bank, said this week. Such record gas prices are hitting industries in Germany and the rest of Europe, with companies announcing production halts or curtailments "until further notice" amid soaring energy costs. Industries have warned that reduced production and operations could lead to a collapse of supply and production chains. Governments are scrambling to secure enough gas for the winter while walking a tight rope between alleviating the cost burdens on households and avoiding an industrial collapse and a wave of bankrupt energy companies. As a result of the gas crunch and a heatwave constraining supply and output from other fuel sources, year-ahead electricity prices continue to soar in Europe, with German power prices, the European benchmark, jumping to over $508 (500 euro) per megawatt-hour on Tuesday—a new record. Despite faster storage builds than usual, Germany will only have enough natural gas to cover two and a half months of consumption this winter if Russia completely suspends deliveries, Klaus Müller, the president of Germany's energy regulator, told Bloomberg this week.

- 14. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 "The burden of high gas and oil prices will actually mean that we are going to see some steep contraction in the European economies next year," Amrita Sen, director of research at Energy Aspects, told Bloomberg on Wednesday. U.S. Natural Gas Prices Rally, Too European prices are at record highs and at around seven times higher than U.S. benchmark prices. But the U.S. prices at Henry Hub have surged, too, to the highest they have been in 14 years. This is the result of flattish domestic production, strong gas demand from the power sector in heatwaves, and lower than normal stocks in storage, despite the outage at the Freeport LNG export terminal, which has made available more gas for domestic consumption. The Freeport LNG outage prompted a 39% decline in Henry Hub prices in June. But in July, higher- than-normal temperatures across much of the U.S. resulted in strong gas demand in the power sector, which absorbed much of the Freeport LNG-related surplus and kept natural gas inventories from rising faster, the EIA said last week. Moreover, natural gas price volatility reached an all-time high in Q1 2022, the EIA noted. Working natural gas stocks are 12% lower than the five-year average and 10% lower than last year at this time, according to the EIA. After a slump in early June due to the Freeport LNG force majeure, U.S. benchmark gas prices have rallied by 70% since the end of June, hitting this week their highest level since August 2008 at above $9.30 per million British thermal units (MMBtu). The European benchmark price in MMBtu equivalents is now nearly $70/MMBtu – roughly seven times higher than American benchmark prices. This wide price differential is expected to pull more LNG exports out of America to Europe, which are already at record highs as the EU looks to replace as much Russian pipeline gas as possible.

- 15. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 Asian LNG Prices Also Soar Asian utilities are also back on the market to procure fuel for the winter, traders tell Bloomberg. Higher demand in northeast Asia sent spot LNG prices rallying to nearly $60/MMBtu—the highest level since the beginning of March when the Russian invasion of Ukraine drove up northeast Asian prices to a record high of over $80/MMBtu. With winter approaching, natural gas prices could see further upside as Russian supply remains low, LNG demand rises, and American producers are not rushing to ramp up production. Eventually, the high prices could spur a response from U.S. shale gas drillers on the supply side, while on the demand side, record prices could accelerate the destruction of demand and sink European economies.

- 16. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 NewBase Specual Coverage The Energy world –August -22 -2022 ENERGY Europe Slips Toward Recession as ECB Mulls Steps Ahead Bloomberg Europeans returning from their summer breaks will find a more fragile economy that risks buckling under the threats of energy rationing, record inflation and tighter monetary policy. Purchasing managers’ indexes due Tuesday will likely show private-sector output shrinking for a second month, adding to signs that a recession in the 19-nation euro zone is now more likely than not. Business confidence gauges from Germany, France and Italy will probably confirm that direction. Germany, Europe’s largest economy, has emerged as the region’s weak spot, with its outsized industrial base suffering disproportionately from surging energy costs and a persistent shortage of supplies. Meanwhile, ser vices aren’t seeing the same kind of tourism boom that’s tiding over countries around the Mediterraneano as vacation travel picks up post-Covid. An update on Germany’s second-quarter performance on Thursday will reveal whether the negligible contraction initially reported, small enough to be rounded away, will be revised into a bigger one, or whether consumer spending was strong enough to avert a decline in output -- for now.

- 17. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 Data in the coming week will be key ingredients for discussions on where monetary policy is headed after the European Central Bank raised rates by half a point in July and signaled “further normalization” in September without pre-committing on the size. The ECB’s next meeting is less than three weeks away, and most policy makers have yet to express their preferences. An account of the July meeting due on Thursday may offer some insight, and about half of the ECB’s 25 rate setters -- including Executive Board member Isabel Schnabel and Bundesbank chief Joachim Nagel -- will get a chance to share their views during the Kansas City Fed’s annual Economic Policy Symposium in Jackson Hole, Wyoming. ECB President Christine Lagarde won’t make the trip to the Grand Tetons this year. But her comments following the July decision, along with another pickup in inflation to just under 9% and expectations that price pressures will increase further, suggest she’s leaning toward a bigger move: “We have to bring inflation down to 2% in the medium-term,” she said. “It’s time to deliver.” What Bloomberg Economics Says:

- 18. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 “Minutes from the ECB’s July 21 meeting may offer clues on whether investors should brace for another 50-basis-point rate hike in September. Given widespread inflationary pressures, a large increase is our base case.” Central bankers from around the world are also headed to Jackson Hole, with Federal Reserve Chair Jerome Powell scheduled to speak on Friday. Before that, Chinese banks will likely trim their benchmark loan prime rates for the first time in months, while monetary policy authorities in Israel, Iceland, South Korea and Botswana are among those expected to hike rates. Europe, Middle East, Africa Elsewhere in western Europe, it’s a fairly quiet week, with UK PMI readings scheduled for Tuesday. In the east, data due on Wednesday will likely show that Russian industrial production slumped in July at the fastest rate since the start of President Vladimir Putin’s war in Ukraine, as energy output falls amid a standoff with the rest of the continent. Iceland’s central bank is expected to raise its key rate by 75 basis points to 5.5%, keeping it ahead of developed-nation peers in tightening as a housing boom there keeps fueling price growth. The Bank of Israel is set to increase its benchmark by another half point after annual inflation and economic growth topped all forecasts, with price gains accelerating to the quickest since October 2008. Botswana may also hike again to curb average inflation that’s at the highest level in more than a decade. The International Monetary Fund said in July that the central bank will need to continue raising rates to bring price growth back within the 3% to 6% target range.

- 19. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 South African data will probably show that inflation in July remained above the 6% top of the central bank’s target range for a third straight month, fueled by gasoline prices. The institution, which is scheduled to meet next on Sept. 22, told lawmakers in a recent presentation that a return to the target band was “likely to be sluggish,” with risks tilted to the upside. US Powell at Jackson Hole on Friday morning is the week’s main event. His remarks on the economic outlook are expected to reaffirm the US central bank’s resolve to keep raising rates to curb decades- high inflation, though he’s not likely to specify to how big officials will go when they meet in September. Policy makers raised rates by 75 basis points in July for the second straight meeting and have said that a similar hike could be on the table again -- or potentially a smaller, half-point move -- depending on the data. Economic data in the coming week include the government’s July personal income and spending report, which will help shape third-quarter growth estimates. Inflation-adjusted outlays on goods and services are projected to have firmed a bit in July after soft readings the previous two months. The report’s personal consumption expenditures price index, which the Fed uses for its inflation target, is forecast to settle back after energy costs plunged. Other data include revised second- quarter gross domestic product, durable goods orders and new home sales for July, and the August S&P Global manufacturing and services surveys. Asia China’s biggest banks on Monday are likely to lower the interest rate they charge their best customers, after the People’s Bank of China cut borrowing costs on Aug. 15.

- 20. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 Meanwhile, coronavirus infections have surged to a three-month high, with tourist destinations worst hit. The current wave of infections is testing Beijing’s Covid Zero policy as the government seeks to strike a balance between containing the virus and maintaining economic growth. Extreme high temperatures and low precipitation since July create more economic challenges for China: The province of Sichuan activated its highest emergency response on Sunday to deal with “extremely outstanding” power supply deficiencies, adding to manufacturers’ woes in the region as they shut down factories. Indonesia’s central bank may retain its outlier status in a world where central banks have been delivering large hikes, though more economists see the potential for an increase at Tuesday’s meeting after the nation’s inflation accelerated in July. The Bank of Korea meets Thursday amid growing fears that further half-percentage hikes may pop a household debt bubble. Those concerns could prompt Governor Rhee Chang-yong to revert to a 25 basis point move before he jets off to Jackson Hole. The BOK decision follows the latest preliminary export figures earlier in the week that will offer a pulse check of global trade so far in August. In Japan, board member Toyoaki Nakamura will deliver the BOJ’s latest view on the economy and prices in a speech on Thursday ahead of Tokyo inflation numbers Friday. Pakistan’s central bank, which has hiked rates by 525 basis points this year, is expected to keep them steady when policy makers meet.

- 21. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21 Latin America When Banxico hiked its key rate to a record 8.5% on Aug. 11, policy makers failed in the post- decision statement to provide forward guidance. Mexico watchers will pore over the meeting minutes posted midweek. Mexico also reports final second-quarter GDP data, June’s economic activity index, and the mid- month reading of consumer prices, which economists see hitting a fresh 21-year high. Banco de Mexico Deputy Governor Gerardo Esquivel on Wednesday said inflation will peak in August or September. In Peru, look for a modest increase in second-quarter output as a new round of pension savings withdrawals in June backstopped consumers. The surprising pick-up in Argentina’s May GDP-proxy data likely helped to buoy June’s results, but headwinds abound and many economists forecast a recession in the second half. In Paraguay, the central bank meets to consider a 13th straight hike from 8%, with inflation running slightly faster than 11%.

- 22. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22 Brazil posts current account and foreign direct investment results as well as the mid-month reading of it benchmark inflation index. Early estimates see the IPCA-15 index coming in at just over 10%, down from 11.39% in July. It’s being slowed largely by government price and tax cuts.

- 23. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 23 NewBase Energy News 22 August 2022 - Issue No. 1540 call on +971504822502, UAE The Editor:” Khaled Al Awadi” Your partner in Energy Services NewBase energy news is produced Twice a week and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscriptions, please email us. About: Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 www.linkedin.com/in/khaled-al-awadi-38b995b Mobile: +971504822502 khdmohd@hawkenergy.net or khdmohd@hotmail.com Khaled Al Awadi is a UAE National with over 30 years of experience in the Oil & Gas sector. Has Mechanical Engineering BSc. & MSc. Degrees from leading U.S. Universities. Currently working as self leading external Energy consultant for the GCC area via many leading Energy Services companies. Khaled is the Founder of the NewBase Energy news articles issues, Khaled is an international consultant, advisor, ecopreneur and journalist with expertise in Gas & Oil pipeline Networks, waste management, waste-to-energy, renewable energy, environment protection and sustainable development. His geographical areas of focus include Middle East, Africa and Asia. Khaled has successfully accomplished a wide range of projects in the areas of Gas & Oil with extensive works on Gas Pipeline Network Facilities & gas compressor stations. Executed projects in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of gas/oil supply routes. Has drafted & finalized many contracts/agreements in products sale, transportation, operation & maintenance agreements. Along with many MOUs & JVs for organizations & governments authorities. Currently dealing for biomass energy, biogas, waste-to-energy, recycling and waste management. He has participated in numerous conferences and workshops as chairman, session chair, keynote speaker and panelist. Khaled is the Editor-in-Chief of NewBase Energy News and is a professional environmental writer with over 1400 popular articles to his credit. He is proactively engaged in creating mass awareness on renewable energy, waste management, plant Automation IA and environmental sustainability in different parts of the world. Khaled has become a reference for many of the Oil & Gas Conferences and for many Energy program broadcasted internationally, via GCC leading satellite Channels. Khaled can be reached at any time, see contact details above.

- 24. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 24

- 25. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 25

- 26. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 26

- 27. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 27

- 28. Copyright © 2022 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavors have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 28